Analysis of Jinyuan Co., Ltd. (000546) Continuous Limit-Up: Driven by Concept Resonance and Transformation Expectations

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

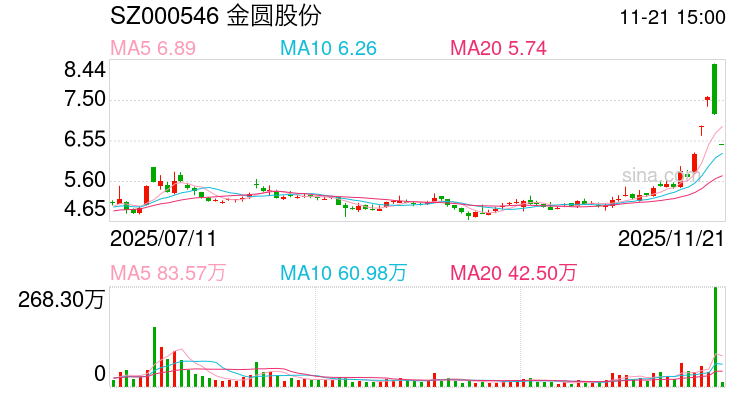

Jinyuan Co., Ltd. (000546) closed limit-up consecutively on November 17 and 18, 2025, with increases of 9.98% and 10.03% respectively, and a turnover of 216 million yuan [0]. Guotai Haitong Securities Chengdu North First Ring Road net bought 40.4974 million yuan, indicating high participation of main funds [2]. The company’s main businesses cover cement building materials and lithium mine development, and it is actively transforming to the new energy materials field [0]. This limit-up was driven by multiple factors: First, the AI application sector broke out comprehensively, with the AIGC concept receiving a net inflow of 5.678 billion yuan from main funds, and the AI agent sector also receiving a net inflow of 4.67 billion yuan [5]; Second, the quantum technology concept became a market hotspot, and the 2025 Quantum Technology and Industry Conference will be held in Hefei from November 20 to 22 [0]; Third, lithium mine concept stocks generally rose sharply [3], and the company benefited from the rise in lithium mine prices and the demand growth in the new energy vehicle and energy storage industries [0].

Cross-sector concept resonance is the core logic of this continuous limit-up: the rotation of the AI application sector and the speculation of the quantum technology concept form a superimposed effect, while the company’s own lithium mine business transformation expectations enhance market confidence [0]. It is worth noting that against the backdrop of the Shanghai Composite Index’s weak consolidation (down 0.81% on November 18) [4], the AI application direction strengthened against the trend, highlighting the market funds’ preference for the technology growth sector [5].

Jinyuan Co., Ltd.'s continuous limit-up reflects the market’s pursuit of emerging concepts such as AI applications and quantum technology, while its lithium mine business transformation also provides fundamental support. Investors need to pay attention to the sector rotation rhythm and the company’s transformation progress, balancing short-term fluctuations and long-term potential [0].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.