Analysis of Driving Factors for the Strong Performance and Growth Prospects of Fuxiang Pharmaceutical (300497)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Fuxiang Pharmaceutical (300497) is an enterprise focused on the R&D, production of chemical APIs and intermediates, and CDMO services [0]. Its recent strong stock performance is mainly driven by the following factors:

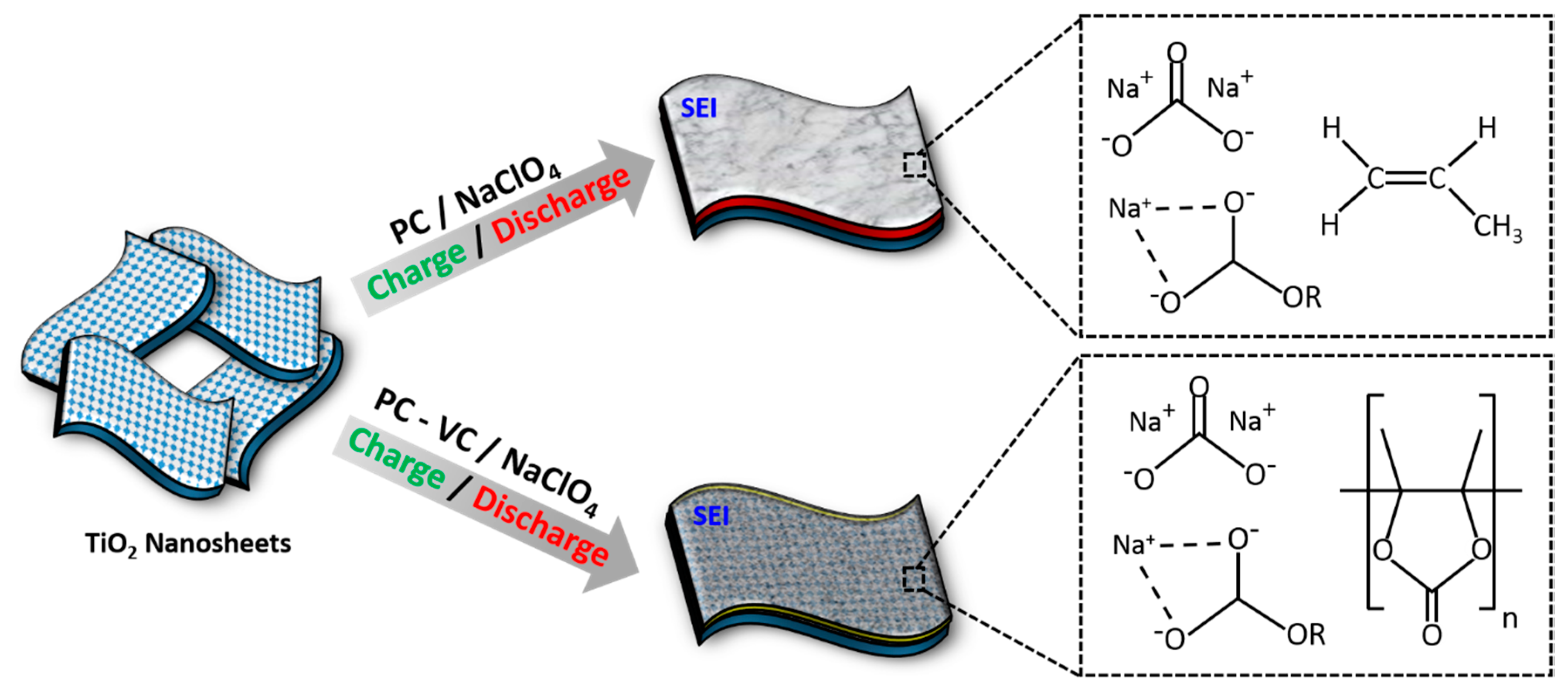

- Surging VC Prices: The average market price of VC (vinylene carbonate), an electrolyte additive, rose to 105,000 yuan/ton on November 14, nearly doubling from the end of October [0], directly boosting the company’s profit expectations;

- Booming New Energy Demand: In the first half of 2025, the shipment volume of energy storage lithium batteries increased by 128% year-on-year [0], and demand for power batteries remains strong, driving demand for electrolytes and additives;

- Capacity Expansion Plans: The company currently has a VC production capacity of 8,000 tons/year, and plans to increase it to 10,000 tons/year through technological transformation, with a long-term plan to expand to 20,000 tons/year [0][1]; the microbial protein business currently has a capacity of 1,200 tons/year, and under-construction projects will form a 20,000-ton capacity [1], with clear new growth points;

- Institutional and Capital Attention: On November 17, the company received research visits from more than 20 institutions including Rongtong Fund [1]; northbound capital had a net purchase of 48.02 million yuan [2]; Dragon and Tiger List data showed active market trading [3].

- Cross-domain Linkage: The high prosperity of the new energy industry is transmitted to upstream chemical materials, and the rise in VC prices forms a positive cycle with demand for energy storage and power batteries;

- Strengthened Growth Logic: Capacity expansion plans and the new microbial protein business provide long-term growth momentum for the company; institutional research reflects market confidence in its development prospects;

- Fundamental Support: Active northbound capital and Dragon and Tiger List activity indicate high short-term capital attention, which helps maintain strong stock prices.

- The release of VC capacity and high price operation are expected to increase the company’s profits;

- The commercialization progress of the microbial protein business may become a future stock price catalyst;

- The sustained growth of the new energy industry provides a stable demand foundation for the company.

- VC Price Volatility Risk: As a commodity, prices are greatly affected by supply and demand; if supply increases or demand slows in the future, prices may correct;

- Capacity Expansion Execution Risk: Project construction and commissioning progress may be affected by external factors;

- Intensified Industry Competition: The electrolyte additive field may attract more participants, leading to increased competitive pressure.

Fuxiang Pharmaceutical’s recent strong performance is jointly driven by rising VC prices, new energy demand, capacity expansion, and institutional attention. The company’s layout in the electrolyte additive and microbial protein fields lays the foundation for long-term development, but attention should be paid to VC price fluctuations and capacity expansion progress. Investors can continue to track based on industry trends and changes in the company’s fundamentals.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.