Analysis of Strong Performance of Zhongfu Information (300659): Driven by AI Applications and Supported by Fundamentals

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Zhongfu Information (300659) has recently shown strong stock price performance, hitting a 20% daily limit on November 17 and continuing to rise by 4.66% to 18.65 yuan on the 18th [0]. The core driving factors include:

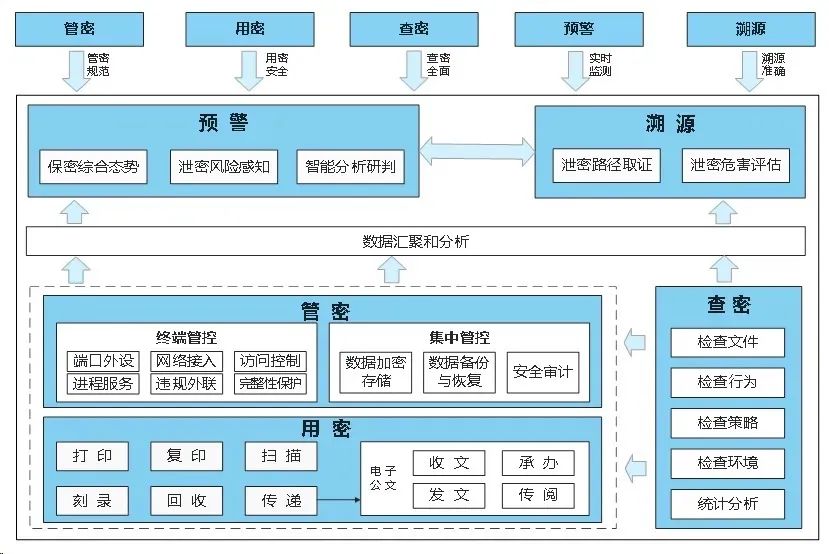

- Boom in AI Application Concept: As the leader in AI confidentiality inspection systems (with a 60% market share), it benefits from catalysts such as the launch of Alibaba’s Qianwen App and other AI application implementation events [1];

- Policy and Scenario Support: Its data security attribute aligns with national policy directions, and the dual-wheel drive of military and government services provides stable demand [0];

- Improved Fundamentals: Revenue in the first three quarters of 2025 increased year-on-year (9.06%/18.72% [0]);

- Sector Rotation and Capital Inflow: The computer sector and AI application concept stocks have strengthened collectively [3], with a net purchase of 64.9539 million yuan by main funds on November 18 [2].

- Shift in AI Application Track: The AI industry is shifting from computing power hardware to application implementation, and Zhongfu Information’s advantages in the vertical field (confidentiality inspection) make it a beneficiary [0][1];

- High-Stickiness Scenario Advantage: The high customer stickiness in military and government service scenarios provides long-term support for performance [0];

- Increased Capital Attention: Recently, there has been a significant inflow of main funds, reflecting the market’s increased attention to the AI application track [2][3].

- Opportunities: Expansion of AI application scenarios (e.g., enterprise-level data security), continuous intensification of data security policies;

- Risks: Short-term market volatility risk, slower-than-expected progress in AI application implementation, intensified industry competition.

Zhongfu Information (300659) is a leading enterprise in the information security field, with a 60% market share in AI confidentiality inspection systems, and its current market capitalization is approximately 6.149 billion yuan (total share capital of 330 million shares [0]). Its recent strong performance is mainly due to the boom in AI applications and multiple supports from policies and capital; the shift in the AI application track and scenario advantages provide potential for future development.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.