China Wuyi (000797) Limit-Up Analysis: Policy Catalysts and Capital Drivers

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

China Wuyi (000797) hit the limit-up on November 18, 2025, driven mainly by the following factors:

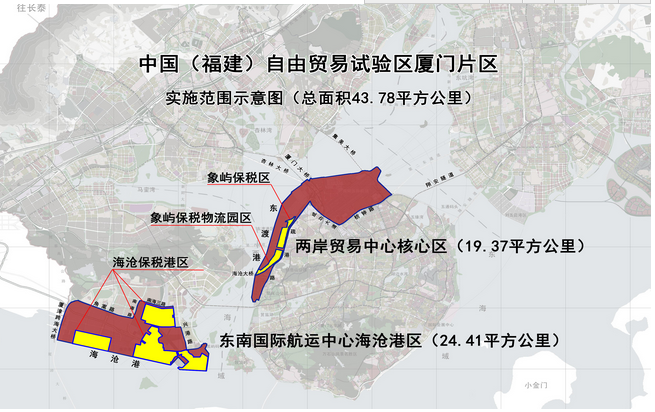

- Policy Catalysts: The Fujian Free Trade Zone sector surged and cross-strait integration sentiment strengthened, making the company a market hotspot [0][2];

- Capital Drivers: Hot money from the Shanghai Songlin Road Sales Department made large purchases [5], and northbound capital net bought 84.6557 million yuan via Shenzhen-Hong Kong Stock Connect [0];

- Market Divergence: Institutional capital had a net outflow of 11.231 million yuan, indicating a divergence in positions between institutions and hot money/northbound capital [6].

- Concept Speculation Dominates: Despite the company’s poor fundamental performance, policy concepts still drove the stock price up, reflecting the current market’s preference for thematic investment [0];

- Capital Structure Differentiation: The divergence between institutional outflows and hot money/northbound inflows suggests that short-term stock price volatility may intensify [0][5][6];

- High Policy Sensitivity: The stock price trend is closely related to regional policies; continuous tracking of Fujian Free Trade Zone and cross-strait policy dynamics is needed [0][4].

- Concept retreat due to policy implementation falling short of expectations [0][4];

- Pressure from hot money taking short-term profits [5];

- Sustained institutional outflows may suppress the stock price [6].

- Short-term thematic investment opportunities (if policies continue to heat up) [0][1];

- Northbound capital inflows show foreign investors’ attention to regional concepts [0].

China Wuyi’s limit-up is the result of the combined effect of policies and capital, with obvious market divergence. Investors should pay attention to:

- Follow-up trends of Fujian Free Trade Zone and cross-strait integration policies [0][3];

- Changes in Dragon and Tiger List and daily capital flows [5][7];

- Improvements in the company’s fundamentals (if any) [0].

Note: This analysis does not constitute investment advice. The market has risks, and investment needs to be cautious.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.