INTS Investment Analysis: Reddit Bull Thesis vs. Clinical & Financial Reality

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Reddit sentiment on INTS is predominantly bullish, with users emphasizing the company’s revolutionary non-covalent drug delivery platform for cancer treatment. Key Reddit insights include:

- Investment Thesis: Users argue against selling INTS, highlighting potential for 20x-100x returns from current $50M market cap to $1-5B upon FDA approval

- Technology Support: Multiple users (pbj37, german-kiwi) support the technology as “an entirely new approach to treating cancer via intratumoral injection”

- Recent Stock Action: Maximum-Tone164 reports the stock dropped due to a $0.80 per share offering, causing investors to dump shares

- Influencer Concerns: Successful-One-905 warns the stock is majority owned by a Twitter influencer who may manipulate for exit liquidity

- Capital Lock-up Warning: RanchHandlher shares experience buying at $0.33, missing the sell at $1.58 due to halted trading, and cautions about tying up capital for years

- Financial Reality: TheLordGatsby explains the company needs $25M total for Phase 3 completion, having raised $4M at $0.80

- Compliance Risks: Few_Interactions_ and Neat_Investment9103 warn of likely reverse split for Nasdaq compliance and continued dilution cycles

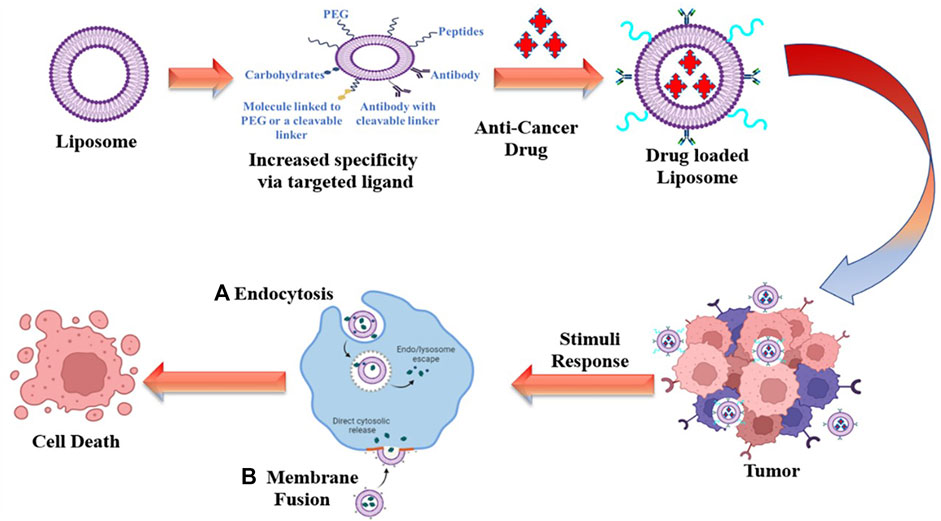

INTS (Intensity Therapeutics) is a late-stage clinical biotechnology company developing novel cancer treatments using a proprietary non-covalent drug delivery platform:

- Technology: Lead candidate INT230-6 is a water-based formulation for intratumoral injection combining multiple chemotherapy agents using non-covalent binding

- Clinical Progress: Phase 1/2 data showed promising results with 75% disease control rate and 11.9 months median overall survival in metastatic or refractory cancer patients

- Phase 3 Status: Company has initiated INVINCIBLE-3 Phase 3 trial for soft tissue sarcoma and other Phase 3 programs for breast cancer

- Timeline Reality: Phase 3 trials typically require 2-5 years to complete enrollment and data collection, plus 10 months for FDA review process

- Financial Constraints: Recent $4 million raise extends financial runway only through Q1 2027, requiring additional funding before Phase 3 completion

- Market Position: Currently trading on Nasdaq with significant capital needs for Phase 3 completion

The Reddit bullish thesis aligns with the revolutionary nature of INTS’s technology but underestimates timeline and financial challenges. Both sources agree that Phase 3 results are years away, but Reddit’s 20x-100x return projections appear overly optimistic given:

- Timeline Mismatch: Reddit acknowledges years-long Phase 3 timeline, but may not fully appreciate that Q1 2027 financial runway will likely expire before trial completion

- Dilution Reality: Reddit correctly identifies recent $0.80/share financing as problematic, but the full scope of ongoing dilution needs may be underestimated

- Technology Validation: Both sources agree the non-covalent drug delivery platform represents an innovative approach to cancer treatment

- Financial Runway: Q1 2027 cash runway likely insufficient to complete Phase 3 trials

- Further Dilution: Additional financing rounds will continue to dilute existing shareholders

- Reverse Split Risk: Nasdaq compliance requirements may force reverse split

- Influencer Manipulation: Concentrated ownership raises exit liquidity concerns

- Clinical Trial Outcomes: Phase 3 success is not guaranteed despite promising Phase 1/2 data

- Technology Breakthrough: Revolutionary non-covalent drug delivery platform could transform cancer treatment

- Market Opportunity: Successful Phase 3 results could support significant valuation expansion

- Undervalued Technology: Current $50M market cap may undervalue the platform’s potential if clinical success continues

- Strategic Partnerships: Potential for pharmaceutical partnerships to provide funding and expertise

Investors should carefully weigh the revolutionary technology against significant execution risks. The Reddit community’s enthusiasm is justified by the innovative approach, but the financial timeline mismatch creates substantial risk. Conservative investors may prefer to wait for additional funding clarity or Phase 3 interim data before committing capital, while high-risk tolerance investors might consider the current valuation as an opportunity to invest in potentially transformative technology at an early stage.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.