Analysis of Seeking Alpha Article on Upcoming Inflationary Phase and Broad Commodity Opportunities

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

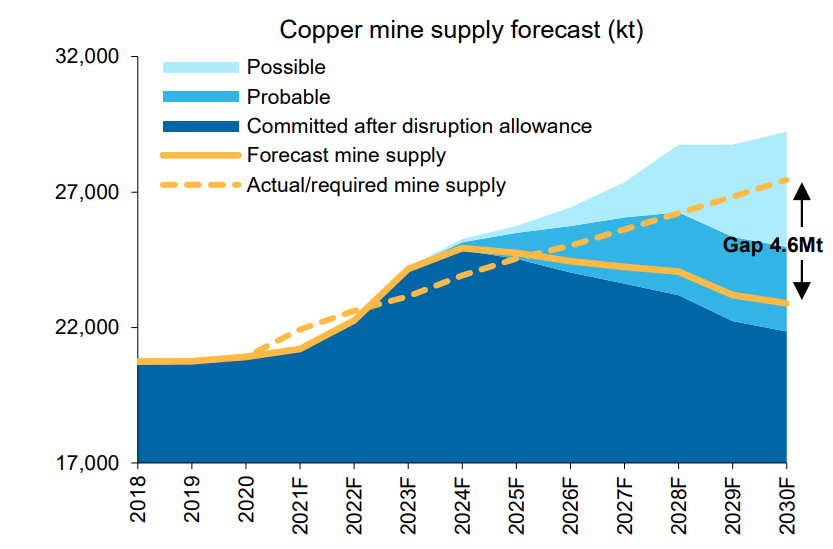

The Seeking Alpha article argues current disinflation is temporary, with an upcoming inflationary phase favoring broad commodities (critical minerals, copper, nickel, uranium, platinum, palladium) over gold/silver. Published post-market (17 Nov 2025, 4:35 PM ET) [1], it had no impact on the day’s trading data. Cleveland Fed’s November inflation nowcast shows a slight uptick (2.99% annual vs October’s2.96%) [2], supporting the inflationary shift thesis. Commodity trends: gold (-2.2%) and silver (-3.38%) dipped [3], copper rose1.24% [5], WTI oil fell3.1% month-to-date [4]. Basic Materials and Energy sectors were down 0.85% [0] but this data predates the article.

- Timing Impact: Post-market publication means no 17 Nov impact; next session (18 Nov) likely to show effects.

- Early Signal: Copper’s gain [5] hints at pre-article interest in broad commodities.

- Inflation Alignment: Uptick in inflation nowcast [2] validates the article’s core thesis.

- Opportunities: Broad commodities (copper, uranium, platinum/palladium) and related sectors (Basic Materials, Energy) could benefit as inflation rises. ETFs like DBC and COPX are potential focus areas.

- Risks: Short-term volatility (gold/silver dips [3], WTI drop [4]) may delay thesis realization; if inflation doesn’t rise, outlook reverses.

- Note: Monitor inflation data [2] closely to validate the thesis.

The article’s message of an inflationary phase favoring broad commodities [1] is supported by inflation signals [2] and copper’s gain [5]. Pre-article sector data [0] and some commodity dips are short-term. No immediate impact on 17 Nov market; focus on next session for Basic Materials and Energy moves.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.