Bearish TSLA Instruments: Risk-Reward Analysis of Puts, Shorts, and Inverse ETFs

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The Reddit discussion reveals strong community skepticism toward bearish TSLA strategies, with multiple users sharing negative experiences:

- Direct warning from experience: One user reported losing 85% on TSLQ (2x inverse ETF) and strongly recommends against bearish bets on TSLA Reddit

- Market timing concerns: User Alkthree warns against shorting a “meme stock” in a bull market with Fed liquidity, calling it “a bad idea despite agreeing TSLA is overvalued” Reddit

- Alternative strategies suggested:

- Selling call spreads for controlled maximum risk

- Synthetic shorts (long put + short call at same strike) to avoid borrow fees

- Ratio put spreads for moderate bearish views Reddit

- Catalyst awareness: Users note the upcoming Elon Musk pay package vote as a potential catalyst requiring caution Reddit

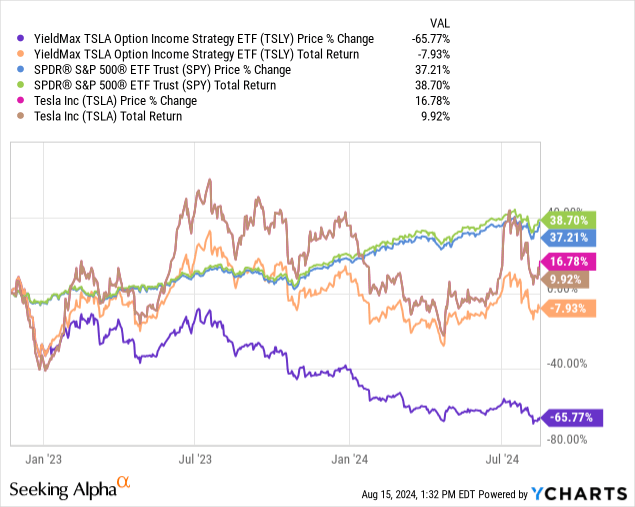

Market data confirms the community’s negative experiences with bearish TSLA instruments:

- TSLQ (2x inverse): 1.17% expense ratio, $360.34M AUM, 31M daily volume

- TSLS (1x inverse): 0.94% expense ratio, $78.07M AUM

- Both funds suffered major losses in 2024 due to Tesla’s strong stock performance Yahoo Finance ETFDB

- Direct shorting: 0.25% borrow fee (lowest ongoing cost) but unlimited downside risk

- Put options: Premium costs plus time decay (theta erosion)

- Inverse ETFs: Higher expense ratios plus volatility drag from daily rebalancing CoinCodex

Inverse ETFs experience performance divergence from expected inverse returns due to daily rebalancing, making them unsuitable for long-term holding Medium

The Reddit community’s negative experiences align closely with quantitative research findings:

- Unlimited downsidein short selling if TSLA continues rallying

- Time decay erosionrapidly devaluing put options in volatile markets

- Volatility dragcausing inverse ETFs to underperform even when TSLA declines

- Catalyst riskaround upcoming Elon Musk pay package vote creating sharp movements

- Defined-risk strategieslike call spreads or ratio put spreads for controlled exposure

- Synthetic shortsto avoid borrow fees while maintaining inverse exposure

- Strategic timingaround specific catalysts rather than continuous bearish exposure

- Partial hedgingrather than outright directional bets given strong momentum

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.