Johnson & Johnson Acquires Halda Therapeutics for $3.05B: Strategic Oncology Pipeline Expansion

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

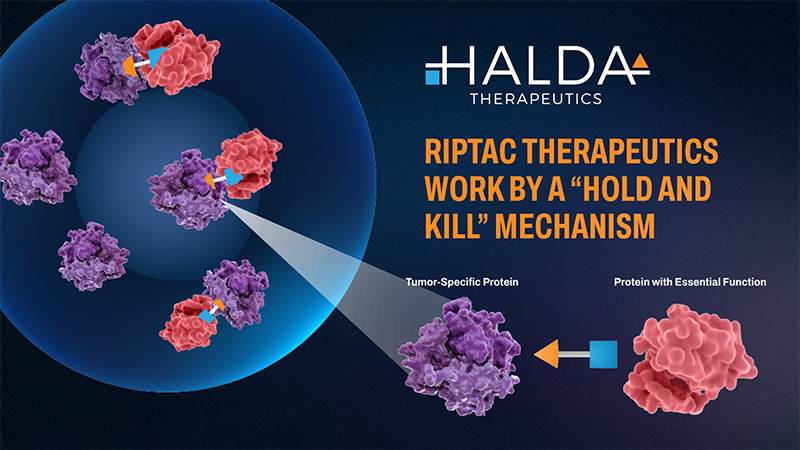

Johnson & Johnson (JNJ) announced the acquisition of Halda Therapeutics for $3.05 billion in cash on November 17, 2025 [1]. The deal focuses on Halda’s proprietary Regulated Induced Proximity TArgeting Chimera (RIPTAC™) platform for solid tumors (prostate, breast, lung) and lead candidate HLD-0915 (Phase 1/2 for metastatic castration-resistant prostate cancer). JNJ’s stock rose 1.86% to $199.58 on the event day, with volume reaching 13.25 million shares—57% above the average daily volume of 8.27 million [0]. This outperformed the broader healthcare sector, which gained 0.506% on the same day [0]. The acquisition represents ~0.63% of JNJ’s $480.85 billion market cap, indicating minimal financial strain relative to its size [0].

- Strategic Fit: The acquisition addresses unmet needs in prostate cancer (projected 1.7 million global cases by 2030 [1]) and complements JNJ’s innovative medicine portfolio, which contributed 64.1% of its 2024 revenue [0].

- Investor Confidence: The positive stock reaction reflects market belief in the pipeline’s potential, despite expected 2026 EPS dilution of $0.15 (~1.45% of current EPS [0]).

- Sector Leadership: JNJ’s outperformance of the healthcare sector highlights investor preference for companies investing in innovative oncology therapies [0].

- Risks:

- Clinical trial failure of HLD-0915 (Phase 1/2 stage, high attrition rate in oncology [1]).

- Integration challenges for Halda’s team and technology [1].

- Regulatory clearance delays or denial [1].

- Minor 2026 EPS dilution ($0.15 [1]).

- Opportunities:

- Gain market share in the growing oncology space [0].

- Commercialize targeted therapies for solid tumors with unmet needs [1].

- Leverage JNJ’s global distribution network for Halda’s candidates [0].

- Acquisition cost: $3.05B cash [1].

- Stock impact: JNJ +1.86% on event day, volume 57% above average [0].

- Expected 2026 EPS dilution: $0.15 [1].

- Key monitoring factors: HLD-0915 clinical trial updates, transaction closing status, integration plans [0][1].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.