Retail Earnings Watch Amid Market Volatility: Q3 S&P500 Insights & Upcoming Reports

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

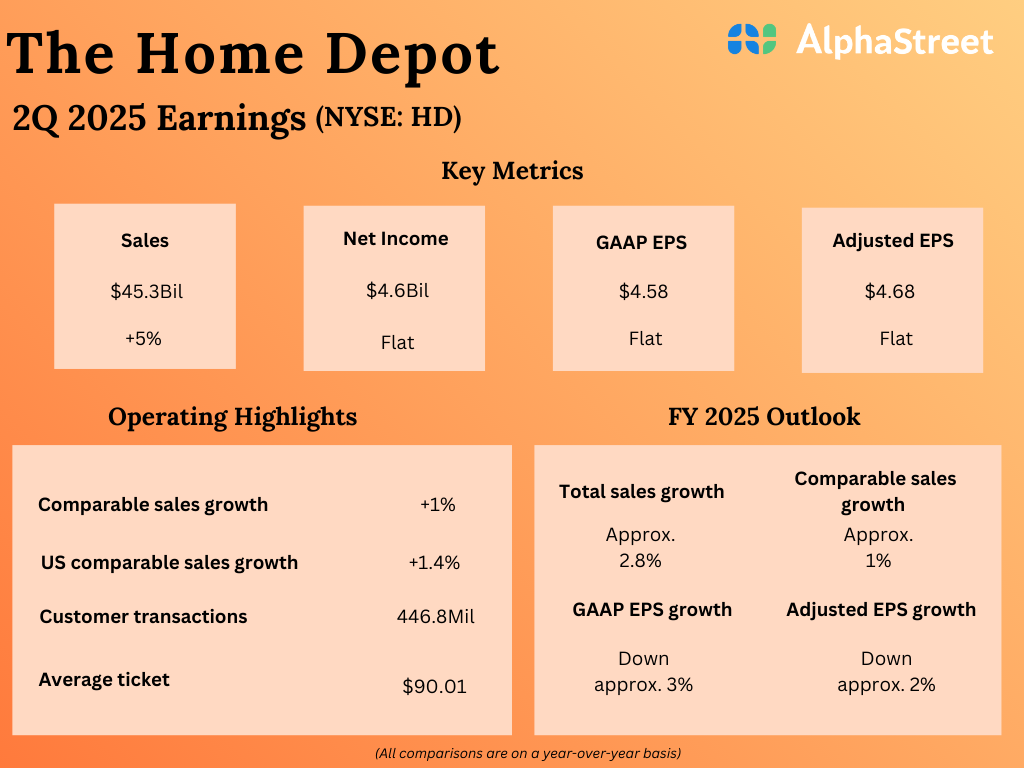

This report draws from a SeekingAlpha article [1] highlighting S&P500 Q3 earnings growth of 13.1% (92% of constituents reporting) and corporate confidence via the LERI metric. Upcoming earnings include major retailers (WMT, TGT, TJX, ROST, HD, LOW) and tech giant NVDA this week. Internal data [0] shows mixed Nov17 performance: WMT (+0.19%) benefited from Black Friday promotions, while TGT (-0.86%), TJX (-0.51%), ROST (-1.56%), HD (-0.74%), LOW (-0.48%), and NVDA (-0.75%) declined. Sector-wise, Consumer Cyclical (-1.11%) and Tech (-0.49%) underperformed, with indices S&P500 (-0.87%), NASDAQ (-0.78%), Dow (-1.05%) [0].

- Corporate confidence (LERI) contrasts with short-term market volatility, indicating a potential disconnect between fundamentals and investor sentiment.

- Retail divergence: Discount retailers (WMT) may outperform cost-conscious consumers, while others (TGT) face foot traffic issues.

- NVDA’s pre-earnings decline reflects profit-taking due to high valuation (1180% surge since 2023) and geopolitical risks [0].

- Risks: TGT’s consecutive foot traffic declines and DEI backlash; NVDA’s US export restrictions to China; low-income consumers cutting non-essentials [0].

- Opportunities: WMT’s Black Friday promotions; NVDA’s AI boom (half-trillion dollar forecast) if expectations are met [0].

- Urgency: Upcoming earnings this week will clarify if corporate confidence translates to results.

- S&P500 Q3 earnings growth:13.1% (92% reporting) [1].

- Upcoming earnings: WMT, TGT, TJX, ROST, HD, LOW, NVDA [1].

- Nov17 changes: WMT (+0.19%), TGT (-0.86%), NVDA (-0.75%) [0].

- Risks: TGT foot traffic, NVDA geopolitics [0].

- Opportunities: WMT promotions, NVDA AI demand [0].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.