Morgan Stanley Downgrades DELL, HPE, HPQ Amid Memory Price Surge Squeezing Margins

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

On November 17, 2025, Morgan Stanley downgraded Dell Technologies (DELL) with a double downgrade and Hewlett Packard Enterprise (HPE) and HP Inc. (HPQ) due to a sustained surge in memory prices (NAND and DRAM up 50–300% over six months) [1][2][3]. This surge threatens to squeeze margins for memory-intensive hardware providers, as memory is a key component in servers, PCs, and storage arrays [2].

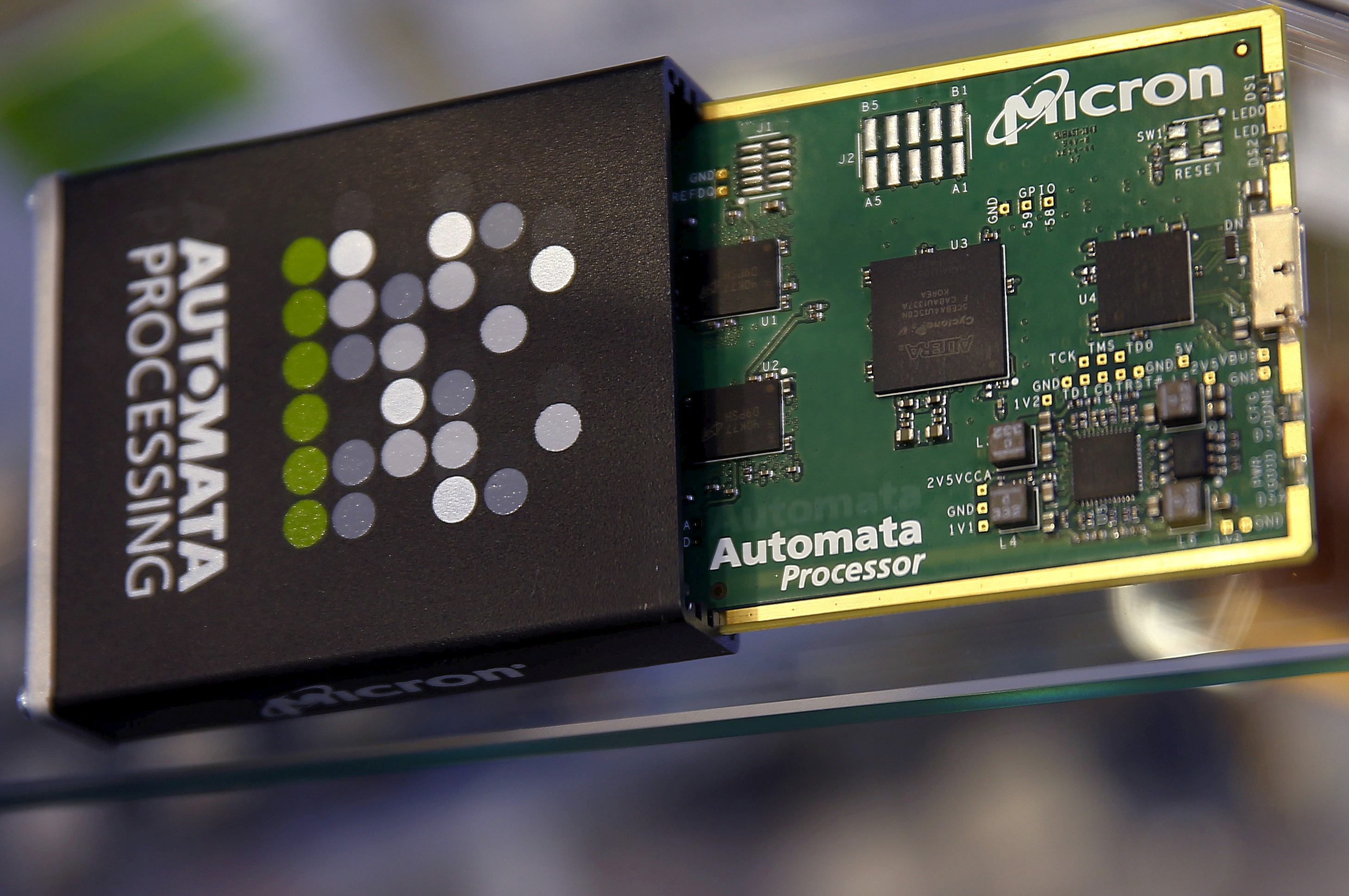

Short-term market impacts are evident: DELL fell ~7.36% to $123.91, HPE dropped ~7.10% to $21.21, and HPQ declined ~4.34% to $23.46 [0]. In contrast, memory manufacturer Micron (MU) rose +0.47% to $248, reflecting tailwinds from higher memory prices [0]. The broader Technology sector was up +0.68% on the day, but these hardware stocks underperformed the sector significantly [0].

Key data points include:

- DELL: Volume 8.43M (1.2x average), market cap $83.31B, P/E ratio (TTM)18.09 [0]

- HPE: Volume18.12M (0.59x average), market cap $27.97B, P/E ratio24.95 [0]

- HPQ: Volume 8.49M (0.75x average), market cap $21.93B, P/E ratio8.53 [0]

- MU: Volume0.66x average, market cap $276.77B, P/E ratio32.72 [0]

Morgan Stanley’s analysis suggests the memory supercycle could persist into 2026, creating a divergence between memory manufacturers (beneficiaries) and hardware OEMs (vulnerable) [2]. Upstream beneficiaries include Micron (MU) and Western Digital (WDC) [1], while insulated peers include firms with diversified revenue or higher software exposure like Apple and Pure Storage [3].

- Sector Divergence: The event highlights a clear split within tech—memory manufacturers benefit from price surges, while hardware OEMs face margin pressure [0][1].

- Revenue Mix Impact: Firms with higher software/services revenue (e.g., Apple, Pure Storage) are less vulnerable to memory price fluctuations, underscoring diversified revenue value [3].

- Volume Trends: DELL saw above-average trading volume (1.2x) indicating stronger investor reaction compared to HPE/HPQ (below-average volume) [0].

- Long-Term Shift: The memory supercycle may shift investor focus from hardware OEMs to memory manufacturers in the near term [2].

- Margin Compression: Rising memory prices are expected to impact DELL/HPE/HPQ margins through 2026 [2]. Monitor margin guidance in upcoming earnings [0].

- Volatility Risk: These stocks are more vulnerable to memory price swings than diversified peers [3].

- Downgrade Cascading: Further analyst downgrades could trigger additional selling pressure [0].

- Memory Sector: Memory manufacturers like MU and WDC stand to benefit from sustained price increases [1].

- Insulated Peers: Firms with diversified revenue models (software/services) may offer relative stability amid sector volatility [3].

- Event: Morgan Stanley downgraded DELL (double), HPE, HPQ on Nov17,2025 due to memory price surge [1][2][3].

- Short-Term Price Changes: DELL (-7.36%), HPE (-7.10%), HPQ (-4.34%), MU (+0.47%) [0].

- Market Caps: DELL ($83.31B), HPE ($27.97B), HPQ ($21.93B), MU ($276.77B) [0].

- Critical Monitoring Factors: Memory price trends, margin guidance, competitive responses (cost-cutting, product mix shifts) [0][2].

- Insulated Peers: Apple, Pure Storage (diversified revenue) [3].

This summary provides objective context for decision-making without prescriptive investment recommendations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.