Analysis of the Strong Performance of Aiko Co., Ltd. (300889) and Judgment on Its Sustainability

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Aiko Co., Ltd. (300889) is a high-tech enterprise listed on the ChiNext board, focusing on LED lighting and energy storage systems [0]. Since 2025, the company’s stock price has performed strongly, with key driving factors including:

- Significant improvement in performance: In 2025, revenue increased by 39.88%, losses narrowed by 78.62%, and the second quarter achieved a single-quarter profit of 3.5703 million yuan, a year-on-year increase of 116.81% [0][4].

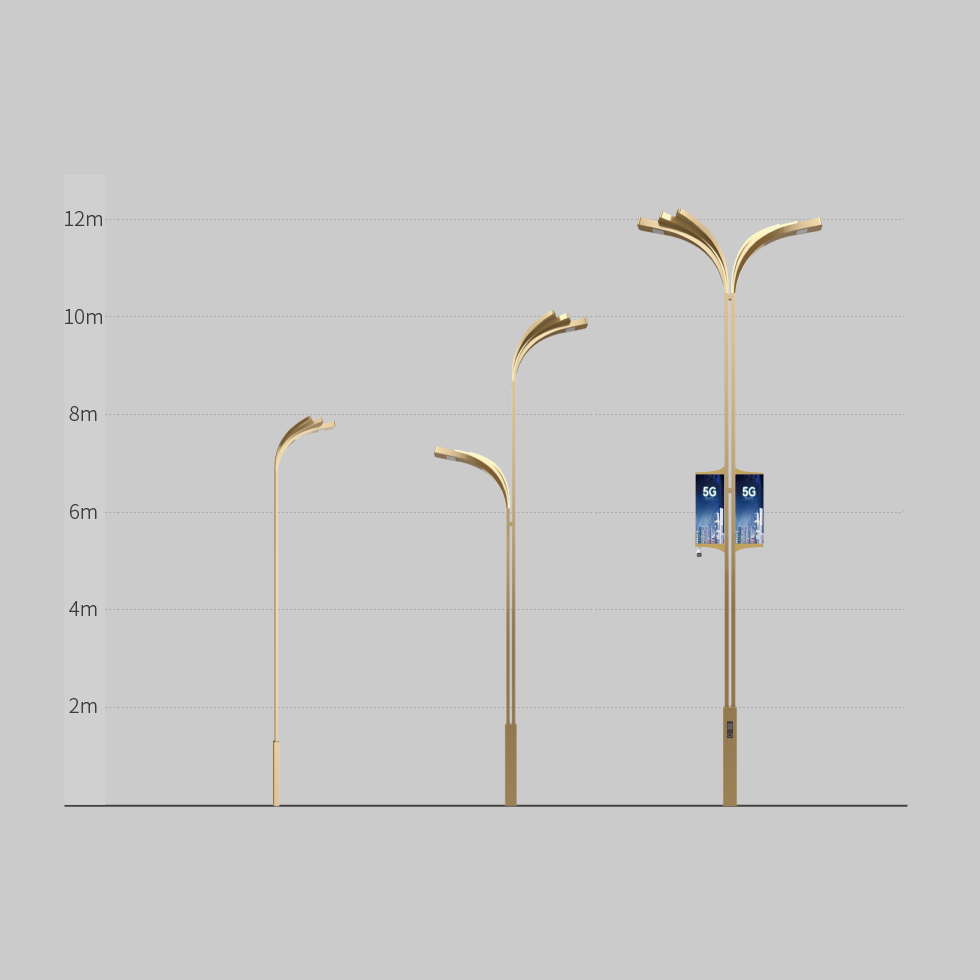

- Policy-aligned industrial layout: The company’s smart street lamp products reserve installation positions for 5G micro base stations, aligning with the direction of new infrastructure policies [6].

- Continuous capital inflow: Main funds have continued to flow in net [3]; as of November 14, the financing balance reached 178 million yuan [5].

- Cross-domain resonance: Improved performance, policy benefits, and capital attention form a positive cycle, driving the stock price higher [0].

- Alignment with industry trends: The company’s transformation towards smart lighting and energy storage aligns with the industry development trends of new energy and new infrastructure [0][6].

- Structural opportunities: Against the backdrop of smart city construction and 5G infrastructure advancement, the application scenarios of the company’s products are expected to further expand [6].

- The proportion of accounts receivable to revenue is as high as 84.41%, posing liquidity risks [4].

Opportunities: - The layout of smart street lamps and 5G micro base stations benefits from new infrastructure policies, with great market demand potential [6].

- If the performance improvement trend continues, it is expected to attract more attention from long-term funds [0][4].

The recent strong performance of Aiko Co., Ltd. (300889) is supported by performance, policy, and capital aspects, but attention should be paid to the risk of high accounts receivable. The company’s layout in the smart lighting and energy storage fields aligns with industry trends; future development needs to focus on performance fulfillment capabilities and accounts receivable management efficiency [0][4][6].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.