Analysis of Zhongfu Information (300659)'s Strong Performance: Catalyzed by Huawei Computing Power Concept and Driven by Cybersecurity Policy Benefits

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on Tushare’s strong stock pool data [0]. Zhongfu Information (300659) has recently shown strong performance and entered the strong stock pool. Core driving factors include Huawei computing power concept catalysis, cybersecurity industry policy benefits, sector rotation effects, and capital pursuit [0][1][4]. The company’s Q3 2025 revenue increased by 9.06% year-on-year, with a main capital net inflow of 103 million yuan [0], and short-term market sentiment is positive.

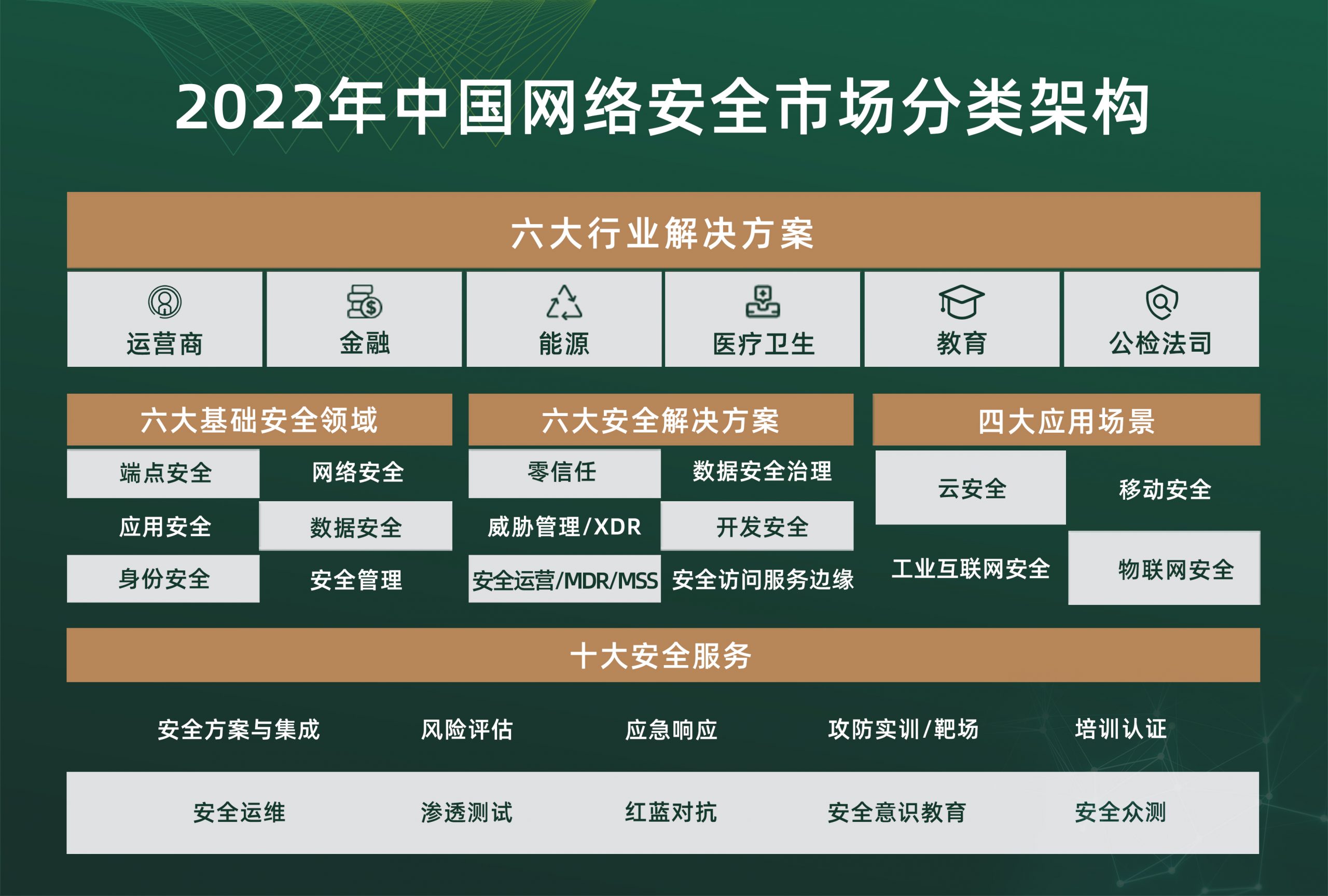

Zhongfu Information is a leading enterprise in China’s information security field, focusing on the research and development of terminal data security solutions. It made a breakthrough in terminal encrypted network traffic analysis technology in 2025 [1]. Its strong performance is mainly due to the following points:

- Huawei Computing Power Ecosystem Linkage: The company deeply participates in Huawei’s Ascend computing power ecosystem. Huawei will release an AI technology breakthrough (computing power utilization rate increased to 70%) on November 21, driving the rise of related concept stocks [0][4];

- Policy Benefit Support: National strategy promotes the development of the information security industry, and the trend of domestic substitution is obvious [2][3];

- Sector Rotation Effect: Capital flows from traditional sectors to technology growth stocks, and the information security sector has become a hot spot [5];

- Significant Capital Inflow: On the day, the main capital net inflow was 102.7034 million yuan, with a net inflow ratio of 16.98% [0].

- AI + Security Integration: The combination of AI technology breakthroughs (such as Huawei’s computing power improvement) and information security needs forms a new growth curve [0][1];

- Accelerated Domestic Substitution: Driven by policies, the process of domestic information security enterprises replacing overseas products is accelerating. Zhongfu Information, as an industry veteran (deeply engaged for nearly 20 years), benefits significantly [2][7];

- Short-term Speculative Atmosphere: The market has high short-term activity, and there are elements of concept speculation. Attention should be paid to subsequent performance verification [5].

- Risks: Large short-term gains may lead to corrections; fluctuations after concept speculation need to be vigilant [5][6];

- Opportunities: Niche segments such as AI security and terminal data security have long-term growth space [0][2].

Zhongfu Information’s strong performance is the result of the combined effect of technological breakthroughs, policy benefits, and capital inflow. The company’s fundamentals are stable (Q3 revenue growth of 9.06%), but short-term market sentiment fluctuations need to be noted. Investors should combine their own risk preferences and pay attention to the long-term industry trends and the matching degree of the company’s performance [0][1][5].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.