Analysis of Rongbai Technology (688005) Strong Performance: CATL Sodium Battery Collaboration Driver and Future Outlook

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

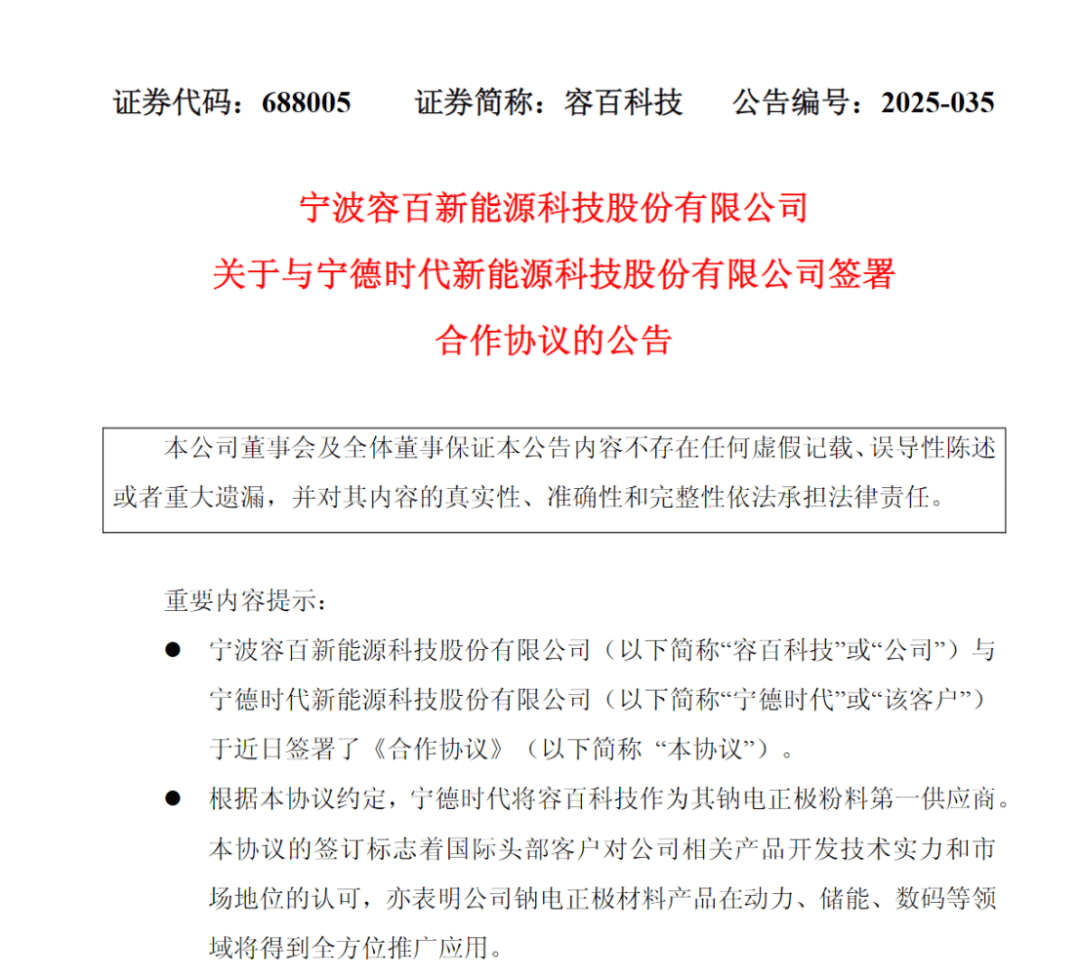

Rongbai Technology (688005) signed a long-term cooperation agreement with CATL in November 2025 to become its primary supplier of sodium battery cathode powder. The agreement is valid until 2029, and CATL commits to purchasing no less than 60% of its total procurement volume annually [0][1][4]. This collaboration signifies the company’s sodium battery technology being recognized by a leading client, directly driving its stock price to surge 20% to 35.40 yuan on November 17, with a turnover of 5.0316 million yuan [0][2]. CATL’s sodium-ion battery recently became the world’s first product to pass the new national standard (GB38031—2025) certification, accelerating the industrialization of sodium batteries and bringing long-term growth opportunities for Rongbai Technology [0][3].

- Validation of Technical Leadership: The collaboration with CATL is a key recognition of Rongbai Technology’s leading position in sodium battery cathode material technology, consolidating its core role in the sodium battery industry chain [0][6].

- Improved Revenue Stability: The 4-year cooperation agreement and the 60% procurement share commitment provide clear revenue growth expectations for the company, helping to alleviate current performance pressure [0][4].

- Industry Trend Dividend: Sodium batteries are seeing rapid demand growth in energy storage and low-speed electric vehicle sectors due to cost advantages; Rongbai Technology is expected to benefit from the industry’s large-scale expansion [0][5].

- Short-term Performance Pressure: The company reported a net loss of over 200 million yuan in the first three quarters of 2025, with a gross margin of only 8.5%, mainly due to increased investment in new technology R&D; short-term profit improvement still requires time [0].

- Supply Chain Execution Risk: Meeting CATL’s large-scale procurement demand will test the company’s capacity expansion and quality control capabilities [0][3].

- Sodium Battery Market Growth: The global sodium battery market is expected to expand rapidly; Rongbai Technology, as a core supplier, will benefit directly [0][5].

- Cost Optimization Potential: When procurement volume reaches 500,000 tons or more, the company can offer more favorable prices, and economies of scale are expected to increase gross margin [0][6].

Rongbai Technology (688005)'s strong performance is mainly driven by its sodium battery collaboration with CATL. This agreement brings long-term development opportunities for the company, but it needs to address performance losses and execution challenges in the short term. Investors should pay attention to the progress of sodium battery industrialization and the company’s capacity expansion to evaluate future growth potential [0][1].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.