Aerospace Development (000547) Limit-Up Analysis: Driven by Military Collaborative Technology Breakthroughs and Sector Resonance

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Aerospace Development (000547) hit the daily limit on November 17, 2025, closing at 10.35 yuan, a 60-day high [0][2]. This limit-up was mainly driven by two factors: first, the Air Force released footage of Attack-11 drones collaborating with manned fighter jets J-20 and J-16 for the first time on its founding anniversary, sparking market attention on military informatization and manned-unmanned collaborative technology [1][4]; second, the company’s first three quarters revenue increased by 42.59% year-on-year, and net profit grew by 24.87%-92.54%, far exceeding the industry average [0][2]. Meanwhile, the aerospace sector strengthened overall: the Aerospace ETF (159227) rose 2.06% that day, and the CSI Aerospace Index (CN5082) increased by 1.98%, forming a sector resonance effect [1][4].

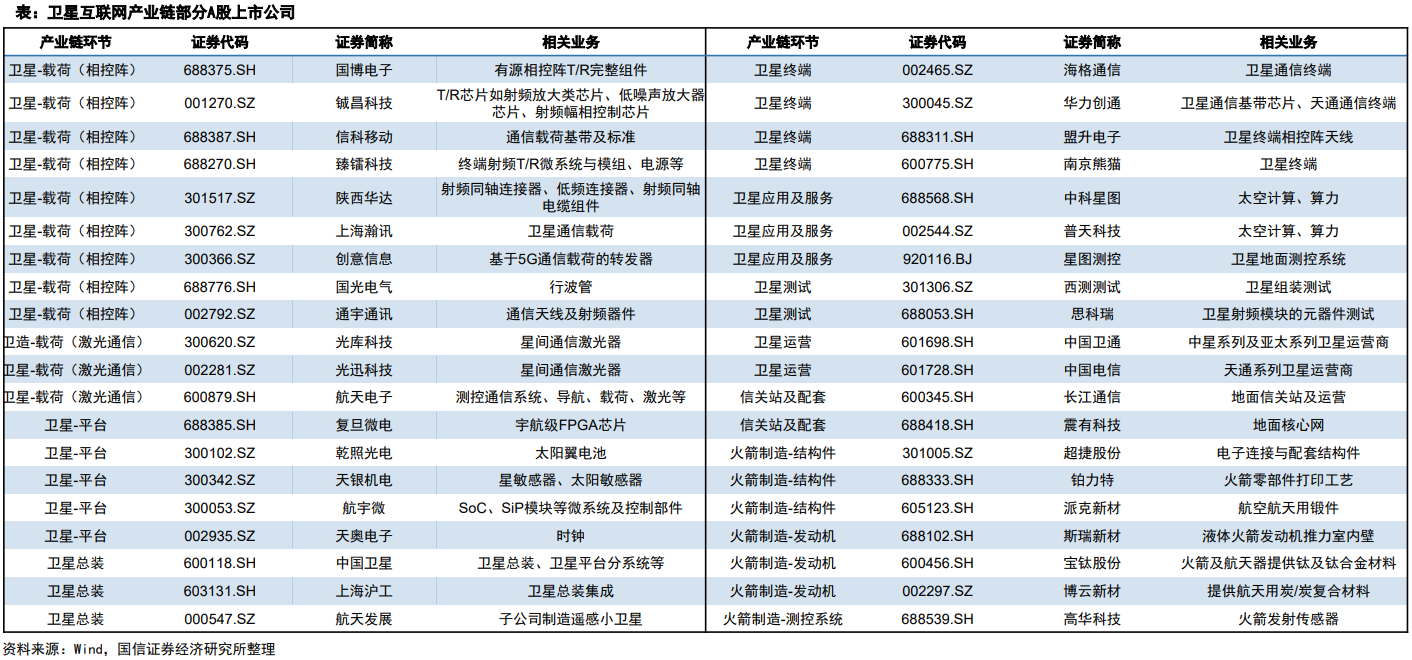

The company’s business covers multiple popular tracks including military informatization, satellite internet, drones, low-altitude economy, and third-generation semiconductors, making it a core target favored by capital [0][4]. In terms of capital flow, the main capital inflow on the day was 100 million yuan (accounting for 45.2% of total turnover), and brokerage seats had a net buy of 274 million yuan, indicating that institutional and retail funds jointly pushed the stock price up [0][2].

- Multi-concept Overlay Advantage: Aerospace Development has deployed in multiple high-growth tracks simultaneously, forming a triple resonance of “technology + market + policy”, giving it stronger elasticity in sector trends [0][4].

- Significant Sector Linkage Effect: This limit-up is not an isolated event for the individual stock but a microcosm of the overall strength of the military sector, reflecting the market’s long-term confidence in independent innovation of national defense technology [1][6].

- Explosive Investor Attention: The number of users following this stock on the Snowball platform reached 84,000, and the discussion volume increased significantly on the day, indicating a rise in market sentiment [5].

- Breakthroughs in manned-unmanned collaborative technology are expected to become a long-term growth point for the military sector, and the company as a participant in related fields will continue to benefit [1][4].

- Emerging tracks such as satellite internet and low-altitude economy are in the period of policy dividend release, and the company’s business layout is expected to fully enjoy the industry growth dividends [0][4].

- The reform of military central enterprises continues to advance, and the company as an enterprise under China Aerospace Science and Industry Corporation may benefit from asset integration and efficiency improvement [0][4].

- The short-term stock price has risen sharply, and there is pressure for profit-taking [0].

- The military sector is obviously driven by policies and events; if there is no sustained positive support in the follow-up, volatility may intensify [1][6].

- Some concepts are still in the early stage, and there is uncertainty in the progress of commercialization [0].

Aerospace Development’s limit-up this time is the result of the joint action of “event-driven + fundamental support + sector resonance”. With its multi-track layout, strong performance growth, and central enterprise background, the company has become a core target in the military sector. Investors need to pay attention to subsequent policy implementation, technology commercialization progress, and sector capital flow to balance long-term investment value and short-term trading opportunities.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.