Analysis of 600327 Grand Orient's Limit-Up: Market Reaction Driven by Medical Transformation and Governance Optimization

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

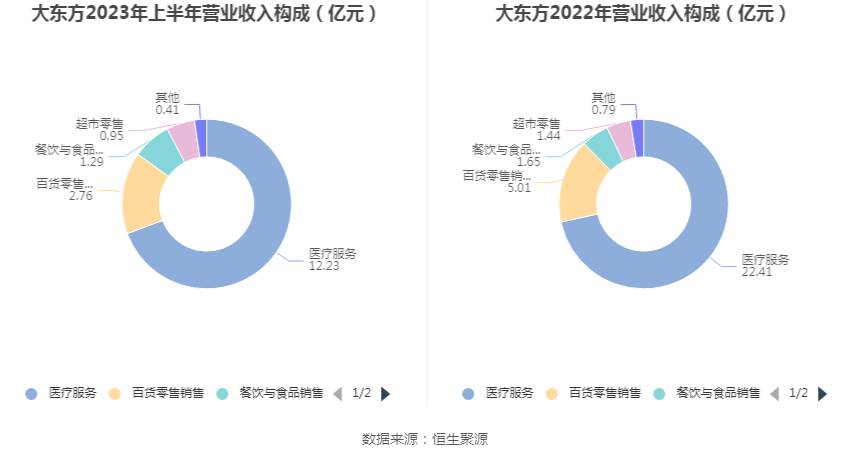

600327 Grand Orient (Wuxi Commercial Building Grand Orient Co., Ltd.), a traditional commercial retail enterprise, has completed its business transformation to focus on medical services, with medical service revenue accounting for 79.22% [0]. This limit-up is the result of multiple factors: first, the company’s governance structure optimization—on November 13, the appointment of a new Vice President raised expectations for improved operational efficiency [0][4]; second, the emergence of results from the medical and health industry transformation, which has become a market focus [0][3]; third, active pursuit by main funds—on November 17, the main net inflow was 15.2356 million yuan [0][2]; fourth, three consecutive days of abnormal fluctuations, with a cumulative deviation of increase reaching 24.74% [0][1].

- Valuation Reconstruction from Cross-Industry Transformation: The company has transformed from the commercial retail industry to medical services, and the track switch has changed the market’s valuation logic. Although not fully reflected in performance yet, it has attracted capital attention [0].

- Positive Cycle Between Governance Optimization and Market Confidence: Management adjustments have sent positive signals, forming a synergistic effect with medical transformation and enhancing investors’ confidence in the company’s future development [0][4].

- Short-Term Divergence Between Capital Drive and Fundamentals: The current PE ratio is as high as 113.14 times, significantly higher than the medical service industry average of 40.39 times [0], while the first three quarters’ performance declined (revenue down 4.23%, net profit down 33.12%) [0], reflecting a short-term mismatch between market expectations and fundamentals.

- Valuation Bubble Risk: PE ratio is far above the industry average. If the transformation progress is less than expected, it may face valuation correction pressure [0];

- Uncertainty in Performance Improvement: The first three quarters’ performance declined, so it is necessary to observe whether the medical business can continuously drive performance recovery [0].

- Potential of Medical Transformation Track: The medical service industry has large long-term growth space. The company’s core business accounts for nearly 80%, and it is expected to benefit from industry development [0][3];

- Cash Flow Improvement: Operating cash flow increased by 140.32% year-on-year [0], providing financial support for transformation investment.

600327 Grand Orient’s limit-up stems from the market’s positive expectations for medical transformation and governance optimization, but attention should be paid to the short-term divergence between valuation and fundamentals. Investors should comprehensively judge based on the company’s transformation progress, medical business profitability, and performance improvement trends, and avoid blind chasing of high prices.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.