Fed QT End Date Sparks Reddit Speculation Amid Official Silence

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The Reddit community is actively discussing the Fed’s alleged decision to end quantitative tightening on December 1, 2025, with mixed interpretations of the implications:

- Policy Interpretation: Users debate whether ending QT automatically means starting QE, with some noting that stopping balance sheet reduction doesn’t necessarily equate to new asset purchases Reddit

- Market Strategy: Several users suggest specific trading approaches, including trading triple-leveraged SPY (SPXL) and shorting the U.S. dollar as potential plays on increased liquidity Reddit

- Inflation Concerns: Community members warn that additional liquidity could exacerbate inflation while consumers face stagnant wages and high asset prices Reddit

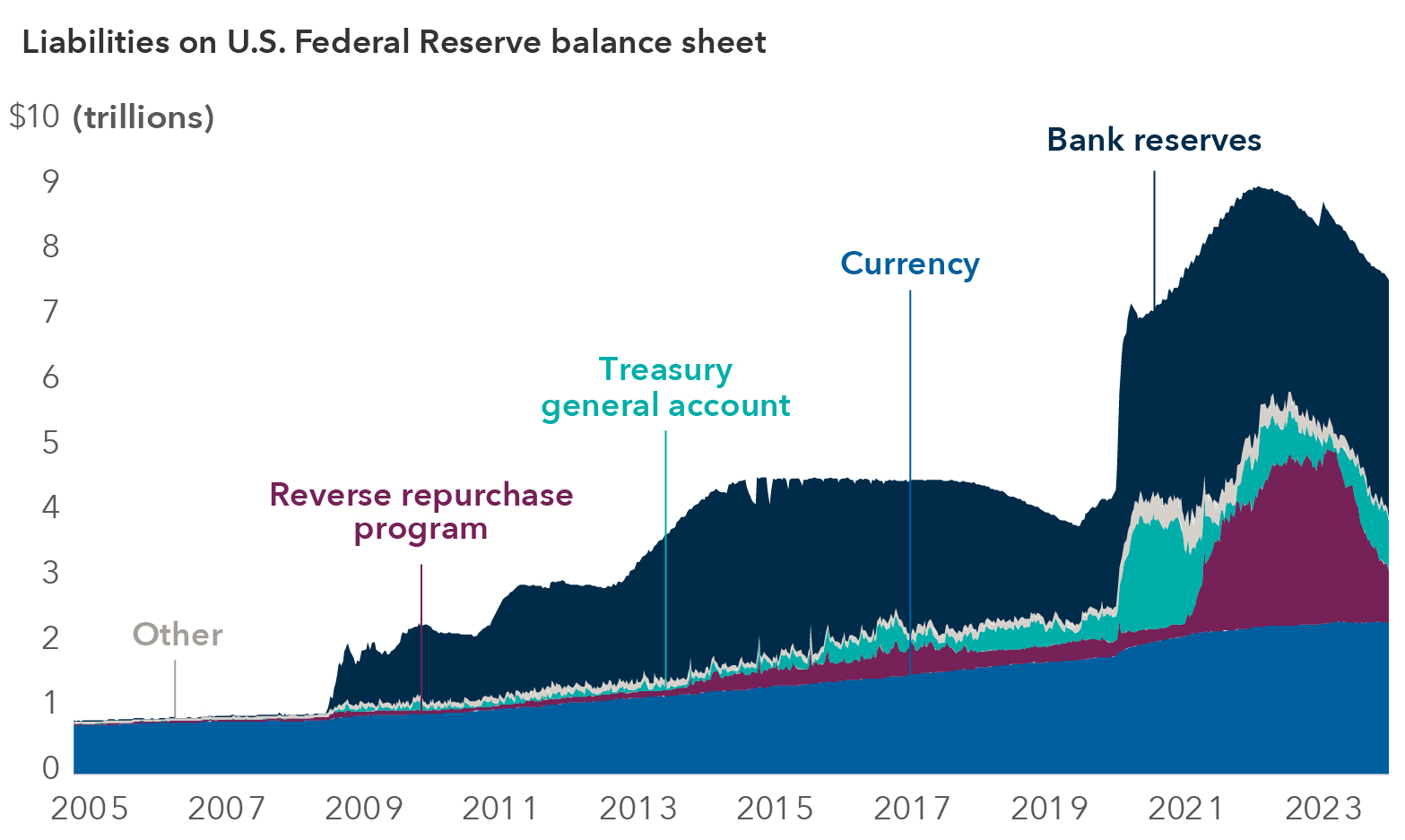

- Skepticism: Some users question whether there was genuine quantitative tightening to begin with, noting the Fed’s balance sheet remains elevated from prior QE programs Reddit

Investigation into the claims reveals significant discrepancies between social media speculation and official sources:

- No Official Confirmation: The Federal Reserve has made no official announcement regarding ending QT on December 1, 2025. Major news organizations (Reuters, Bloomberg, WSJ) have not reported this policy change Federal Reserve

- Social Media Origins: Claims appear to originate from Instagram posts and secondary financial websites, with no verification through official Fed channels Instagram Binance

- Liquidity Concerns: Some analysis suggests the Fed is facing mounting liquidity strains, with recent $29.4 billion liquidity injections indicating potential market stress Economic Times

- AI Sector Impact: Discussions continue around AI bubble concerns, with Goldman Sachs warning of potential corrections while Big Tech’s robust cash flows may support continued expansion NinjaAI

The stark contrast between Reddit’s active speculation and the absence of official Fed confirmation creates a challenging information environment for investors. While Reddit users are trading on the assumption of confirmed policy changes, research indicates these claims remain unverified. This disconnect suggests that market participants may be acting on rumors rather than official policy signals, potentially creating volatility based on misinformation rather than fundamentals.

The liquidity concerns mentioned in some analyses may be real, as evidenced by recent Fed interventions, but these don’t necessarily translate into the specific QT end date being discussed on social media. The AI bubble concerns remain valid regardless of QT policy, representing an independent risk factor that investors should monitor.

- Acting on unconfirmed policy announcements could lead to significant losses if the Fed doesn’t follow through

- SPXL and other leveraged positions carry amplified risk, especially in uncertain policy environments

- Inflation concerns remain valid regardless of QT policy, potentially impacting real returns

- Information asymmetry between social media speculation and official communications

- Monitor official Fed communications for actual policy changes rather than social media rumors

- Consider defensive positioning if liquidity concerns prove accurate

- AI sector may offer opportunities if bubble concerns are overblown, but requires careful entry timing

- Gold and other safe-haven assets may benefit from policy uncertainty FX Empire

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.