Analysis of Tax-Loss Harvesting Strategy for High-Income Taxpayers Considering Riskier Investments

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

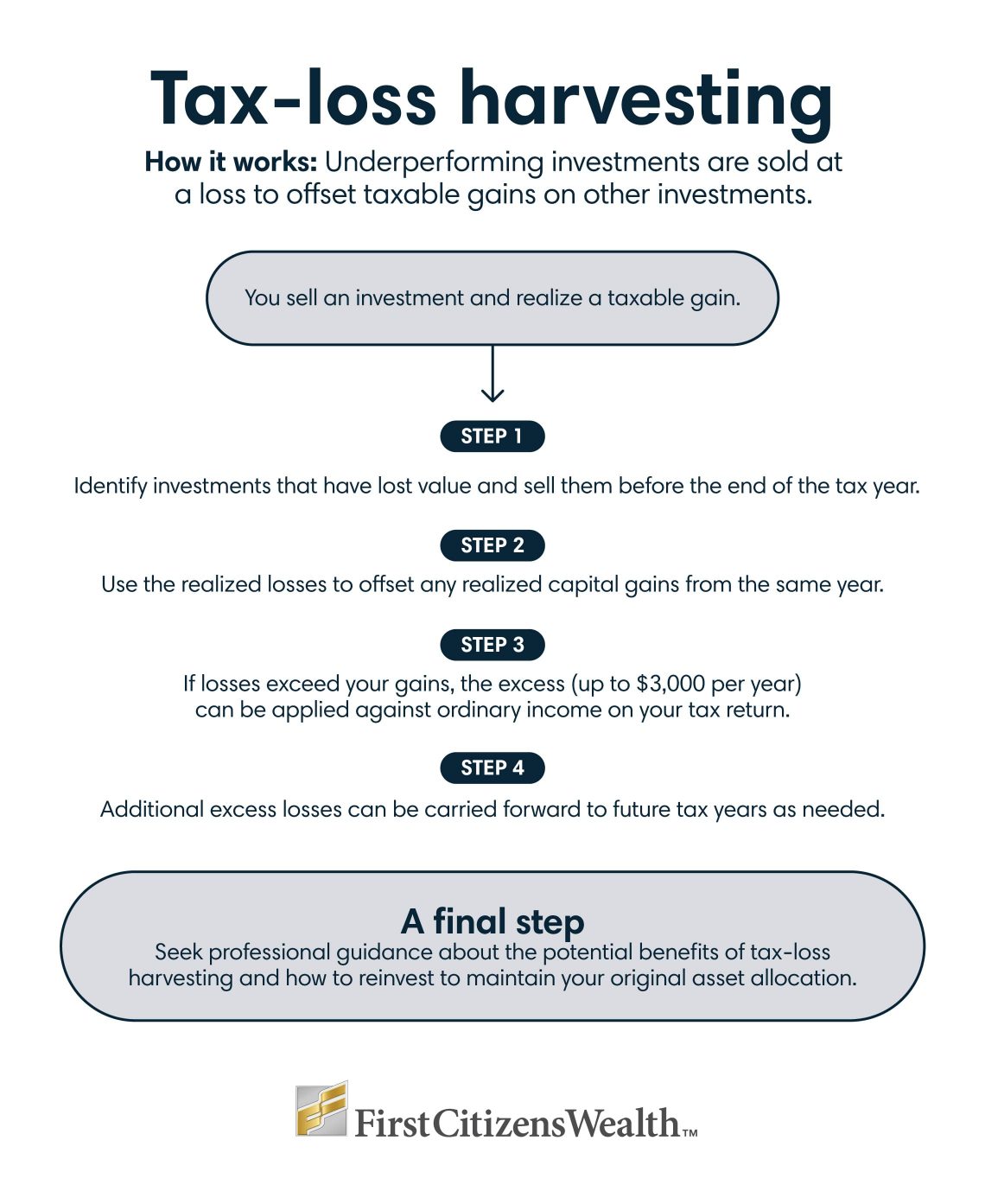

A taxpayer facing abnormally high 2025 taxes due to a large one-time gain is considering riskier investments to facilitate tax-loss harvesting. This strategy involves offsetting taxable gains with investment losses, which is particularly valuable for high-income earners due to higher marginal tax rates (20% long-term capital gains +3.8% NIIT for single filers over $533k) [2,3]. Riskier assets like individual stocks offer more loss harvesting opportunities but increase downside investment risk [6]. Key rules to note: net capital losses can offset up to $3k of ordinary income annually (carryforwards apply) [1], and the wash sale rule disallows losses if the same security is repurchased within 30 days [4,5].

- High-income taxpayers derive greater benefit from tax-loss harvesting due to higher tax brackets, with potential savings of 23.8% per dollar of harvested loss [3].

- Riskier investments amplify both tax savings potential and investment loss exposure.

- Compliance with wash sale rules is critical—workarounds include using alternative ETFs or waiting 31 days to repurchase [5].

- Complementary strategies (charitable giving, long-term holding) can enhance tax efficiency [8].

- Risks: Investment losses exceeding tax savings, accidental wash sale violations, limited ordinary income offset ($3k/year).

- Opportunities: Significant tax savings, indefinite loss carryforwards, flexibility to optimize future tax liabilities.

The decision to use riskier investments for tax-loss harvesting depends on individual risk tolerance, exact tax bracket, and existing portfolio. Critical considerations include compliance with wash sale rules, understanding loss deduction limits, and leveraging complementary strategies. This analysis provides objective context for decision-making without prescriptive recommendations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.