Bonds on Track for Best Year Since 2020: Fed Rate Cuts Override Deficit Fears

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

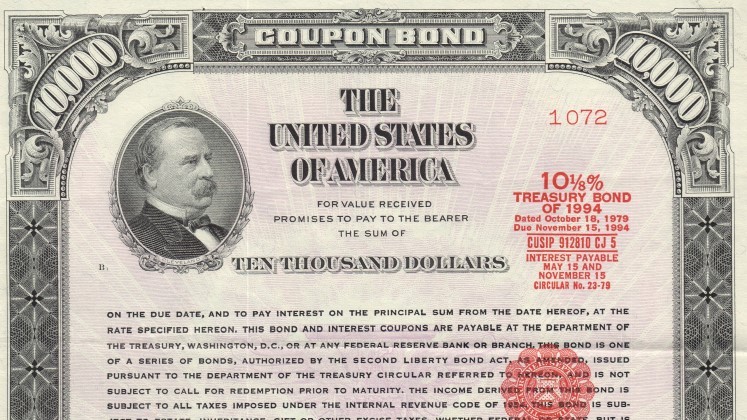

According to the Wall Street Journal, bonds are heading for their best year since 2020, driven by Federal Reserve rate cuts that have overridden concerns about rising government deficits[6]. The article highlights that Treasury and corporate debt markets have rallied as easing monetary policy offsets worries about increased debt issuance and fiscal imbalances.

- Fed Rate Cuts: Two 25-basis-point cuts in September and October 2025 brought the federal funds target range to 3.75%–4.00%[2].

- Bond Returns: As of mid-2025, year-to-date returns stood at:

- High-yield corporates:4.0%

- Investment-grade corporates:3.6%

- U.S. Treasuries:3.3%[0]

- Default Rates: The trailing 12-month high-yield default rate remained above 4% for 20 consecutive months ending May 2025, in line with the 20-year average of ~4.5%[0].

- Deficit Trends: The cumulative fiscal year 2025 deficit reached $1.3 trillion by June, with long-term fiscal imbalance prompting credit rating downgrades from Moody’s[5].

- Directly Impacted: U.S. Treasury securities (all maturities), investment-grade corporate bonds, high-yield corporate bonds.

- Related Sectors: Financial services (bond funds, asset managers), fixed-income ETFs, and companies with high debt loads (benefiting from lower borrowing costs).

- Supply Chain: Upstream (bond issuers) and downstream (institutional/retail investors) participants in the fixed-income market.

- Information Gaps: Need to confirm full-year 2025 bond returns and whether the Federal Reserve will implement a third rate cut in December (Goldman Sachs expects this to be likely)[1].

- Multi-Perspective Analysis: While some firms see opportunities in bonds, Morgan Stanley remains cautious on duration risk, noting limited upside for long-term bonds[4].

- Risk Considerations:

- Users should be aware that elevated high-yield default rates (above 4%) may impact returns for investors in sub-investment-grade debt[0].

- Long-term fiscal deficits continue to pose a risk to Treasury yields, potentially offsetting the benefits of rate cuts[5].

- Key Factors to Monitor:

- Federal Reserve’s December policy meeting (rate cut decision)

- Inflation data and labor market indicators

- Fiscal deficit trends and debt issuance plans

[0] Charles Schwab. “Corporate Bonds: Mid-Year 2025 Outlook”. URL: https://www.schwab.com/learn/story/corporate-bond-outlook

[1] Goldman Sachs. “The Fed Is Forecast to Cut Rates in December as Employment Cools”. URL: https://www.goldmansachs.com/insights/articles/the-fed-is-forecast-to-cut-rates-in-december-as-employment-cools

[2] Trading Economics. “United States Fed Funds Interest Rate”. URL: https://tradingeconomics.com/united-states/interest-rate

[3] Syfe. “What the Latest Fed Rate Cut Means for Bonds and Investors in 2025”. URL: https://www.syfe.com/magazine/what-latest-us-fed-rate-cut-means-bonds-investors-2025/

[4] YCharts. “10 Year Treasury Rate - Real-Time & Historical Yield Trends”. URL: https://ycharts.com/indicators/10_year_treasury_rate

[5] Bipartisan Policy Center. “Deficit Tracker”. URL: https://bipartisanpolicy.org/report/deficit-tracker/

[6] Wall Street Journal. “Bonds Are Heading for the Best Year Since 2020”. URL: https://www.wsj.com/finance/bonds-are-heading-for-the-best-year-since-2020-02c5738b

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. All data is sourced from publicly available reports as of November 16, 2025.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.