Amazon Covered Call Strategy Analysis: Managing Deep ITM Position After Earnings Surge

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The Reddit community on r/StockMarket (186 upvotes, 130 comments) shows strong consensus on managing the AMZN covered call position[1]:

- Primary Strategy: Roll the covered call up and out to a higher strike and later expiration to capture more premium and avoid immediate assignment

- Alternative Approach: Let shares be called away, then implement the wheel strategy by selling cash-secured puts to potentially repurchase at lower prices

- Perspective Check: Many users emphasize the investor still profited ($700 premium + upside to $230) and should accept this as a learning experience

- Risk Management: Community advises against selling covered calls on stocks intended for long-term holding and to always assume assignment when setting strikes

- Timing Caution: Users stress checking earnings dates before selling options and monitoring ex-dividend dates for early assignment risk (though AMZN currently has no dividend)

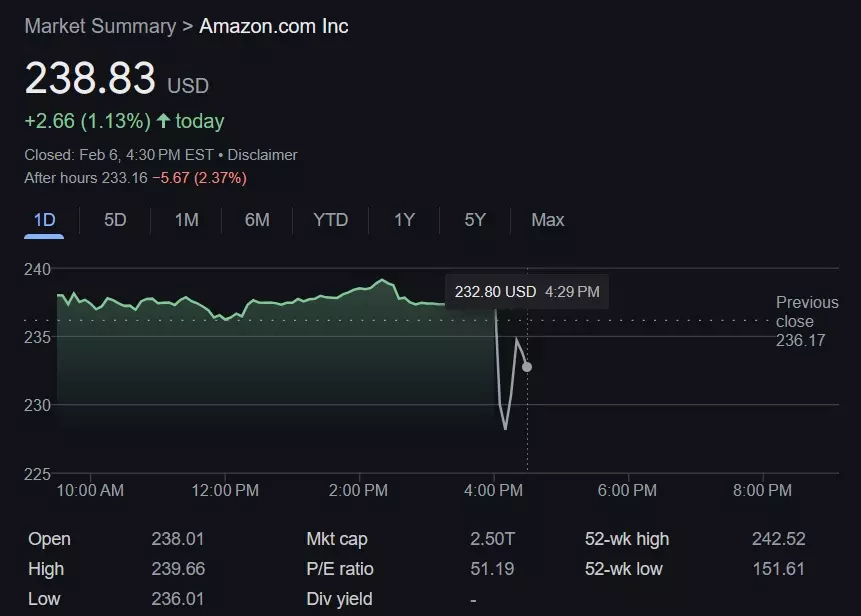

Current market data and strategic analysis provide context for the decision[2][3][4]:

- Stock Performance: AMZN trading around $244.3 as of October 31, 2025, with technical support at $244 and resistance near $253

- Options Pricing: $230 strike weekly calls (10/31/2025 expiration) were priced at $7.832, suggesting the user’s $700 premium was reasonable

- Fundamental Strength: Amazon reported strong Q3 2025 earnings with 13% net sales growth and AWS segment sales surging 20%

- Analyst Outlook: Positive sentiment with price targets reaching up to $335, suggesting further upside potential

- Rolling Strategies: Multiple approaches available including rolling up (higher strike), rolling out (later expiration), or combining both

The Reddit consensus aligns well with the fundamental and technical picture. The community’s recommendation to roll up and out is particularly prudent given:

- Strong Fundamentals: Q3 earnings beat and AWS growth suggest continued upside potential beyond current levels

- Technical Position: With resistance at $253 and current trading around $244-252, rolling to strikes above $260 could capture additional premium while allowing for more upside

- Risk Management: Rolling extends the position timeline, reducing immediate assignment risk while maintaining income generation

The community’s perspective that this represents a “good problem to have” is accurate - the user has already captured significant premium and capital appreciation up to $230.

- Premium Capture: Rolling to higher strikes can generate additional income while maintaining upside potential

- Fundamental Momentum: Strong earnings and AWS growth support further stock appreciation

- Strategic Flexibility: Multiple rolling approaches allow customization based on market outlook

- Assignment Risk: Deep ITM position ($252 vs $230 strike = $22 intrinsic value) creates high assignment probability

- Cost to Close: Buying back the current position would require paying significant intrinsic value

- Market Timing: Incorrect strike selection in rolling could limit upside if AMZN continues surging past new strikes

- Tax Implications: Assignment may trigger capital gains, while rolling creates new tax basis considerations

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.