Value Investing's Evolution: Macro Trend Insight & Buffett's Platform Ecosystem Focus

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

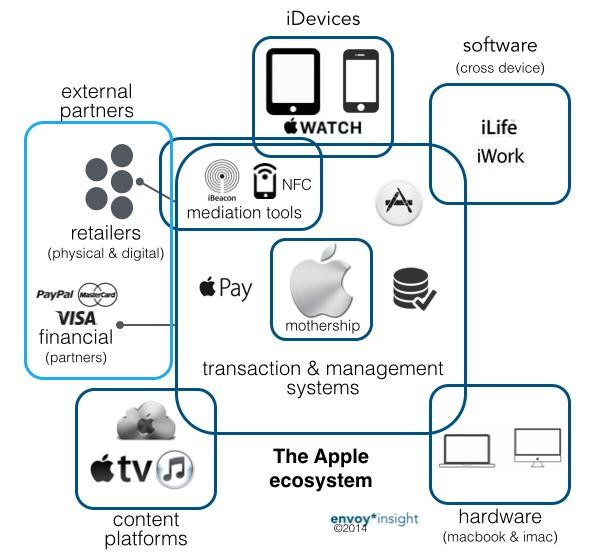

The post claims value investing’s ultimate form is the understanding of major social macro trends, not just traditional valuation metrics. Buffett’s Apple (platform value & user barriers) and Alphabet (remains unbeatable regardless of the AI bubble) investments illustrate focusing on structural moats. True value investing is dynamic, combining trends and competition.

- Berkshire’s Portfolio Shifts: In Q3 2024, Berkshire took a first-time position in Alphabet (GOOGL) with 17.84 million shares ($43B, 10th largest position), and reduced its position in Apple (AAPL) to 238.2 million shares (a 22.69% reduction from over 50%). Buffett views Apple as a consumer company, not a tech company.

- Moat Evolution: Platform ecosystems include network effects (the strongest), user stickiness (switching costs/data), and the AI era adds data flywheels and standards.

Both post and research align on platform ecosystems as core moats. Buffett’s actions reflect evolving value investing (adapting to tech via platform understanding).

- Opportunities: Companies with robust platform ecosystems (network effects, user stickiness).

- Risks: Misjudging moat durability, overvaluation in bubbles, missing trend shifts.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.