AI Market Non-Bubble Analysis: Industrial Buildout & Immediate Sector Impact

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

On November 16, 2025, Seeking Alpha published an article arguing the current AI-driven market is not a bubble but a “massive industrial buildout” underpinned by real cash flows and disciplined capital allocation [tool0]. Key claims include:

- Trillions in AI capex from hyperscalers and major tech firms

- Financing remains disciplined with risks increasingly priced in

- Valuation volatility in AI sectors makes diversification into energy, infrastructure, and private credit attractive [tool0]

The article contrasts with concerns about AI bubbles by emphasizing tangible infrastructure investments rather than speculative asset pricing [tool7, result0].

- Technology Sector: +2.03% gain on the latest available trading day (November 14, 2025), aligning with positive sentiment around AI infrastructure investments [tool1].

- Energy Sector: +3.11% gain, reflecting demand for power in AI data centers (consistent with the article’s diversification recommendation) [tool1].

- NASDAQ Composite: +1.58% increase on November 14, driven by AI-related stocks [tool8].

Leading AI/hyperscaler stocks showed strong gains in recent trading:

- NVIDIA (NVDA): +4% on November 14 [tool2]

- Microsoft (MSFT): +2.4% on November 14 [tool3]

- Alphabet (GOOGL): +1.84% on November 14 [tool4]

Note: The article was published on Sunday (non-trading day), so full market reaction will be visible on Monday, November 17.

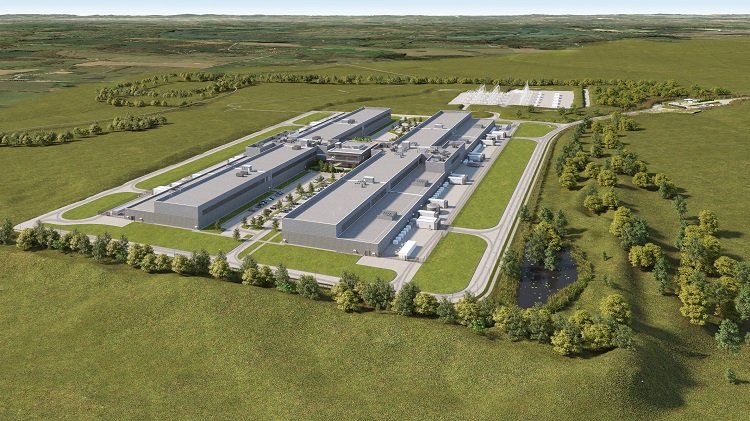

- Hyperscaler Investments: 5 largest hyperscalers to spend >$300B in 2025 and $1T+ during 2025–2027 (KPMG) [tool7, result2].

- Goldman Sachs Forecast: $1.15T in AI-related capex from 2025–2027 (double 2022–2024 levels) [tool7, result1].

- Token Pricing: Wholesale rates for GPT-4 Turbo dropped from $30 to $5–7 per M-tokens in 12 months (KPMG) [tool7, result2].

- Payback Period: AI factories may take a decade or more to reach breakeven (SiliconAngle) [tool7, result4].

- NVIDIA (NVDA): 186M shares traded on November14 (volume up from 154M on November12) [tool2].

- Microsoft (MSFT): 28.5M shares traded on November14 (consistent with recent averages) [tool3].

- Hyperscalers: Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL), Meta (META) [tool0, tool7].

- Chipmakers: NVIDIA (NVDA) (core supplier for AI GPUs) [tool2, tool7].

- Upstream: Semiconductors (NVIDIA, TSMC) and data center hardware providers.

- Downstream: Cloud services (Azure, AWS, GCP) and enterprise AI solutions.

- Supporting: Energy (power for data centers) and infrastructure (data center construction) [tool1, tool7].

- NASDAQ Composite (^IXIC): Heavily weighted toward AI/tech stocks [tool8].

- Technology Select Sector SPDR Fund (XLK): Tracks tech sector performance [implied from tool1].

- Monday Market Reaction: Need to monitor November17 trading data to assess investor response to the article.

- Official Capex Reports: Verify projections with quarterly earnings transcripts from Microsoft, Amazon, and Alphabet.

- Energy Cost Trends: Track natural gas and electricity prices for data center operations.

- Bull Case: Real cash flows and disciplined financing support long-term growth (Seeking Alpha) [tool0].

- Bear Case: Long payback periods and declining token prices may pressure margins (SiliconAngle, KPMG) [tool7, results2,4].

- Long Payback: Decade+ breakeven timeline for AI factories could delay returns [tool7, result4].

- Token Deflation: Falling pricing may impact revenue growth for AI model providers [tool7, result2].

- Capex Efficiency: Investors should monitor how hyperscalers optimize capital allocation to avoid waste [tool7, result1].

- Capex Overspending: Unchecked investments in AI factories could lead to asset write-downs.

- Energy Supply: Data center power demand may outpace grid capacity in key regions.

- Competitive Pressure: Rising number of AI providers could further compress token prices.

- Capex Efficiency: Return-on-compute (ROC) for hyperscalers (KPMG framework: NPV = Σ[(price per token – variable cost) × tokens × utilization] – (CapEx + fixed OpEx)) [tool7, result2].

- Token Volume: Growth in AI token consumption to offset pricing declines.

- Energy Costs: Monthly electricity prices for major data center hubs (e.g., Northern Virginia, Ireland).

- Review Monday’s trading data (November17) for AI stocks and tech indices.

- Analyze Q4 2025 earnings calls for updates on capex plans.

- Monitor regulatory developments around AI infrastructure (e.g., energy efficiency mandates).

[tool0] Crawled content: Seeking Alpha article “The AI Bubble Everyone Fears Doesn’t Exist” (2025-11-16)

[tool1] Sector performance data (2025-11-14)

[tool2] NVIDIA (NVDA) daily prices (2025-11-12 to 2025-11-14)

[tool3] Microsoft (MSFT) daily prices (2025-11-12 to 2025-11-14)

[tool4] Alphabet (GOOGL) daily prices (2025-11-12 to 2025-11-14)

[tool7] Web search results: AI capex projections and market analysis (2025)

[tool8] NASDAQ Composite (^IXIC) daily prices (2025-11-12 to 2025-11-14)

Note: All data is from publicly available sources via the specified tools. Past performance does not guarantee future results.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.