Biotech Research Insights: Workflows, Tools, and Risk Mitigation Strategies

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- Professional investors (e.g., Sanctuary_Bio) rely on corporate presentations, earnings reports, and journal subscriptions (NEJM, Lancet, STAT) for deep scientific/valuation analysis [0].

- Retail investors without advanced biochem/pharma degrees or decade+ experience lack an edge (callmecrude) [0].

- A $350k loss on Biohaven (BHVN) underscores binary FDA event risks (AnalFelon) [0].

- PhD/JD investors stress patent pipeline and cash runway due diligence (Sufficient-Curve-853) [0].

- Mid/large caps (OGN, VTRS, AMGN, ABBV) are preferred over small caps; ETFs are recommended for diversification (JacquesHome) [0].

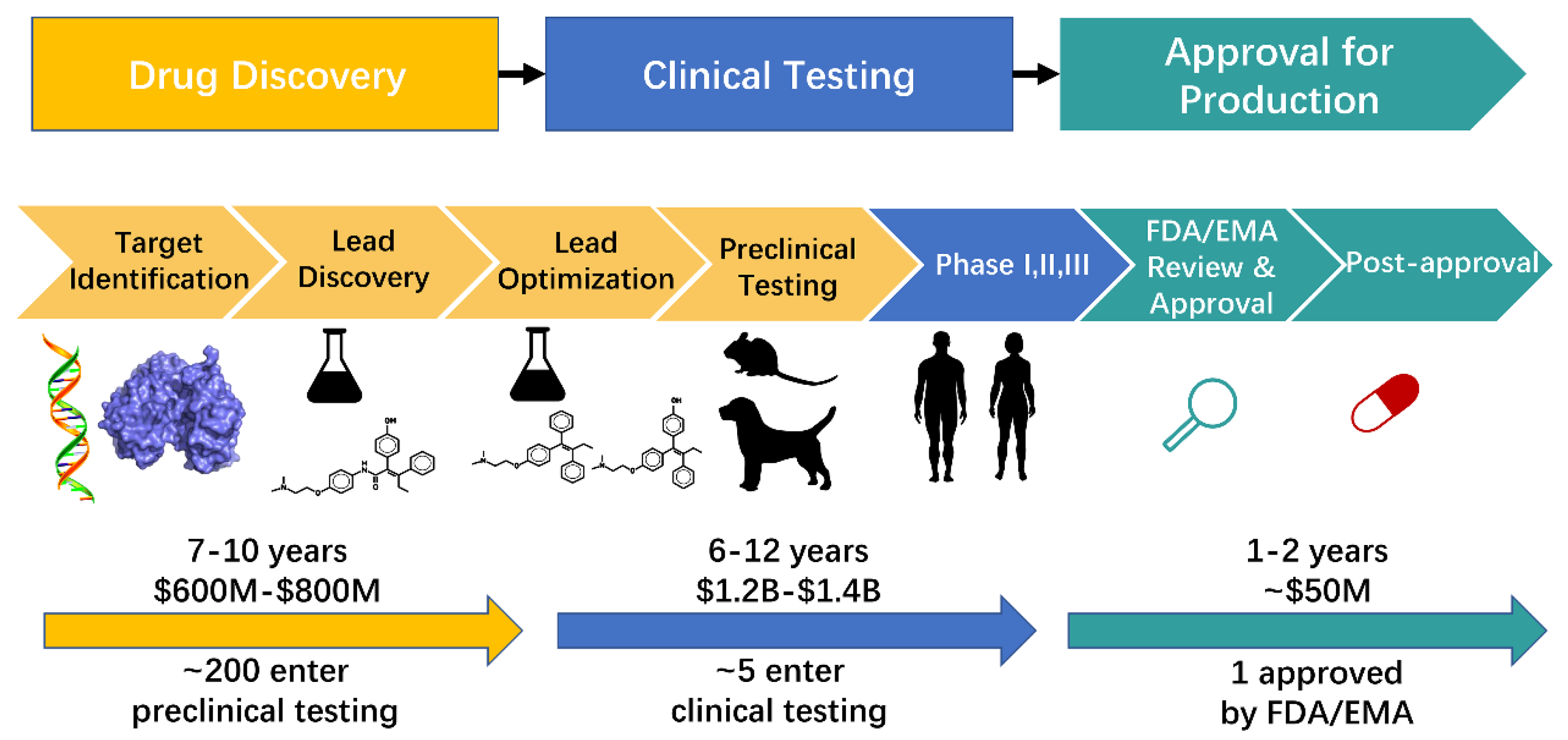

- 2025 best practices include pipeline analysis (clinical stages, success probabilities), catalyst tracking (patents, FDA decisions), cash runway (average:6-7 quarters), and AI-driven analytics [2,6].

- Tools: Premium platforms (Citeline [7], DrugPatentWatch [2]) and free resources (ClinicalTrials.gov [6], FDA databases) [100].

- AI tools reduce time commitment for active investors [100].

- Consensus: Pipeline and cash runway are critical for risk mitigation [0,2,6].

- Contradiction: Pros use deep science; retail investors should avoid binary events or use ETFs [0,100].

- Implications: Casual investors prioritize ETFs; active investors need specialized tools [0,100].

- Risks: Binary FDA events, dilution, patent expiration [0,2].

- Opportunities: Catalyst-driven gains (e.g., Prime Medicine’s gene editing [3]) and AI tools simplifying analysis [100].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.