Analysis of Strong Performance of Yingxin Development (000620): Driven by Cross-border Semiconductor Acquisition and Market Impact

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

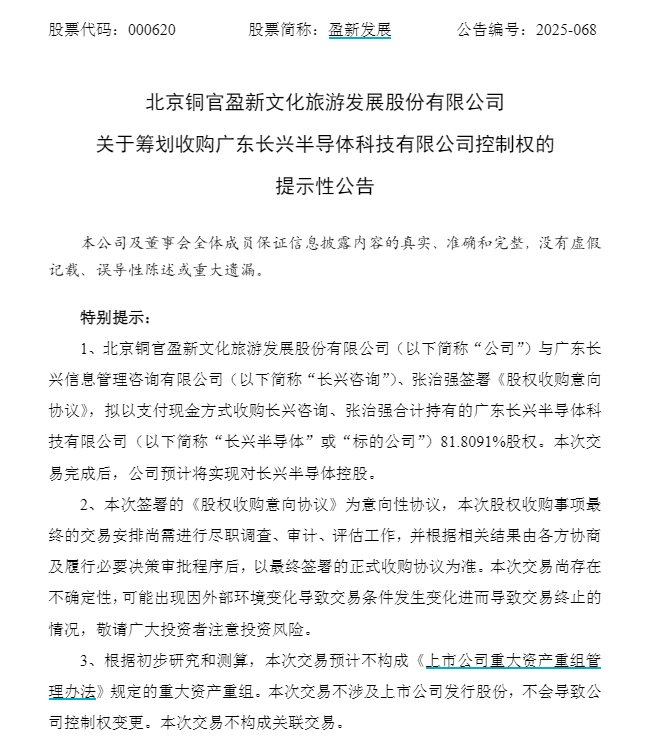

Yingxin Development (000620) is a comprehensive enterprise mainly engaged in cultural tourism, real estate, and hotel management businesses [0]. In H1 2025, the company’s fundamentals were weak, with revenue of 772 million yuan, a year-on-year decrease of 50.97%, and a net profit attributable to parent company of -161 million yuan [1]. However, after announcing its plan to acquire an 81.8091% stake in Changxing Semiconductor in October, the company’s stock price rose strongly, with 5 consecutive trading days of limit-up and a weekly gain of 60.98% [2][5]. Main funds increased their positions for five consecutive days, with a cumulative net inflow of over 550 million yuan [0].

This round of rise is mainly driven by multiple factors: 1) Cross-border semiconductor layout: Entering the storage chip track, which aligns with the upward trend of AI industry chain prosperity [7]; 2) Policy dividends: In 2025, the country increased support for the semiconductor industry, and the suspension of BIS’s 50% penetration rule provided a window for the development of domestic chips [8]; 3) Concept superposition: The company has popular concepts such as storage chips and short drama games [0]; 4) Market sentiment: Cross-border merger and acquisition policies have been relaxed, and the sector effect is obvious [4].

- Cross-border Merger and Acquisition Transformation Path: Yingxin Development is transforming from traditional cultural tourism real estate to the semiconductor field, seizing market hotspots through policy windows, and becoming a typical case of traditional enterprise transformation [0][8].

- Concept Superposition Amplification Effect: The dual concept superposition of storage chips and short drama games has significantly increased the market attention and capital attraction of the company’s stock [0].

- Fundamental and Stock Price Divergence: The short-term strong stock price contrasts sharply with the H1 loss fundamentals, reflecting the characteristics of concept-driven market trends [1][6].

- Merger and Acquisition Integration Risk: The semiconductor industry has high technical barriers, and the company lacks relevant operation experience, making post-merger integration difficult [0];

- Fundamental Pressure: The revenue of original businesses continues to decline; if the merger and acquisition progress is not as expected, the stock price may face correction risks [1];

- Market Volatility Risk: Concept-driven rises are easily affected by market sentiment, leading to high stock price volatility [3].

- Policy Dividend Window: National semiconductor industry support policies continue to be released; if the merger and acquisition is successful, the company is expected to benefit from the domestic substitution trend [8];

- AI Storage Demand Growth: Storage chips are a key link in the AI industry chain, with significant market demand growth potential [7];

- Business Diversification Transformation: Achieve business diversification through mergers and acquisitions, opening up long-term growth space [0].

The strong performance of Yingxin Development is mainly driven by the cross-border semiconductor acquisition event, superimposed with policy support and AI concept factors. Investors should focus on the merger and acquisition progress and integration effects, while alerting to potential risks brought by the divergence between fundamentals and stock prices.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.