Comparative Analysis of Systematic Bubble Risk Assessment in the AI Sector and Investment Warnings in the Energy Storage Industry

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on an article published by a Snowball user on November 16, 2025 [1], comparing the investment risks and opportunities of the AI and energy storage industries:

- AI Sector: Capital expenditures are concentrated among four tech giants—Meta, Google, Microsoft, and Amazon—with a total of nearly 400 billion US dollars in 2025 [5]. Meta raised nearly 30 billion US dollars through a Special Purpose Vehicle (SPV) model, and the debt is not consolidated into the balance sheet, effectively isolating the risks of AI infrastructure investment [2]. JPMorgan predicts that global AI infrastructure investment will continue until 2030, with a scale exceeding 5 trillion US dollars [4].

- Energy Storage Industry: In 2024, global energy storage cell capacity reached 750GWh, but shipments were only 266GWh, with a capacity utilization rate of less than 36% [3]. In 2025, the lowest bid price for energy storage system tenders by China Huadian Corporation reached 0.4563 Yuan/Wh, a drop of more than 42% compared to the end of 2023 [3]. The industry structure is fragmented, with the CR5 of global energy storage system integrators being only 33% [3].

- Cross-domain risk structure differences: The AI sector reduces systematic risks through concentrated investment by giants and innovative financing structures (SPV), while the energy storage industry faces structural pressures due to overcapacity and fragmented market structure.

- Head enterprise advantages are prominent: AI giants (Meta, Google, etc.) and leading energy storage enterprises (CATL, BYD, etc.) have stronger risk resistance capabilities in their respective fields, while small and medium-sized players face the risk of elimination [3][5].

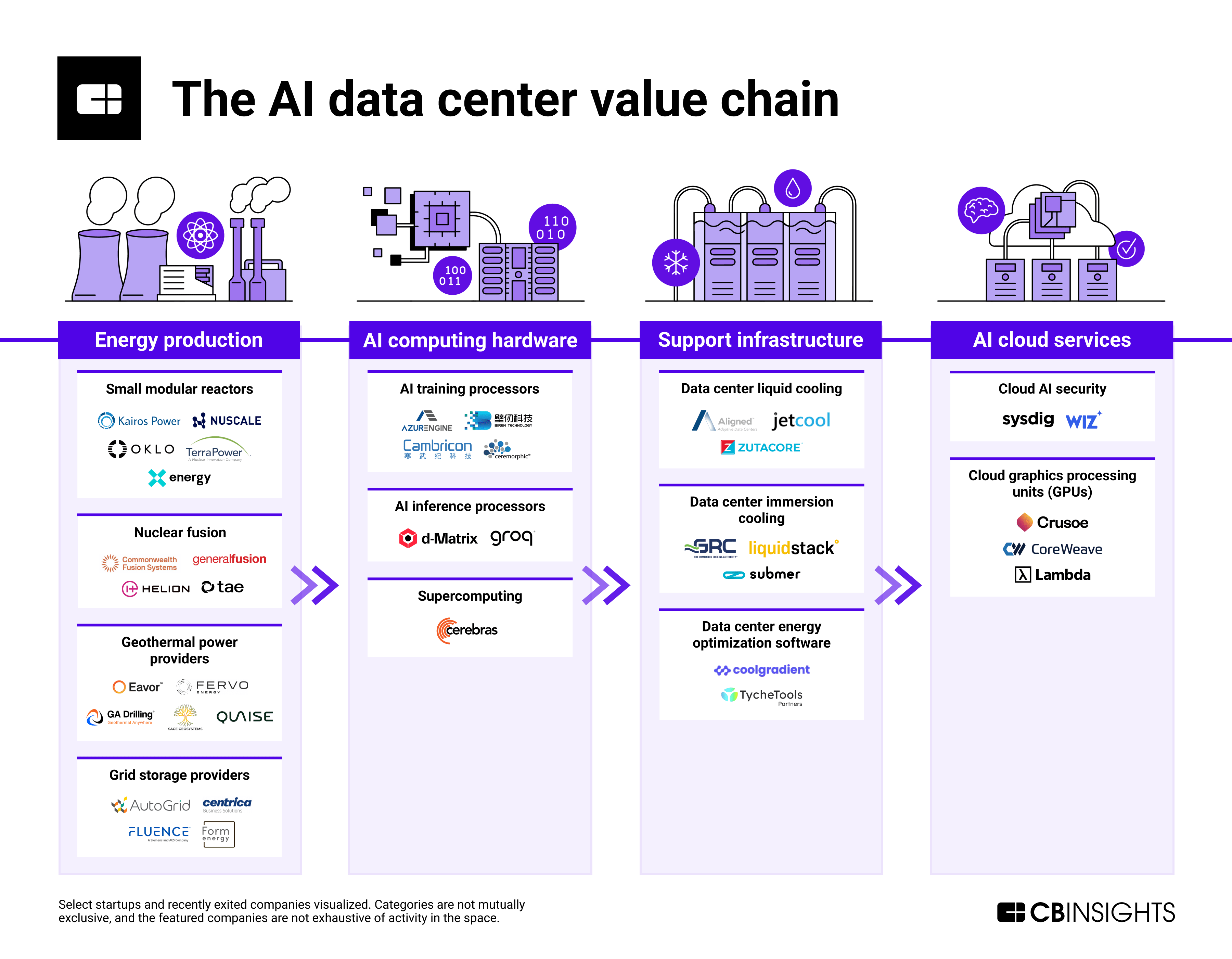

- AI industry chain transmission effect: Tech giants’ AI infrastructure investment will drive the growth of upstream hardware suppliers (Nvidia, TSMC, Zhongji Innolight, etc.) [0].

- Risks:

AI Sector: Insufficient monetization capacity (needs an annual increase of 650 billion US dollars in revenue to maintain a 10% return rate [4]), technological disruption, power gap [5];

Energy Storage Industry: Overcapacity, price wars, elimination of small and medium-sized manufacturers [3]. - Opportunities:

Upstream enterprises in the AI industry chain (e.g., Nvidia, Zhongji Innolight);

Leading energy storage enterprises (CATL, BYD) [3][0].

The AI sector has no systematic bubble, but attention needs to be paid to monetization and technical risks; the energy storage industry has significant overcapacity and fragmented market structure issues, requiring cautious investment. The concentrated capital expenditure of AI giants and the high utilization rate of leading energy storage enterprises (e.g., CATL’s 89.86% [3]) are the core differences between the two industries.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.