Analysis of Reddit User's 2.5R ES Swing Short Trade & Strategy Validity

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

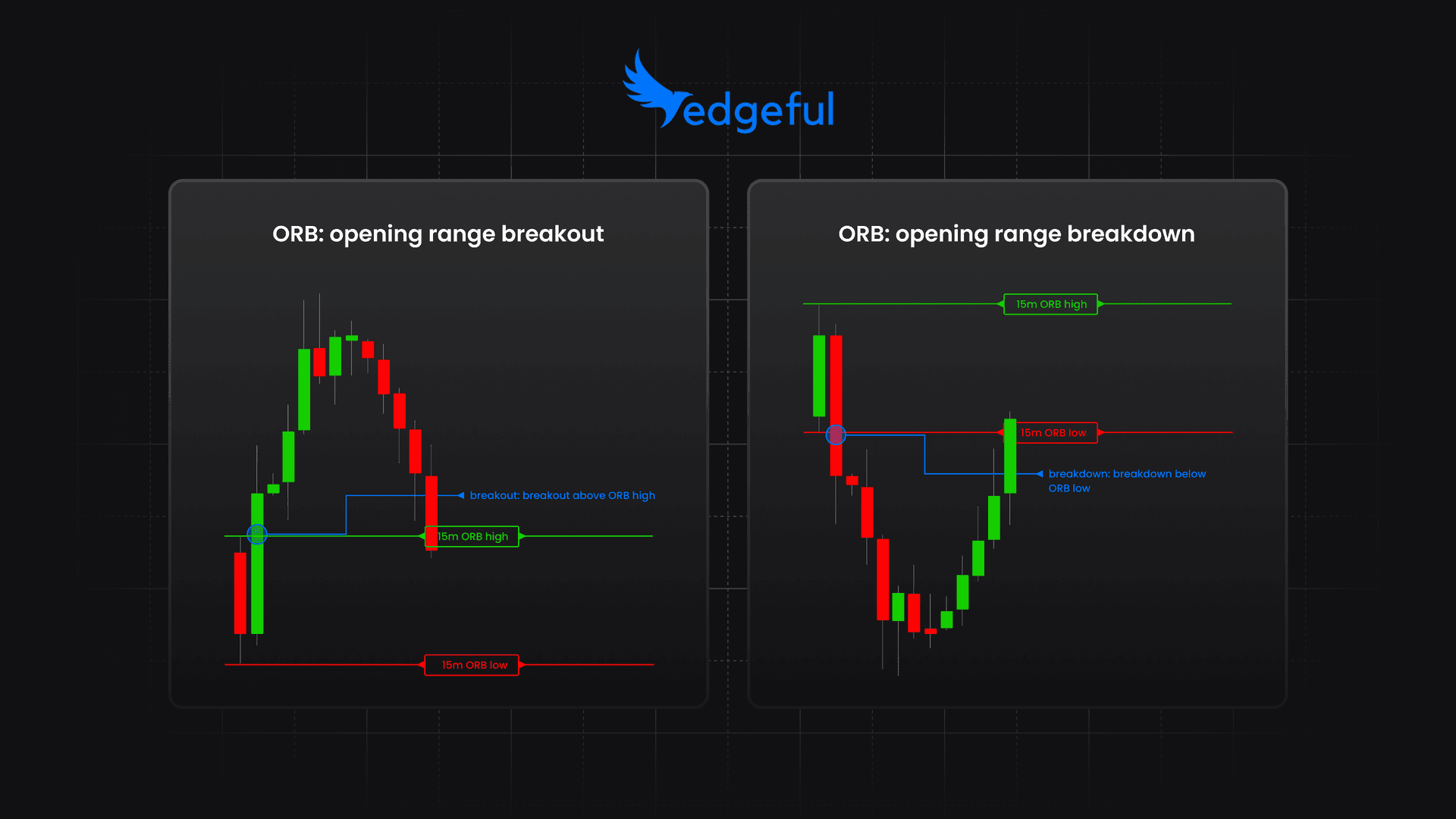

- A Reddit user reported a swing short trade on ES futures (Sept 24,2025) yielding +25.25 points and a 2.5R risk-reward ratio, with entry at follow-through bar low post weak pullback, target via ORB measured move, stop above pullback high Reddit Post.

- Comments noted Fibonacci levels as helpful (JestfulJank31001) and clarified the trade was the best due to point gain (OP response).

- Exact price action for Sept24,2025 ES could not be verified; Sept2025 ES contract expired on Sept19,2025 Indices Futures Expirations Calendar - Barchart.com.

- Current Nov2025 ES levels range 6755-6891 Futures - Bloomberg - Bloomberg Markets.

- Strategy components are established: follow-through bars confirm momentum Learn how trade candlestick patterns, ORB uses opening range for targets 5-Minute Opening Range Breakout (ORB) - NY Session Indicator, and 2.5R ratio aligns with sound risk management Why are most traders so bad at risk management?.

- While the specific trade’s date context is questionable (expired contract), the strategy framework (ORB, follow-through bars, 2.5R ratio) is valid and widely used in professional ES futures trading E-mini S&P 500 Futures Overview - CME Group.

- The case demonstrates how combining technical patterns with risk-reward discipline can drive profitable outcomes, though traders must ensure contract validity and setup context.

- Risks: Using expired contracts (invalidates setup), improper execution of ORB/follow-through patterns leading to false signals 60 Essential Candlestick Patterns : Trading Guide for Beginners.

- Opportunities: Adopting structured strategies with clear risk-reward ratios improves consistency; leveraging ORB and follow-through bars for trend confirmation Best Swing Trading Strategies For Beginners.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.