Practical Market Context Strategies for Day Trading: Multi-Timeframe Insights & Indicator Tools

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Day traders prioritize concise multi-timeframe approaches to avoid over-analysis: key strategies include using daily charts for directional bias + hourly for trading context +15-minute/5-minute for entries/exits [1]; capping context at24 hours to focus on current market structure [1]; leveraging higher-timeframe supply/demand zones (30-minute levels effective) [1]; combining5-second/15-second execution with1-minute/5-minute/15-minute context plus volume profile, VWAP, and orderflow [1]; splitting analysis into higher-timeframe direction + recent conditions with hourly/30-minute limit order execution [1]; and using volume for trend detection + options positioning to validate pullbacks [1].

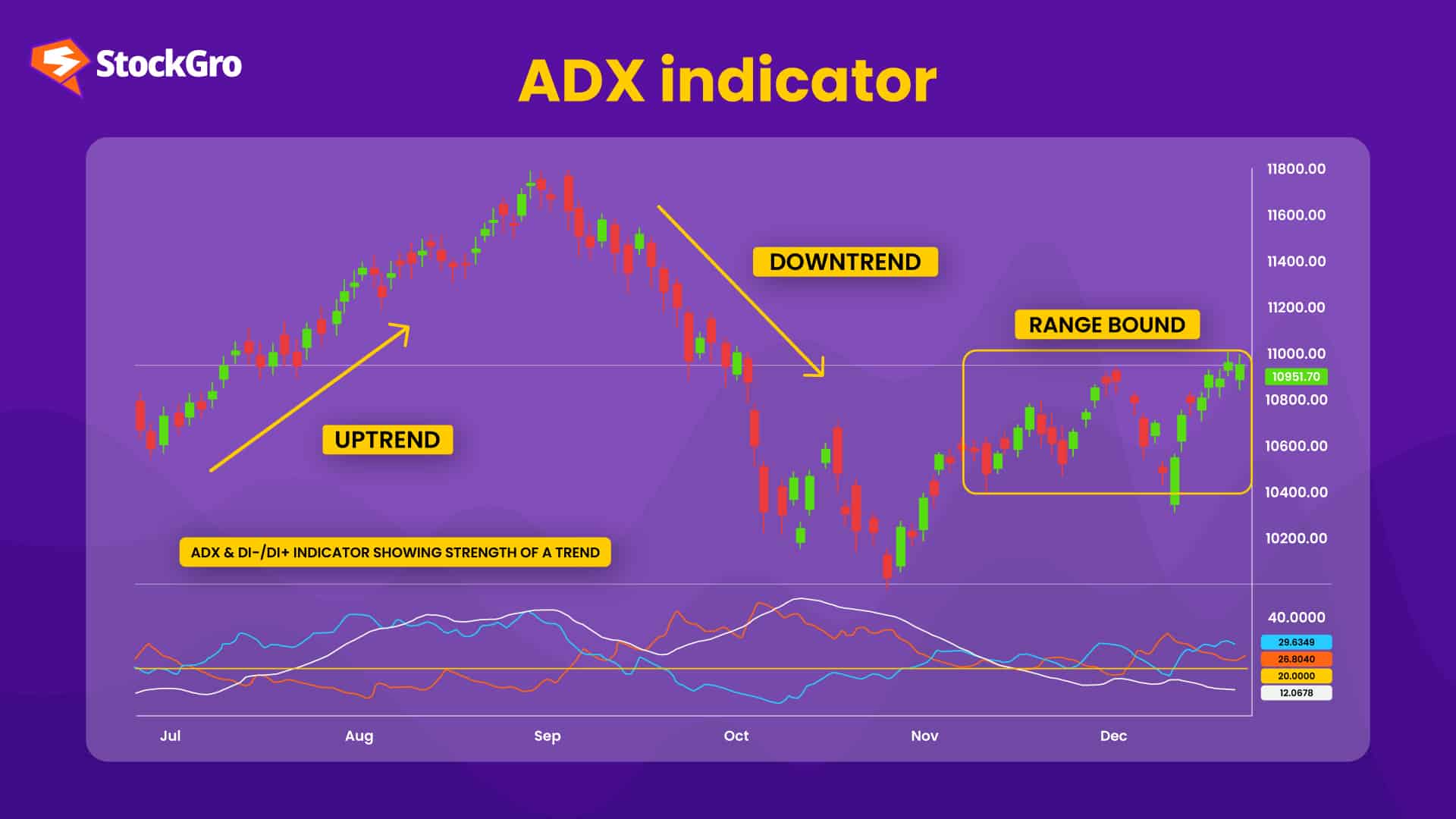

Professional day traders use a hierarchical multi-timeframe framework:4-hour charts for primary trend bias,1-hour for intermediate confirmation,15-minute for execution, and5-minute for entry fine-tuning (daily charts for major trends but not intraday) [2]. Reliable indicators for trend/range detection include: ADX (>25=strong trend, <20=range) [3]; moving average ribbons (trend direction/strength via alignment/spacing) [4]; Bollinger Bands (expanding=trend, contracting=range) [3]; and price action patterns (higher highs/lows for trend) [2]. Combining multiple indicators improves signal accuracy over single tools [2].

Reddit and research align on multi-timeframe importance: Reddit’s daily/hourly bias matches research’s4-hour/1-hour trend context, and both use15-minute/5-minute for execution [1,2]. Reddit’s focus on avoiding over-analysis (24h cap, supply/demand) complements research’s structured indicator use (ADX, Bollinger Bands) for trend/range confirmation [1,3]. Volume profile/VWAP (Reddit) and moving averages (research) are complementary tools to enhance context [1,4]. Implication: Adopting a hybrid approach (hierarchical timeframes + key indicators) reduces noise and aligns trades with market conditions, lowering risk.

- Risks: Over-reliance on single timeframes/indicators leads to misaligned trades; ignoring higher-timeframe trends increases failure rates for intraday setups [1,2].

- Opportunities: Using ADX to filter strong trend setups (avoiding range-bound noise) [3]; combining Bollinger Bands with price action to identify entry points in trending markets [3]; leveraging volume profile to confirm supply/demand zones for high-probability entries [1].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.