Analysis of ICT's Statement on Volume Profile Utility and Market Implications

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

On November 15, 2025 (UTC 17:15), the Inner Circle Trader (ICT) claimed volume profile is “practically useless” and asserted he detects volume moves before they appear on charts, urging traders to disregard volume-based signals. This statement was referenced in a Reddit thread (r/FuturesTrading) and aligns with ICT’s recent commentary in a November14,2025 YouTube live stream where he questioned volume profile’s relevance: “Now think about this folks. Tell me where in volume profile is that? It’s not.” [1][2]

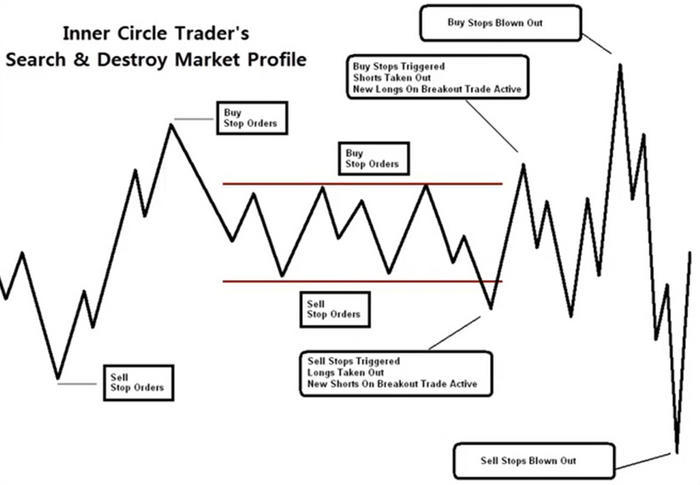

While this event has no direct financial market price impact, it may influence the behavior of ICT’s 1.94M YouTube subscribers and followers. Traders adhering to ICT’s methodology could reduce or eliminate volume profile from their analysis toolkit, shifting focus to alternative ICT concepts like volume imbalances, fair value gaps, and liquidity zones [2][3]. For non-ICT traders, the discussion reinforces ongoing debates about technical indicator utility.

- ICT’s Core Claims: Volume profile is useless; he identifies volume moves before they appear on charts [1].

- Volume Profile Utility: Identifies support/resistance (Point of Control, high-volume nodes), confirms breakouts, and enhances trend analysis [5][3].

- Volume Profile Limitations: Subjective interpretation, less effective in low-volume markets [5].

- ICT Methodology Context: ICT traders typically use volume imbalances (sharp price moves with higher volume) rather than volume profile [3].

Indirectly, all financial instruments traded using ICT methodology, including forex pairs (EURUSD, GBPUSD), futures (ES, NQ), and stocks.

- Full transcript of ICT’s statement (to understand exact reasoning and context).

- Complete community reaction (Reddit thread comments blocked).

- Data on how many ICT traders currently use volume profile.

While ICT dismisses volume profile, most experts consider it a valuable complementary tool. The Phidias Prop Firm guide notes volume profile enhances ICT setups by identifying institutional activity zones [4].

- “Users should be aware that discarding volume profile entirely without evaluating its role in their specific strategy may lead to incomplete market analysis. Volume profile remains a key tool for identifying critical price levels.”

- “This development raises concerns about over-reliance on a single expert’s opinion, which may overlook volume profile’s complementary value with other trading tools.”

- Future ICT content clarifying his stance.

- Changes in trading performance among ICT followers who stop using volume profile.

- Community discussions on alternative volume analysis tools.

- Signal Incompleteness: Ignoring volume profile may cause traders to miss critical support/resistance levels, especially in high-volume markets.

- Methodological Bias: Blindly following ICT’s statement could lead to over-reliance on subjective “volume move detection” without objective confirmation.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.