Roth IRA Portfolio Construction: Core-Satellite Strategy Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Reddit users demonstrate strong preferences for equity-heavy allocations with minimal diversification:

- Consensus Approaches: ncz34 recommends 80% VTI/20% VXUS for total market exposure, while Classic_Speed907 advocates for total market funds and S&P 500 index funds[1]

- Aggressive Concentration: azuredota and Kantmzk propose concentrated bets with 100% allocations to single funds (VOO and VGT respectively)[1]

- Core-Satellite Implementation: Hwood8790 suggests at least 50% in S&P funds with monthly DCA, complemented by individual growth stocks including GOOG, PLTR, PANW, SOFI, STOK, ONDS, KTOS, RKLB, IMSR, WULF, NVTS, PATH, BMNR[1]

- Moderate Approach: fakemedicines recommends VTI for conservative exposure with QQQ for tech tilt[1]

- Risk Awareness: ElatedRacism correctly notes that 100% VTI remains aggressive despite being diversified, as it represents 100% equity exposure[1]

Professional financial guidance provides structured allocation frameworks:

- Conservative: 14% US stocks, 50% bonds, 36% short-term investments[2]

- Balanced: 35% US stocks, 40% bonds, 25% short-term investments[2]

- Growth: 49% US stocks, 25% bonds, 26% short-term investments[2]

- Aggressive Growth: 60% US stocks, 15% bonds, 25% short-term investments[2]

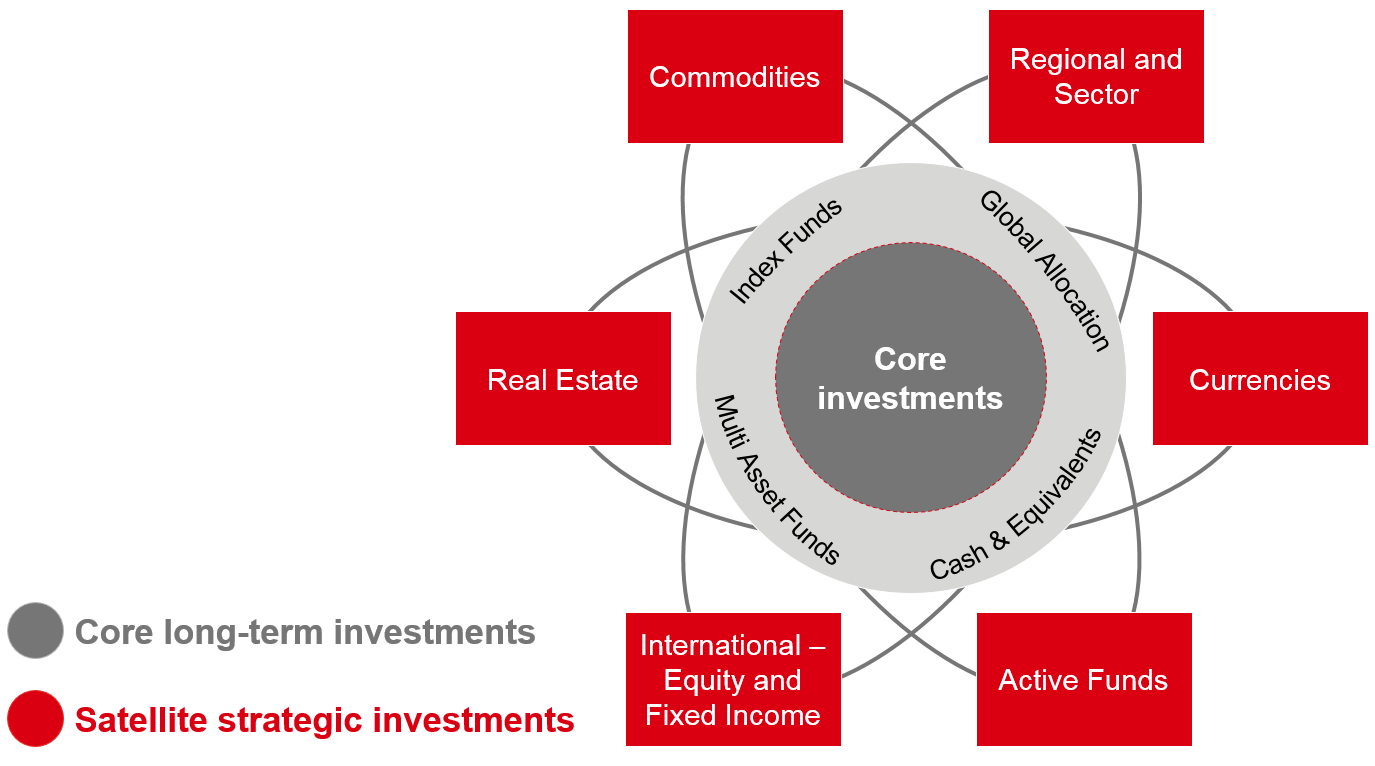

- Core holdings: 60-80% in diversified index funds and bonds[3]

- Satellite positions: 5-30% based on risk tolerance[3]

- Conservative investors: 5-10% speculative allocation[3]

- Moderate investors: 10-20% speculative allocation[3]

- Aggressive investors: 20-30%+ speculative allocation[3]

- Target date funds and three-fund portfolios are popular for beginners[2]

- Regular rebalancing and position sizing critical for risk management[3]

- Roth IRA’s tax-free growth makes it suitable for long-term satellite positions[3]

The Reddit community’s equity-heavy approach aligns with aggressive growth strategies but lacks the risk management framework recommended by professionals. A synthesis approach would:

- Core Foundation: Implement 60-70% allocation to broad market index funds (VTI/VXUS combination as suggested by Reddit users)

- Satellite Growth: Allocate 10-20% to individual growth stocks as recommended by Hwood8790, but limit exposure to prevent concentration risk

- Risk Management: Incorporate 10-20% bond allocation contrary to Reddit preferences but aligned with professional guidance

- Implementation Strategy: Use monthly DCA as suggested by Reddit users while maintaining the core-satellite framework

The Reddit preference for individual stock selection can be accommodated within the satellite portion, while professional guidance provides the necessary risk management through core holdings and bond allocation.

- Reddit’s 100% equity recommendations expose investors to significant volatility, particularly concerning for those nearing retirement

- Concentrated positions in individual stocks (as suggested by multiple Reddit users) create company-specific risk

- Lack of international diversification in many Reddit recommendations

- Roth IRA’s tax-free growth makes it ideal for the growth-oriented approach favored by Reddit users

- Individual stock selections within satellite positions can potentially outperform broader market indices

- Monthly DCA strategy combines Reddit’s practical approach with professional risk management

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.