Conservative Long-Term Investment Options for $10k Family Funds: VOO vs SPY Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

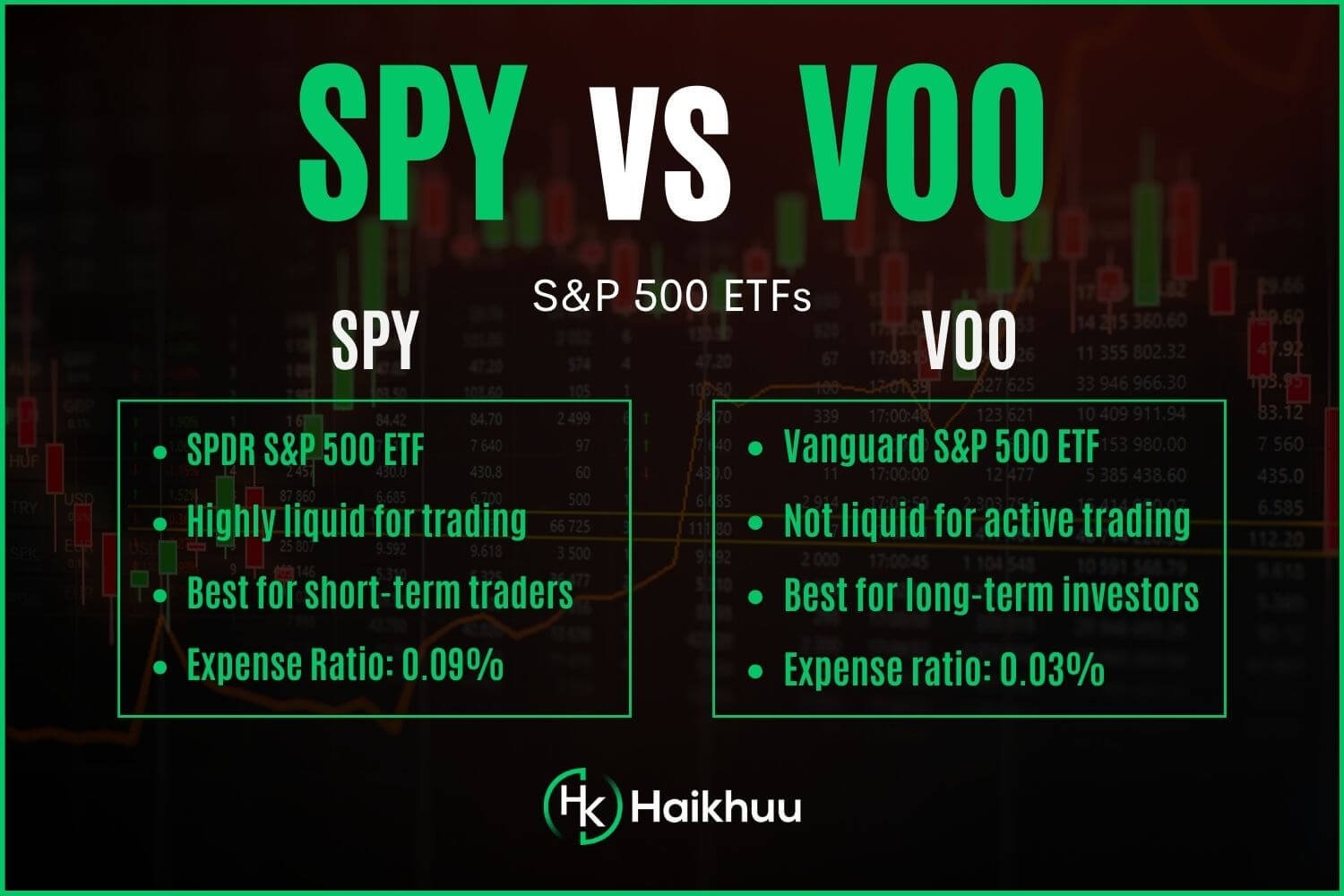

The user’s request centers on allocating $10k in family funds to conservative long-term investments, contrasting their personal penny stock trading. Key comparisons between VOO (Vanguard S&P500 ETF) and SPY (SPDR S&P500 ETF Trust) show VOO’s lower expense ratio (0.03% vs SPY’s ~0.0945%) and higher 5-year return (17.60% vs SPY’s16.33%) [1,2,3,4]. Conservative strategies for $10k include index funds, bonds, REITs (e.g., VNQ), robo-advisors (0.25% annual fee), debt repayment, and emergency fund building [5,6]. Penny stocks carry extreme risks (low liquidity, fraud, no long-term viability) while index funds offer diversification and lower risk [7,8].

- Cost compounding impact: Choosing VOO over SPY saves ~$6.45 annually for $10k, which compounds to ~$70 over 10 years (assuming a5% return) [2].

- Age-based allocation: For family goals, asset allocation should adjust with age—e.g.,80/20 stocks/bonds for 30-40-year-olds,60/40 for older investors [6].

- Family fund priorities: Capital preservation takes precedence over high growth, aligning with index fund investments rather than penny stocks.

- Risks: Penny stock investments pose a risk of total capital loss unsuitable for family funds [7,8]; ignoring expense ratios can erode long-term returns [2].

- Opportunities: Low-cost index funds like VOO offer steady growth with minimal fees; robo-advisors provide automated, diversified portfolios for hands-off management [5,6].

Family funds require capital preservation first, followed by steady growth. VOO is preferred over SPY for long-term investments due to lower fees and better historical returns. Conservative allocation should consider age, time horizon, and existing financial baseline (debt, emergency funds). Critical gaps in user info include age/time horizon, debt status, and exact risk tolerance.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.