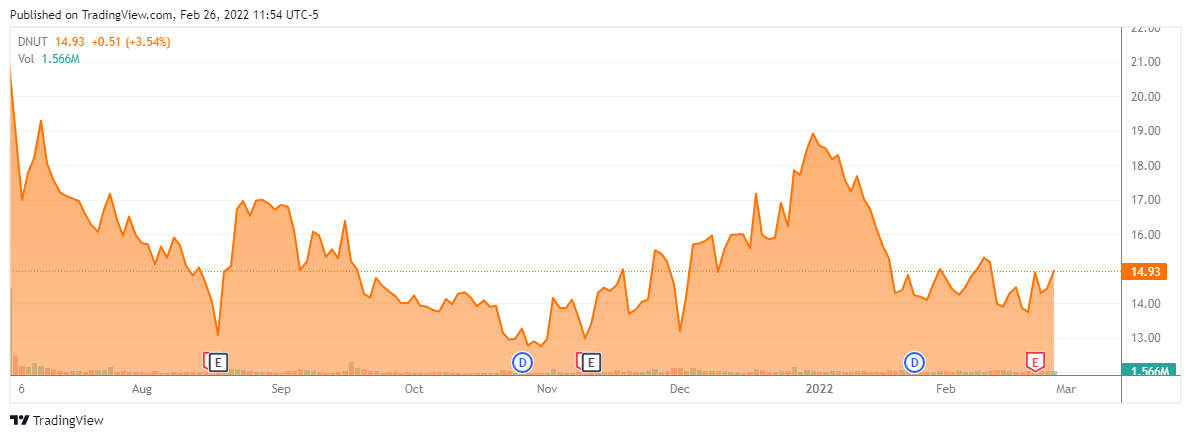

WEN vs DNUT: Comparative Analysis of Beaten-Down Fast-Food Stocks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Reddit investors express significant pessimism toward both beaten-down fast-food stocks, with a clear preference for Wendy’s relative safety:

- Financial Health Assessment: Reddit users characterize DNUT’s financials as “abhorrent” while viewing WEN as undervalued but lacking growth potential [1]

- Dividend Concerns: While WEN currently pays a high dividend, users question its long-term sustainability, with some preferring tobacco dividends for reliability [1]

- Macroeconomic Headwinds: Users note that fast-food chains have “outpriced their core consumers,” hindering any potential bounce-back [1]

- Health Trends: Ozempic usage is specifically mentioned as negatively impacting DNUT’s sales [1]

- Cost Pressures: One user suggests waiting for beef prices to drop before considering WEN investment [1]

- Overall Sentiment: The consensus leans toward extreme pessimism, with one user suggesting “burying money instead” of investing in either stock [1]

Financial performance data confirms Reddit’s assessment of Wendy’s superior position:

- Revenue Comparison: WEN generated $2.23B in revenue (12 months ending Q2 2025) vs. DNUT’s $1.67B (2024) [2]

- Market Position: WEN holds 1.37% market share in the restaurant industry, while DNUT operates in a more specialized niche [2]

- Growth Metrics: DNUT shows stronger growth indicators with 5% organic revenue growth and $193M adjusted EBITDA [2]

- Strategic Challenges: WEN faces breakfast sales decline due to economic pressure on consumers [3]

- Leadership Changes: WEN appointed interim CEO Ken Cook after Kirk Tanner’s departure to Hershey in July 2024 [4]

- Turnaround Initiatives: WEN’s board expressed dissatisfaction with company valuation and initiated a strategic turnaround plan, hiring consultancy firm Creed UnCo for brand revitalization [5]

- Partnership Failure: DNUT and McDonald’s ended their partnership on July 2, 2024, just months after announcing it in March 2024, due to low sales performance [6]

The Reddit discussion and research findings align on several key points while revealing additional nuance:

- Both sources confirm WEN’s superior financial position relative to DNUT

- The failed McDonald’s partnership is validated as a significant setback for DNUT

- Both acknowledge challenging market conditions affecting fast-food stocks

- Reddit’s bankruptcy concerns for DNUT aren’t explicitly confirmed by research, but the McDonald’s deal failure and revenue gap support financial vulnerability

- Research reveals WEN’s proactive turnaround strategy that Reddit discussions don’t fully capture

- While Reddit focuses on dividend sustainability concerns, research shows WEN’s board is actively addressing valuation issues

WEN represents the “safer” beaten-down option with established market position and active turnaround strategy, while DNUT offers higher risk/reward potential contingent on successful international expansion and recovery from the McDonald’s setback.

- Breakfast sales decline due to economic pressure on consumers [3]

- Dividend sustainability concerns as noted by Reddit users [1]

- Execution risk associated with turnaround strategy [5]

- Beef price volatility affecting input costs [1]

- Stronger financial foundation with $2.23B revenue base [2]

- Established 1.37% market share provides stability [2]

- Active turnaround plan with professional consultancy support [5]

- Potential undervaluation as recognized by board [5]

- Significant setback from McDonald’s partnership failure [6]

- Bankruptcy concerns raised by Reddit community [1]

- Smaller revenue base ($1.67B) with less financial cushion [2]

- Negative impact from health trends like Ozempic [1]

- Strong 5% organic revenue growth demonstrates business resilience [2]

- International expansion strategy for 2025 growth [2]

- Higher potential upside if turnaround succeeds

- $193M adjusted EBITDA shows operational profitability [2]

For risk-averse investors, WEN presents the more compelling case with its stronger financial position, established market share, and active turnaround strategy. For speculators seeking higher returns, DNUT’s growth metrics and international expansion plans offer potential upside, but the McDonald’s failure and bankruptcy concerns suggest extreme caution.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.