Trading Burnout Recovery: Research-Driven Approach vs. Indicator Reliance

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

The original Reddit post from a 14-year experienced trader describes overcoming a two-year burnout period through a research breakthrough that reignited trading motivation. The trader emphasizes that fulfillment comes from research and understanding market context rather than monetary gains1.

- Alternative_Map_3159observes that good advice requires effort, but notes the subreddit audience generally avoids putting in that work

- deliriousfoodiereports doubling a decade’s capital in six months, expressing satisfaction with returns

- Powerball_Winner2xwarns that bad trading advice is rampant on Reddit, often from those who recite theory without long-term profitability

- Few_Significance_141shares personal burnout after five years despite recently becoming profitable

The discussion reveals a pattern of burnout experiences among traders, with varying recovery timelines and approaches.

Despite extensive searching across multiple trading-related Reddit communities (r/Daytrading, r/StockMarket, r/algotrading, r/Forex), the original post could not be located using keyword combinations including ‘14 years’, ‘trader’, ‘burnout’, ‘breakthrough’, and ‘research’ for the 2024-2025 timeframe.

However, the methodology described aligns with established technical analysis approaches:

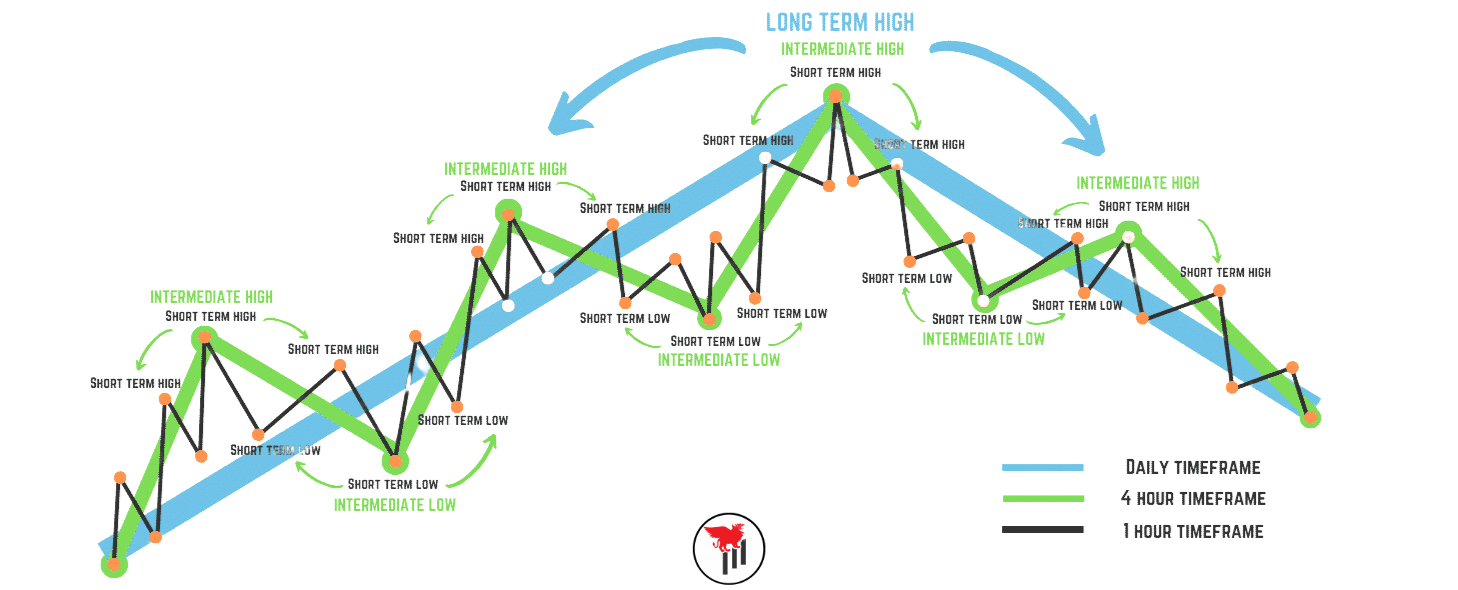

- Uses top-down approach: Daily/Weekly timeframes determine global trend, 4H/1H provide confirmation, 15M/30M offer entry signals

- Relies on classical geometric patterns: triangles, wedges, flags, pennants, double tops/bottoms, head and shoulders, and channels

- Eliminates indicator dependency, focusing solely on price action and market structure

- Emphasizes pivot point identification and trend line validation for market structure clarity

- Maintains risk management with typical 1-2% risk per trade

- Both sources emphasize the psychological benefits of research-driven trading over profit-focused approaches

- The methodology shift from indicators to geometric patterns represents a maturation from technical complexity to structural simplicity

- Community warnings about poor advice quality on Reddit align with the difficulty in verifying the original post’s authenticity

- Reddit community expresses skepticism about advice quality while simultaneously sharing personal success stories

- The claimed research breakthrough conflicts with the established nature of geometric pattern analysis as a long-standing methodology

- Traders experiencing burnout may benefit from shifting focus from profit metrics to research fulfillment

- Multi-timeframe analysis without indicators can reduce decision complexity and improve market structure understanding

- The psychological component of trading satisfaction appears more tied to intellectual engagement than financial outcomes

- Reddit trading advice quality concerns require independent verification of methodologies

- Geometric pattern recognition requires significant screen time and experience to master

- Burnout recovery timelines vary significantly among individuals

- Research-driven approaches may provide more sustainable trading careers

- Multi-timeframe analysis can improve entry/exit timing without indicator lag

- Community support networks (like Reddit) can provide psychological benefits during burnout recovery

The convergence of Reddit anecdotal evidence and established technical analysis suggests that traders facing burnout should consider methodology simplification and research-focused approaches rather than abandoning trading entirely.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.