Market Rotation Analysis: Hidden Turbulence Beneath Surface Stability

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

This analysis is based on the MarketWatch report [1] published on November 15, 2025, which highlights that a smooth stock market surface is masking underlying nerves and turbulence through a powerful sector rotation.

The current market landscape reveals significant fragmentation beneath apparent stability. Recent trading data shows mixed performance across major indices [0]:

- S&P 500: 6,734.11 (+0.93% on November 14)

- Nasdaq: 22,900.59 (+1.58%)

- Dow Jones: 47,147.48 (-0.16%)

- Russell 2000: 2,388.23 (+1.23%)

In contrast, Chinese markets show substantial weakness, with the Shanghai Composite down 0.97%, Shenzhen Component falling 1.93%, and ChiNext Index declining 2.82% [0].

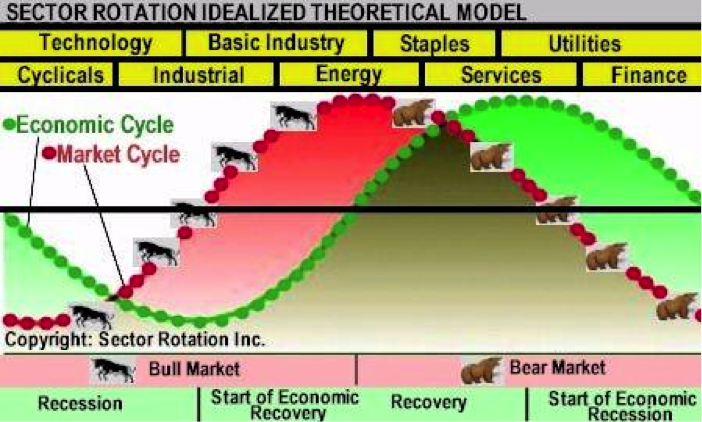

The rotation phenomenon is clearly evidenced by sector performance disparities [0]:

- Outperforming sectors:Energy (+3.12%), Utilities (+2.16%), Technology (+2.03%)

- Underperforming sectors:Communication Services (-2.22%), Basic Materials (-0.94%), Consumer Defensive (-0.40%)

This aligns with Morningstar analysis noting healthcare up 5.2% and energy gaining 4% in November through Friday, while information technology declined 3.8% month-to-date [4].

BNY Mellon analysis reveals alarming concentration risks, with the top 10 S&P 500 companies now representing 40% of total market capitalization [5]. This concentration mirrors patterns observed during previous market bubbles, including the 1999 tech bubble and 2008 financial crisis.

Rockport Wealth’s November update highlights a growing divergence between market-cap and equal-weight indices [5]:

- S&P 500 Index: +2.34% for November, 17.52% year-to-date

- S&P 500 Equal Weight Index: -0.93% for November

This 3.27 percentage point gap underscores how recent market strength has been driven primarily by a handful of mega-cap stocks.

Market turbulence is intensifying, with the Dow experiencing an 800-point decline (1.65%) on Wednesday, while Nasdaq fell approximately 2% and S&P 500 dropped 1.66% in the same period [5]. The VIX has surged to multi-week highs, indicating rising fear and uncertainty among market participants.

Monetary policy uncertainty is exacerbating market volatility. Traders are now pricing in less than 50% probability of a quarter-point rate cut in December, down dramatically from 62.9% earlier in the week and 95.5% a month ago [5]. This rapid shift in expectations reflects mounting unease about the Fed’s upcoming interest rate decision.

The significant underperformance in Chinese markets raises concerns about global economic synchronization and potential spillover effects. The divergence between US and Chinese market performance may indicate broader macroeconomic shifts affecting different regions asymmetrically.

-

Concentration Risk:The 40% market cap concentration in top 10 S&P 500 stocks represents significant systemic risk [5]. Any disruption to these mega-cap stocks could trigger broader market instability.

-

Deteriorating Market Breadth:The significant underperformance of the equal-weight S&P 500 relative to the market-cap version suggests that market breadth is deteriorating, which historically has preceded market corrections [5].

-

Policy Uncertainty:The dramatic reduction in Fed rate cut expectations indicates rapid shifts in monetary policy outlook [5]. This uncertainty typically precedes increased market turbulence.

-

Increased Volatility:The return of 1%+ daily moves (13 out of 22 trading days in October) indicates that market stability is weakening [5].

- Sector momentum sustainability, particularly whether Energy and Utilities can maintain outperformance

- Liquidity conditions in large-cap technology stocks that have driven recent gains

- Upcoming earnings reports that could validate or reverse current rotation trends

- Federal Reserve communications for shifts in policy stance

- International market correlations, especially potential contagion from Chinese market weakness

The market is experiencing a significant rotation characterized by deteriorating breadth and increasing concentration risk. While major indices show mixed performance, the underlying dynamics reveal growing turbulence. The divergence between market-cap and equal-weight indices (3.27 percentage point gap) indicates that market gains are increasingly narrow [5]. Energy and Utilities sectors are leading performance gains while Communication Services lags significantly [0]. Federal Reserve policy uncertainty has intensified, with December rate cut probability plummeting from 95.5% to under 50% in just one month [5]. The VIX surge to multi-week highs and increased frequency of large daily moves suggest rising market nervousness [5]. Concentration risk has reached concerning levels, with the top 10 S&P 500 companies now accounting for 40% of total market capitalization [5].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.