Aerospace Development (000547.SZ) Hot Stock Analysis: Military Industry Recovery and Performance Inflection Point

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

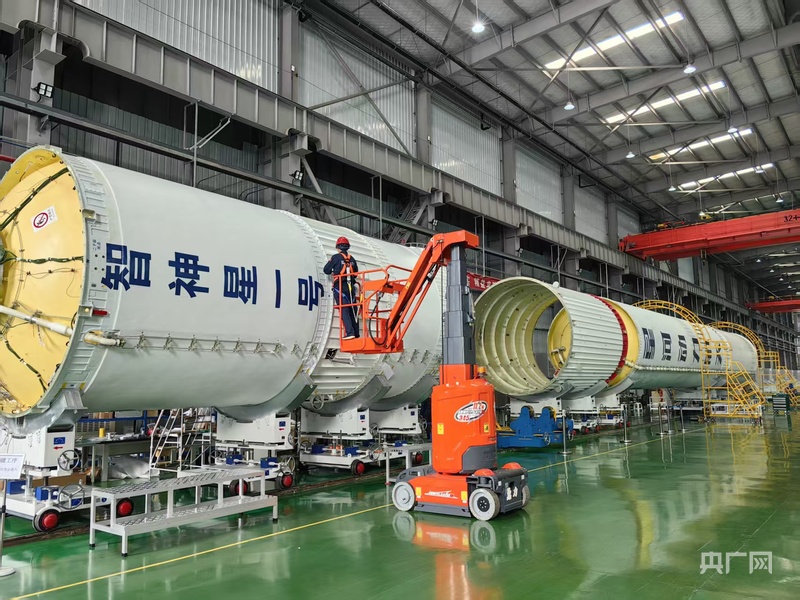

Aerospace Development (000547.SZ) made it to the hot list today, with market attention rising significantly. There are multiple driving factors behind this phenomenon. As a military aerospace enterprise listed on the Shenzhen Stock Exchange, the company mainly engages in aerospace-related businesses, belongs to the national defense military industry and commercial aerospace sectors, and has a central enterprise background [0].

- The military industry continues to receive policy support, with broad industry development space

- The company’s performance inflection point has emerged, and future profitability is expected to further improve

- The Haixi (Strait West Bank) concept may bring additional thematic investment opportunities

- The company is still in a loss state, and profitability needs further verification

- The military industry sector is highly volatile and significantly affected by policies

- Hot stocks are often accompanied by short-term speculation risks; need to be alert to capital withdrawal

Aerospace Development (000547.SZ) becoming a hot stock is the result of multiple factors. The company’s fundamentals have indeed shown signs of improvement, especially the significant revenue growth and cash flow improvement. The overall recovery of the military industry sector and favorable policies provide support for the stock price, and the active pursuit of institutional capital also reflects the market’s recognition of the company’s prospects.

When paying attention to this stock, investors should focus on the continuous improvement of the company’s profitability and the policy trends of the military industry sector. At the same time, it is necessary to note the short-term volatility risks usually associated with hot stocks, and it is recommended to make judgments based on an in-depth understanding of the company’s fundamentals.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.