Analysis of Arctech Solar's (688408) Strong Performance: Policy Tailwinds vs. Fundamental Challenges

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- Sustained Performance Decline Risk:Net profit fell 71.59% year-on-year, with a loss in Q3. If the trend cannot be reversed, it will affect the long-term performance of the stock [0]

- Capital Outflow Pressure:Main funds net sold 114 million yuan, showing a cautious attitude of large funds [1]

- Core Technical Talent Loss:Changes in the company’s core technical personnel may affect R&D capabilities [0]

- Intensified Industry Competition:The PV industry still faces fierce competition, and profitability recovery will take time

- Policy Dividend Release:New energy consumption policies bring deterministic growth opportunities to the industry [0]

- Industry Integration Opportunities:Under the “anti-involution” policy, leading enterprises are expected to benefit from industry consolidation [0]

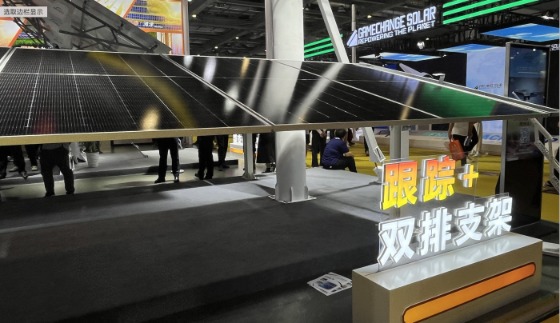

- Technology Upgrade Space:New business areas such as BIPV systems have growth potential

- Valuation Repair Opportunity:After previous adjustments, the current valuation is relatively reasonable

Arctech Solar’s (688408) strong performance is mainly driven by policy factors, but fundamentals face great pressure. The company actively responds through share repurchases, strategic adjustments, etc., but performance decline and capital outflow are still major constraints. Investors should focus on the effect of policy implementation, the progress of the company’s performance improvement, and changes in the industry competition pattern. The short-term technical outlook is strong, but the medium- and long-term investment value still needs to observe the substantial improvement of fundamentals.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.