Investment Strategy Analysis: Reddit vs. Research on Post-Emergency Fund Allocation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The Reddit discussion from r/stocks reveals several key investment preferences and strategies from investors who have secured emergency funds:

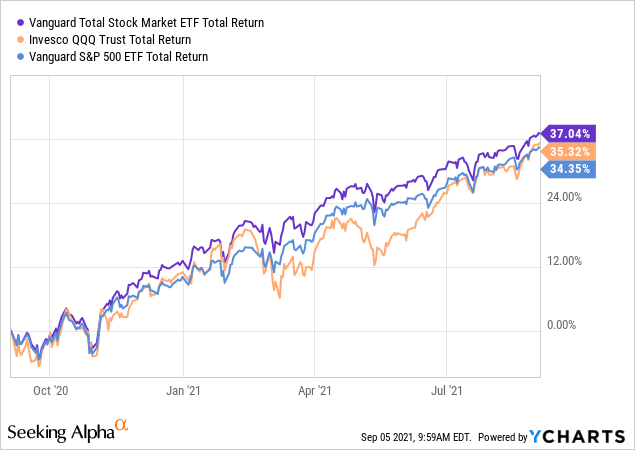

- Broad Market ETF Dominance: Multiple users strongly recommend VTI, VOO, VT, SPY, and QQQ as core holdings for systematic investing

- Individual Stock Preferences: Some investors favor specific positions including NVDA, GOOG, AMZN, TSLA, MSFT, SOFI, WM, and STRC

- Dividend-Focused Approaches: Several users mention dividend ETFs like SCHD, FEPI, YMAG, QQQI, SPYI, and GPIQ for income generation

- Cash Management Strategy: Many recommend keeping some cash in HYSA accounts (particularly SoFi HYSA) for flexibility and opportunistic buying

- Tax Optimization: One user emphasizes maxing out 401k contributions ($70k in 2025) before taxable investing

- Anti-Market Timing: Several users advise against trying to time FAANG dips, recommending immediate investment to avoid cash drag

Current investment research for 2024-2025 provides data-driven insights that validate many Reddit preferences while challenging others:

- ETF Performance Superiority: QQQ led 2024 with 23.05% YTD returns, SPY delivered ~15% YTD, and VTI showed 12-14% YTD performance

- Cash Drag Costs: Holding cash resulted in substantial opportunity costs, with average checking accounts earning only 0.07% while inflation ran at 3.0%

- Passive vs Active: 65% of actively managed funds underperformed the S&P 500 in 2024, supporting Reddit’s ETF preference

- Systematic Investing Advantage: Dollar-cost averaging through systematic monthly investments helps manage volatility and builds positions gradually

- Age-Based Allocation: Asset allocation should decrease equity exposure as retirement approaches, with target-date funds providing automatic adjustments

- Market Timing Inefficiency: Research shows market timing with cash reserves historically underperforms systematic investing

- Maximize 401k contributions first (as noted by Reddit users)

- Implement systematic dollar-cost averaging into broad market ETFs (VTI/SPY/QQQ)

- Maintain minimal HYSA buffer (3-6 months expenses, already established)

- Consider small individual stock positions only after core ETF foundation is built

- Concentration risk in individual FAANG stocks favored by some Reddit users

- Inflation erosion of cash holdings while waiting for market dips

- Sequence risk if systematic investing begins during market downturns

- Tax inefficiency if prioritizing taxable accounts over 401k optimization

- Compound growth advantage through systematic ETF investing

- Tax optimization through proper account sequencing (401k first)

- Reduced portfolio volatility through diversification

- Historical outperformance of QQQ (23.05% in 2024) for growth-oriented investors

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.