Bitfarms $500 Million Convertible Notes Offering: Strategic Capital Raise with Market Implications

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Bitfarms Ltd. (NASDAQ/TSX: BITF) executed a significant capital raise through convertible senior notes, upsizing from the initially proposed $300 million to $500 million. The offering was priced at an attractive 1.375% interest rate due January 15, 2031, with a conversion price representing a 30% premium to the stock price at announcement. While the successful upsizing indicates strong institutional confidence in Bitfarms’ AI infrastructure pivot strategy, the market reaction was notably negative, with the stock declining over 20% from its peak. The company faces the classic convertible notes dilemma: securing favorable financing terms while managing immediate market sentiment and future dilution concerns.

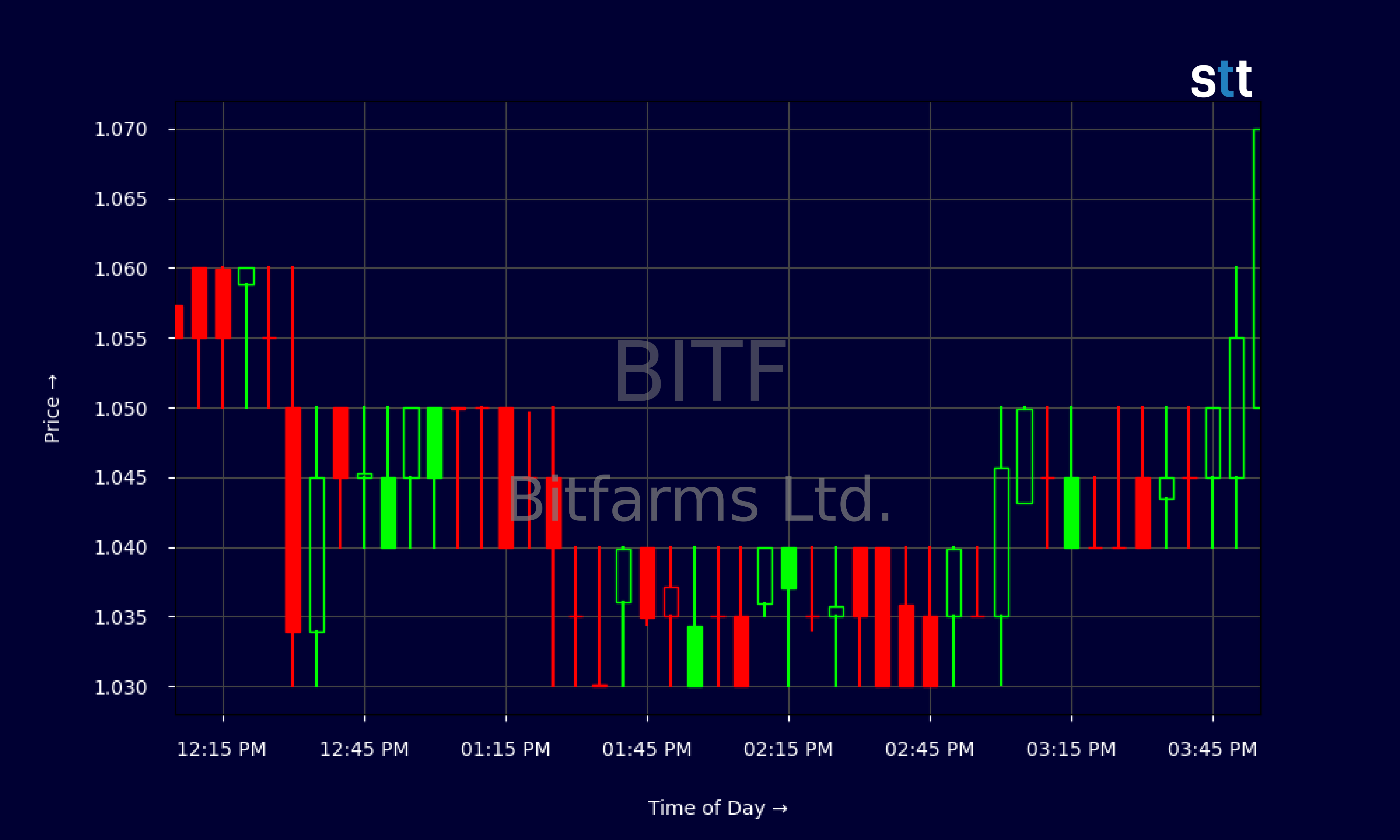

The convertible notes announcement created significant market volatility for BITF shares:

- Pre-announcement momentum: Stock surged 128% in two weeks, rising from $2.89 to $6.60

- Immediate reaction: Peak at $6.60 on announcement day (Oct 15), followed by sharp decline

- Post-announcement decline: Closed at $5.28 on Oct 16 (-18.4%), further dropping to $5.01 on Oct 17 (-5.1%)

The dramatic price reversal suggests investors were caught off guard by the dilution implications, despite the company’s strong prior performance and the favorable financing terms achieved.

The convertible notes offering features several strategically important elements:

- Principal Amount: $500 million (upsized from $300 million)

- Interest Rate: 1.375% (exceptionally low, indicating strong demand)

- Maturity: January 15, 2031 (6-year term)

- Conversion Price: ~$6.86 per share (30% premium to $5.28 closing price)

- Conversion Rate: 145.6876 shares per $1,000 principal amount

- Additional Option: 13-day option for initial purchasers to buy extra notes

- Dilution Protection: Use of cash-settled capped calls to offset economic dilution up to 125% premium

- Use of Proceeds: General corporate purposes and hedging transactions

The low interest rate and successful upsizing demonstrate institutional confidence in Bitfarms’ business model and strategic direction, particularly its AI infrastructure pivot.

- Market Capitalization: $1.56 billion

- Revenue (TTM): $245.66 million

- Quarterly Revenue Growth: 87.3% YoY (exceptional growth)

- EPS: -$0.18 (negative profitability despite revenue growth)

- Beta: 4.098 (extremely high volatility)

- Valuation: Trading at 6.34x price-to-sales (significantly above traditional metrics)

- Bitcoin mining sector experiencing strong AI pivot narrative

- BITF leading sector gains with +66% week-over-week performance prior to announcement

- Competitor TeraWulf also executing major financing ($3.2 billion senior secured notes)

- Sector-wide rally driven by AI computing demand trends

The company’s fundamental profile reveals a classic growth story: explosive revenue growth but current unprofitability, high volatility, and premium valuation metrics that require continued execution to justify.

The successful upsizing to $500 million at favorable terms indicates strong institutional backing for Bitfarms’ strategy, while the sharp stock decline reflects retail investor concerns about dilution and current unprofitability. This divergence creates a complex investment narrative.

The low 1.375% interest rate suggests institutional investors are pricing in significant upside from Bitfarms’ AI infrastructure strategy, potentially viewing the company more as an AI play than a traditional Bitcoin miner.

The $6.86 conversion price creates a important technical reference point. Below this level, notes remain debt instruments; above it, conversion becomes likely, potentially creating future selling pressure but also validating the company’s strategic direction.

Bitfarms’ offering follows broader sector trends of Bitcoin mining companies securing substantial capital to fund AI infrastructure expansion, suggesting a structural shift in the industry’s business models.

- Dilution Overhang: $500 million in convertible notes will increase share count upon conversion, potentially creating long-term selling pressure

- Profitability Concerns: Negative EPS (-$0.18) despite strong revenue growth raises questions about business model sustainability

- Extreme Volatility: Beta of 4.098 indicates high sensitivity to cryptocurrency market fluctuations

- Valuation Risk: Trading at 6.34x price-to-sales suggests premium valuation requiring continued execution

- Bitcoin Correlation: High exposure to cryptocurrency volatility could impact AI infrastructure narrative

- Conversion Price Pressure: $6.86 conversion level may create technical resistance

- Strategic Capital Position: Low-cost financing provides flexibility for AI infrastructure investments

- Sector Momentum: Bitcoin mining stocks outperforming in 2025, with AI narrative driving valuations

- Growth Trajectory: 87.3% quarterly revenue growth demonstrates strong operational execution

- Dilution Mitigation: Capped call transactions provide protection against economic dilution up to 125% premium

- Institutional Validation: Strong demand for notes suggests confidence in long-term strategy

- Market Leadership: BITF has been leading sector performance gains

The convertible notes offering represents a double-edged sword for Bitfarms investors. On one hand, the company secured favorable financing terms that provide strategic flexibility for its AI infrastructure pivot. On the other hand, the immediate market reaction and dilution concerns create significant near-term volatility.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.