Megacap Tech Earnings Risk: Startup Dependency Concerns Impact Market Volatility

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the CNBC report [1] published on November 14, 2025, which highlighted concerns about megacap technology companies’ earnings vulnerability due to their reliance on startup usage. The report comes amid significant volatility in tech stocks, with the NASDAQ Composite experiencing a -1.69% decline on November 13 before recovering +1.57% on November 14 [0].

The technology sector has been under pressure due to converging factors including stretched valuations, macroeconomic headwinds, and profit-taking after robust 2025 performance (tech sector up 24.8% YTD) [0][4]. Current market data shows mixed performance among megacap stocks: Microsoft (+1.37%) and NVIDIA (+1.77%) showing recovery, while Apple (-0.20%) and Alphabet (-0.78%) remain under pressure [0].

The core concern centers on megacap companies’ exposure to startup ecosystem volatility through:

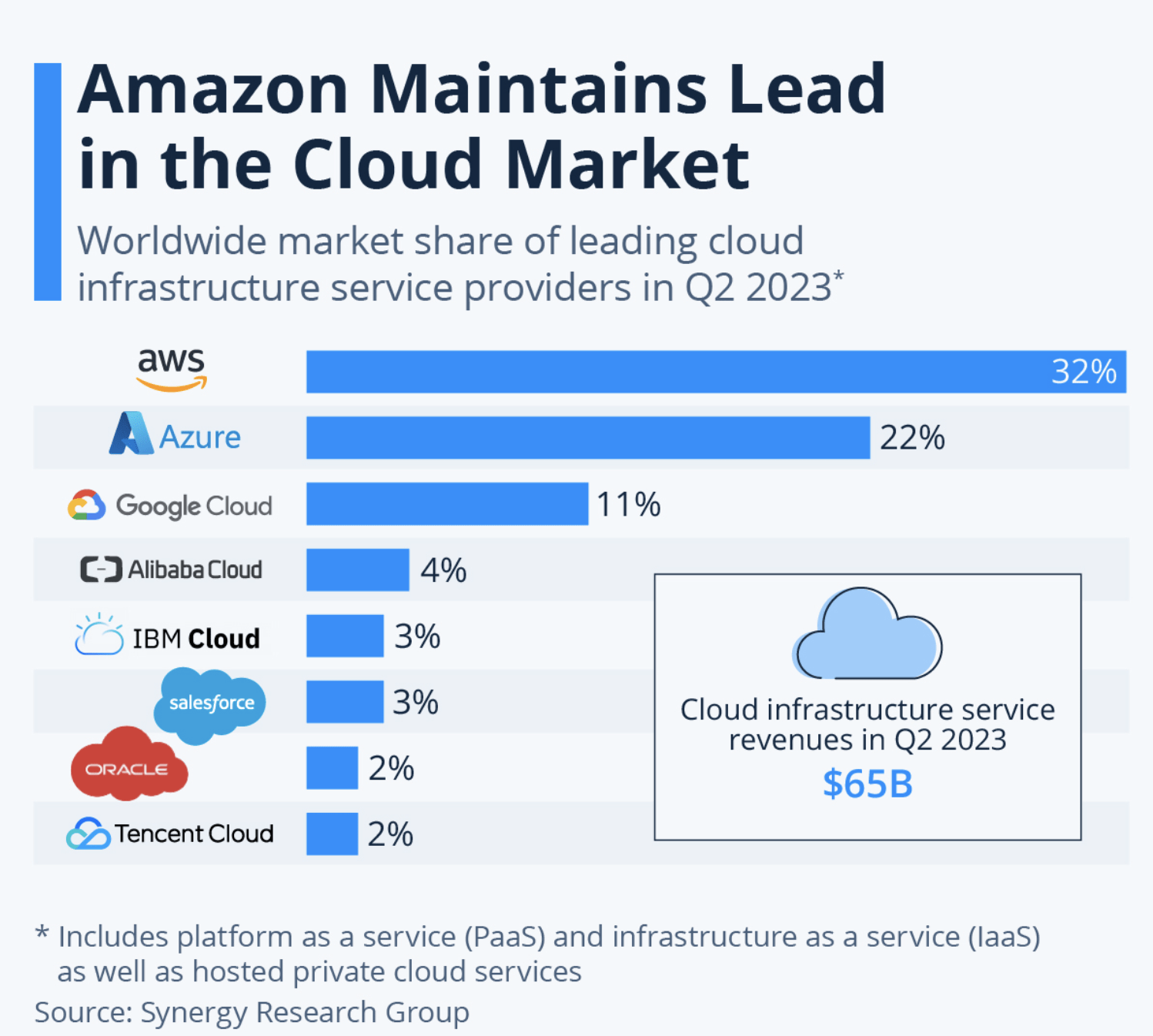

- Cloud Computing Services: Major providers (Microsoft Azure, Google Cloud, AWS) depend significantly on startup customers for growth

- Platform and API Usage: Startups represent substantial usage of developer tools and platform services

- Advertising Revenue: Startup marketing spend contributes to advertising platform revenues

This dependency creates concentration risk, as startups are highly sensitive to venture capital availability and economic cycles, making their spending patterns more volatile than enterprise customers [0][1].

The startup dependency risk extends across multiple megacap business models, creating systemic exposure that could impact earnings across cloud services, platform revenues, and advertising segments simultaneously [0][1].

The current risk emerges during a period of elevated tech valuations and macroeconomic uncertainty, potentially amplifying the impact of any startup spending contraction [2][3]. The recent volatility suggests market participants are reassessing growth sustainability in the tech sector.

Companies with stronger enterprise customer bases and more diversified revenue streams may be better positioned to weather startup spending volatility, creating potential competitive advantages in the current environment [0].

- Funding Environment Sensitivity: Venture capital funding has shown volatility in recent quarters, directly impacting startup spending capacity [0]

- Economic Cycle Exposure: Startup spending patterns are typically more cyclical than enterprise spending, creating amplified volatility during economic uncertainty [0]

- Competitive Pressure: Increased competition in cloud services could pressure pricing and margins, particularly if startup growth slows [0]

- Venture Capital Flow: Monitor VC funding announcements and startup funding rounds as leading indicators

- Cloud Revenue Growth: Track quarterly cloud revenue growth rates and customer acquisition trends

- Startup Failure Rates: Monitor startup bankruptcy and shutdown rates as early warning signals

- Enterprise Adoption: Watch for shifts toward enterprise customer acquisition strategies

- Enterprise-Focused Providers: Companies with strong enterprise customer bases may benefit from relative stability

- Diversified Platforms: Companies with multiple revenue streams beyond startup dependency

- Market Consolidation: Potential for stronger players to acquire struggling startups or competitors

- NASDAQ Performance: +1.57% on November 14 after -1.69% decline on November 13 [0]

- Tech Sector Daily Performance: +2.49% on November 14 [0]

- YTD Tech Sector Performance: +24.8% through November 2025 [4]

- Megacap Stock Divergence: MSFT (+1.37%), NVDA (+1.77%), AAPL (-0.20%), GOOGL (-0.78%) [0]

- Quantitative Startup Exposure: Specific percentage of megacap revenue derived from startup customers

- Customer Segmentation Data: Detailed breakdown of enterprise vs. startup revenue mix

- Forward Guidance: How companies are addressing startup dependency in earnings forecasts

- Venture Capital Trends: Q4 2025 VC funding data and startup spending projections

The startup dependency risk suggests that market participants should focus on companies with:

- Strong enterprise customer acquisition capabilities

- Diversified revenue streams across multiple customer segments

- Proactive strategies to reduce startup concentration risk

- Robust competitive positioning in cloud and platform services

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.