Predicting Market Turnarounds: Reddit Day Trader Insights vs Technical Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Experienced day traders on Reddit consistently advise against attempting to predict market turnarounds, instead emphasizing reactive strategies based on price action and disciplined methodology:

- React vs. Predict: Multiple traders (Ripple1972Europe, sequirahha) stress that successful day trading involves reacting to market movements rather than attempting predictions[1]

- Institutional Dynamics: redditissocoolyoyo notes that turnarounds aren’t predictable due to institutional control and profit-taking shakeouts that retail traders cannot anticipate[1]

- Historical Patterns: I_Love_Rockets9283 observes that Fridays are historically green and 1% down opens are rare, suggesting patience for trend emergence[1]

- Technical Frameworks:

- JohnTitor_3 demonstrates reacting to gap-downs into 1hr support on SPY/ES, entering long on VWAP reclaims with proper stop management[1]

- Rav_3d points to futures support at prior lows as key reference points[1]

- DontHaveAC0wMan identifies descending channels to heavy SPY support, suggesting institutional positioning[1]

- Systematic Approach: Patient-Capital5993 recommends market profile theory and building personalized systems, while kat_sky_12 and Rav_3d emphasize following backtested methodologies[1]

Technical analysis research provides specific indicators and patterns for identifying potential reversals:

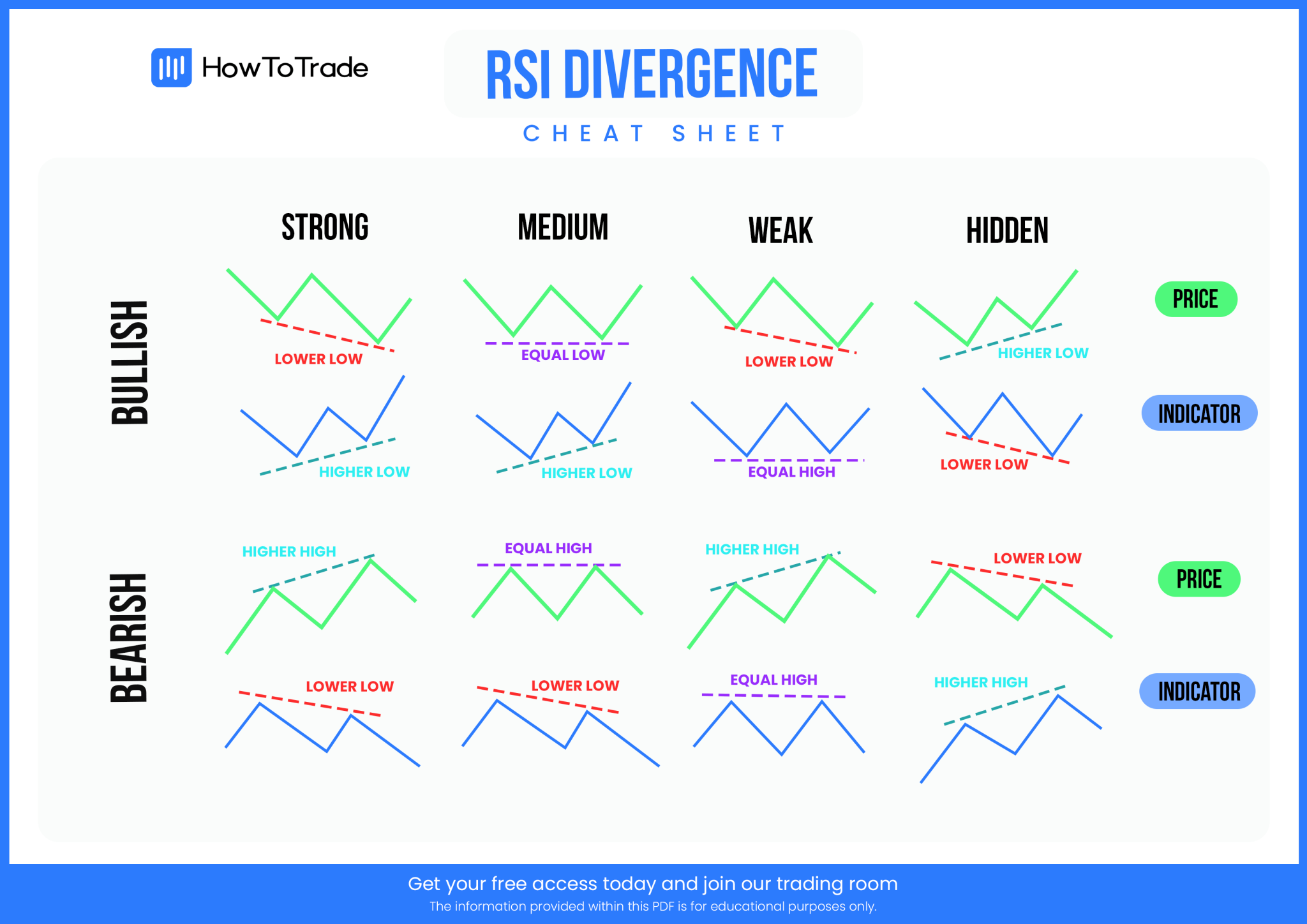

- RSI/MACD Divergence: RSI crossing above 30 from oversold territory combined with MACD bullish crossover provides strong reversal signals[2][6]

- Candlestick Patterns: Hammer, bullish engulfing, morning star, and inverted hammer patterns at local bottoms offer reversal confirmation[3][4]

- Volume Analysis: Genuine reversals typically show 20-30% higher volume compared to previous sessions[2]

- Bollinger Bands Squeeze: Combined with other indicators, enhances signal accuracy and reduces false entries[5]

- VWAP Reversals: Volume Weighted Average Price reversals at support levels provide high-probability entry points[2]

- Multi-Timeframe Analysis: M5-H1 timeframes optimal for spotting reversal patterns in day trading[2]

- Moving Averages: 5, 10, 20, 50, 100, and 200-period MAs provide trend context and confirmation[8]

- S&P 500 and Nasdaq recovered from earlier tech sell-offs to post modest gains (0.38% and 0.68% respectively)[9][10]

- Federal Reserve policymakers signaled hesitation about December rate cuts due to persistent inflation[9]

- Government shutdown resolution provided some relief but was already priced in[11]

- Tech sector experienced significant volatility with brief sell-offs before partial recovery[9]

Reddit trader insights and technical research reveal both alignment and contradiction:

- Both sources emphasize the importance of support/resistance levels and volume analysis

- Recognition that institutional activity significantly influences market movements

- Need for systematic, disciplined approaches rather than emotional reactions

- Reddit traders overwhelmingly emphasize reacting over predicting, while technical research focuses on predictive indicators and patterns

- Reddit suggests turnarounds are largely unpredictable due to institutional control, whereas technical analysis claims specific patterns provide reliable reversal signals

The most balanced approach combines Reddit’s emphasis on reactive discipline with technical analysis’s specific entry/exit criteria. Rather than attempting pure prediction, traders should:

- Monitor key technical levels (support/resistance, VWAP, moving averages)

- Wait for confirmation through multiple indicators (RSI/MACD divergence, volume spikes, candlestick patterns)

- React decisively when signals converge, with proper risk management

- False signals from single indicators without multi-factor confirmation

- Institutional-driven movements that can override technical patterns

- Volatility from Fed policy uncertainty and inflation concerns[9][12]

- High-probability setups at major support levels with multi-indicator confirmation

- Volatility-based trading strategies during market uncertainty

- Systematic approaches that combine technical analysis with reactive discipline

The November 14 market context demonstrates that even with technical signals, broader market conditions (Fed policy, economic data) significantly influence reversal success rates.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.