Portfolio Protection Strategies Without Major Tax Implications

Integrated Analysis

This analysis is based on comprehensive research into tax-efficient portfolio protection strategies for investors with substantial unrealized gains. The core challenge lies in balancing downside protection against tax efficiency, as traditional stop-loss approaches trigger capital gains taxes that can significantly erode portfolio value.

Options-Based Hedging Approaches

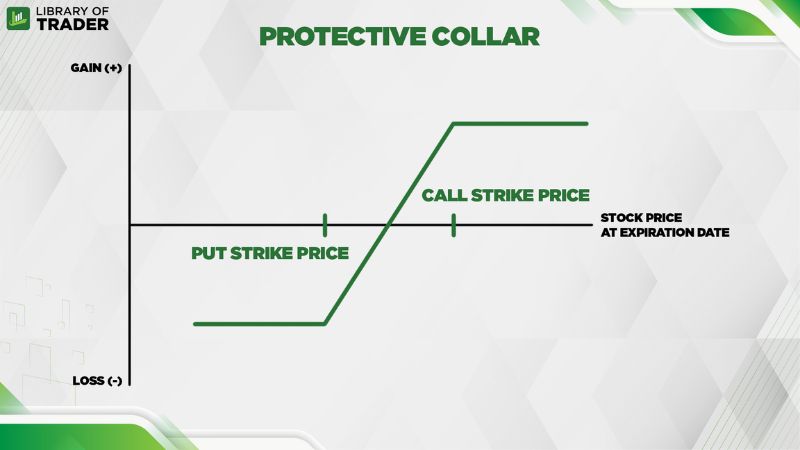

Protective Collars

represent a cost-effective hedging strategy that combines buying protective put options with selling call options against existing holdings. This creates a protected range where downside is limited while upside is capped, often at little to no net cost since the call premium offsets the put premium [1]. For example, with a stock trading at $75, an investor could buy puts with a $70 strike and sell calls with an $80 strike, creating protection below $70 while capping gains at $80 [1]. However, this strategy may not be particularly tax-efficient and requires sophisticated options trading knowledge [4].

Protective Puts

provide straightforward downside protection while maintaining full upside potential, but require ongoing premium payments that reduce overall returns [2]. This approach is particularly valuable for guarding against the loss of unrealized gains in concentrated positions [4].

Covered Calls

have gained significant traction in 2025, with $40 billion in inflows during the first seven months of the year [5]. This strategy generates regular premium income (the S&P 500 Daily Covered Call Index had an annualized yield of 11.9% as of March 31, 2025) while offering limited downside protection [5]. The strategy is tax-efficient but caps upside potential.

Tax-Optimization Strategies

Direct Indexing

has emerged as a powerful tool for tax-efficient portfolio management. This approach involves owning individual securities directly rather than through ETFs or mutual funds, enabling strategic tax-loss harvesting while maintaining market exposure through similar but not identical securities [6]. Direct indexing can enhance after-tax returns by 0.5-1.5% annually depending on market volatility and portfolio composition [6]. However, it typically requires minimum investments of $100,000+ and involves higher transaction costs due to frequent loss-harvesting trades [6].

Tax-Loss Harvesting

remains a cornerstone strategy, involving systematic selling of investments at losses to offset capital gains. Investors should review portfolios quarterly for harvesting opportunities and be strategic about which lots to sell when partially liquidating positions [1]. Critical to success is maintaining exposure to similar investments while avoiding wash sale rules [1].

Liquidity and Leverage Solutions

Securities-Based Lending

allows investors to borrow against appreciated stock positions as collateral, providing liquidity without triggering capital gains taxes. This preserves the portfolio’s growth potential while offering cash for diversification or other needs [7]. J.P. Morgan Private Bank analysis shows that borrowing against a $10 million portfolio rather than selling $3 million in securities can result in significantly higher net returns over time [8]. However, this approach introduces leverage risk, as market downturns can trigger margin calls potentially forcing sales at inopportune times [7].

Key Insights

Market Context and Strategy Evolution

The current market environment in 2025 has seen significant growth in tax-efficient investment strategies, with assets in derivative income strategies reaching $150 billion by July 2025 [5]. This growth reflects increasing investor sophistication and the maturation of technology platforms that make complex tax management more accessible. AI-powered direct indexing solutions, such as those offered by Brooklyn Investment Group, represent the cutting edge of automated tax optimization [6].

Strategy Selection Framework

The optimal strategy depends heavily on individual circumstances:

For Concentrated Positions

: Gradual diversification over multiple tax years can spread out taxable events while reducing concentration risk [3]. Securities-based lending may be particularly valuable for accessing liquidity without selling core positions.

For Income Generation

: Covered calls offer attractive yields in sideways or mildly bullish markets, with the S&P 500 Daily Covered Call Index demonstrating 11.9% annualized yields [5].

For Maximum Protection

: Protective puts provide the most comprehensive downside protection but at significant cost through ongoing premium payments [2].

For Tax Efficiency

: Direct indexing combined with systematic tax-loss harvesting offers the best long-term tax optimization potential, though it requires substantial minimum investments [6].

Implementation Complexity and Costs

Options Strategies

require active management, close monitoring, and appropriate brokerage approvals [4]. The collar strategy, while cost-effective, is not recommended for inexperienced option traders [4].

Direct Indexing

benefits from sophisticated technology platforms but carries the risk of underperformance relative to benchmarks due to deviation from index weights [6].

Securities Lending

is relatively straightforward through major brokerage firms but requires careful attention to loan terms, interest rates, and collateral requirements [7][8].

Risks & Opportunities

Primary Risk Factors

Options Trading Risks

: Options strategies introduce complexity and potential for significant losses if not properly managed. Protective collars limit upside potential, while covered calls offer limited downside protection despite generating income [1][5].

Leverage Exposure

: Securities-based lending introduces counterparty risk and market volatility exposure. Margin calls can force sales at inopportune times, potentially triggering the very tax events investors seek to avoid [7].

Tracking Error Risk

: Direct indexing strategies may underperform benchmarks due to deviation from optimal index weights, particularly during periods of market stress [6].

Wash Sale Violations

: Tax-loss harvesting requires careful navigation of complex wash sale rules to avoid disallowed losses [1].

Opportunity Windows

Tax Alpha Generation

: Systematic tax-loss harvesting can generate significant tax alpha over time, with most harvesting opportunities occurring in earlier years of implementation [6].

Income Enhancement

: Covered call strategies offer attractive current income generation, particularly valuable in low-yield environments [5].

Liquidity Access

: Securities-based lending provides immediate access to portfolio value without disrupting long-term investment strategies or triggering tax events [7][8].

Market Volatility

: Increased market volatility creates more opportunities for tax-loss harvesting while potentially increasing the value of downside protection strategies [1][6].

Key Information Summary

Strategic Recommendations Based on Portfolio Characteristics

For Highly Concentrated Portfolios

: Consider gradual diversification combined with protective options strategies and securities-based lending for liquidity needs [3][7].

For Tax-Efficient Growth

: Direct indexing with systematic tax-loss harvesting offers the best long-term tax optimization potential for portfolios exceeding $100,000 [6].

For Income-Oriented Investors

: Covered call strategies provide attractive yields with moderate protection, particularly suitable for sideways or mildly bullish market expectations [5].

For Maximum Protection

: Protective puts offer comprehensive downside protection but require careful cost-benefit analysis due to ongoing premium expenses [2].

Implementation Considerations

Timing

: Tax-loss harvesting opportunities should be evaluated throughout the year, not just at year-end [1]. Options strategies require ongoing monitoring and adjustment as market conditions change [1][4].

Cost Structure

: Implementation costs vary significantly across strategies, from minimal costs for basic covered calls to substantial management fees for sophisticated direct indexing platforms [6].

Regulatory Compliance

: All strategies require careful attention to tax regulations, including wash sale rules, options tax treatment, and margin requirements [1][4][7].

The analysis reveals that no single strategy dominates across all scenarios. The optimal approach typically involves combining multiple strategies tailored to individual circumstances, tax brackets, risk tolerance, and market outlook. Investors should consider professional guidance when implementing complex options or direct indexing strategies, particularly given the tax implications and execution risks involved.