Hidden Gem Stock Analysis: Reddit's Under-the-Radar Winners vs. Market Reality

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The Reddit community highlighted several under-the-radar investment opportunities beyond megacaps:

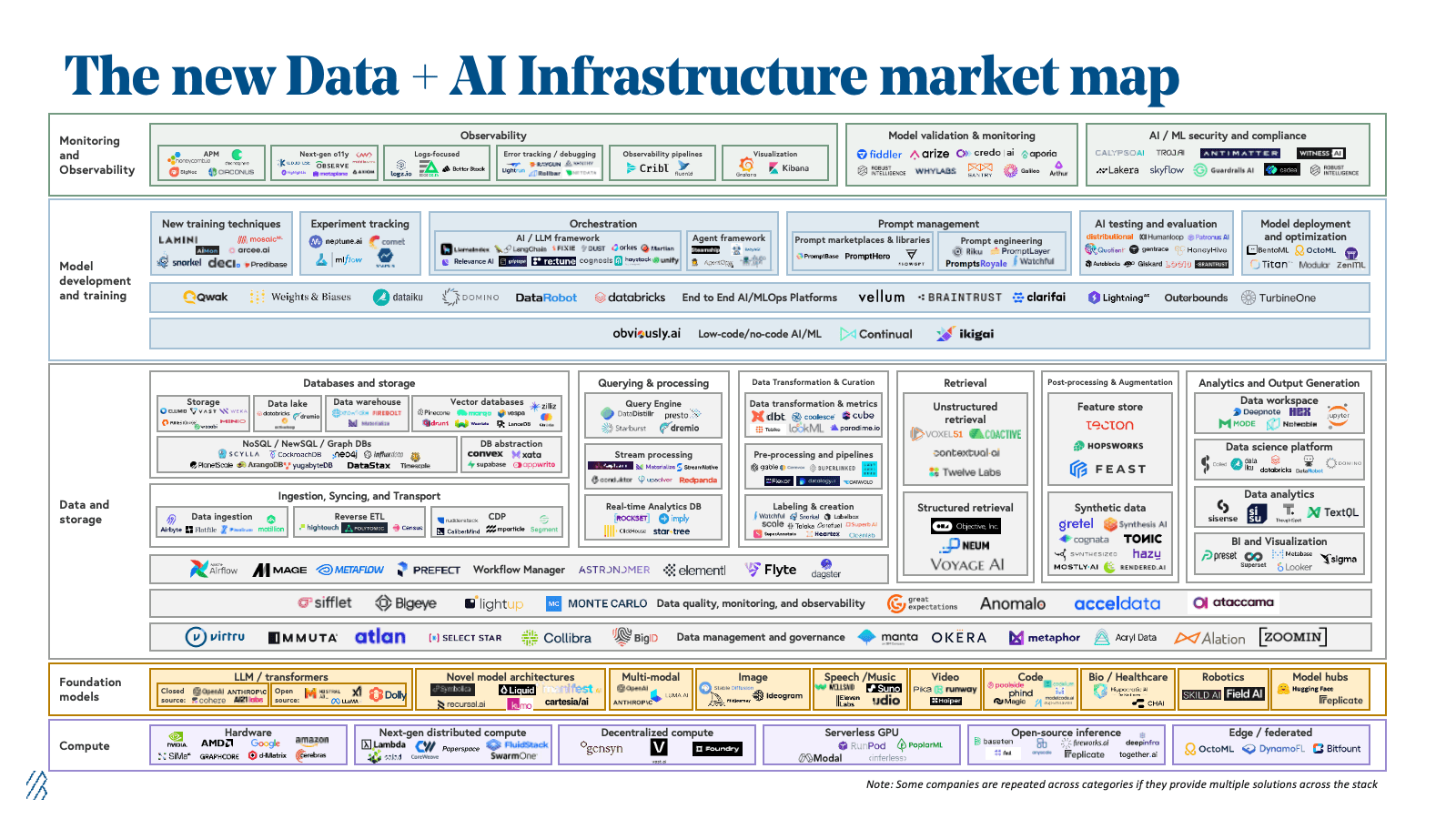

- Datacenter Hardware: Celestica (CLS) reported up ~200% YTD, along with Seagate, Lumentum, Credo, and Astera Labs as under-the-radar plays benefiting from AI infrastructure demand

- Mueller Industries (MLI): Identified as fundamentally cheap and underfollowed industrial

- Korean Technology: Samsung and Korean firms highlighted as attractively priced with HBM leadership and restructuring potential

- Jackson Financial (JXN): Claimed +214% gains since May 2023 with ~10% yield

- Broadcom (AVGO): Suggested as Tesla replacement in Mag7

- American Tower (AMT): Long-term 2000% unrealized gains reported

- Treasury ETF (TLT): Positioned for monthly returns as rates decline

- AVGO: +48.4% YTD with Moderate Buy consensus from 34 analysts

- OSK: +32.49% YTD, outperforming S&P 500’s 14.55%

- MLI: +35.74% YTD gains with Strong Buy analyst rating

- JXN: Research shows -14% 1-year performance with current Sell recommendations, contradicting Reddit’s +214% claim

- TLT: Down 0.9% YTD as bond prices declined in 2025

- AMT: Moderate Buy consensus but recent underperformance despite long-term gains

- Allient (ALNT): +117.1% YTD gains, benefiting from AI-related power solutions demand

- Comfort Systems (FIX): +127% YTD with record backlog and strong earnings growth expectations

- CleanSpark (CLSK): +41.86% YTD, outperforming S&P 500’s 16.34%

- FuboTV (FUBO): More than doubled in 2025, driven by streaming momentum and acquisition prospects

- AI Infrastructure: Datacenter hardware stocks (CLS, ALNT) showing exceptional performance

- Industrial Engineering: FIX and MLI benefiting from infrastructure spending and AI-related demand

- M&A Catalyst: Small-cap M&A activity at 25-year highs in healthcare, creating potential acquisition targets

- AI-driven industrial stocks with minimal analyst coverage

- Infrastructure plays benefiting from both traditional and AI-related spending

- Small-cap stocks in sectors with active M&A

- High volatility in less-covered stocks

- Potential misinformation in community-driven recommendations

- Limited liquidity in smaller names

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.