Market Divergence Analysis: Hedge Fund Selling vs. Retail Investor Support

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the CNBC report [1] published on November 13, 2025, which highlights a critical market divergence between institutional and retail investor behavior.

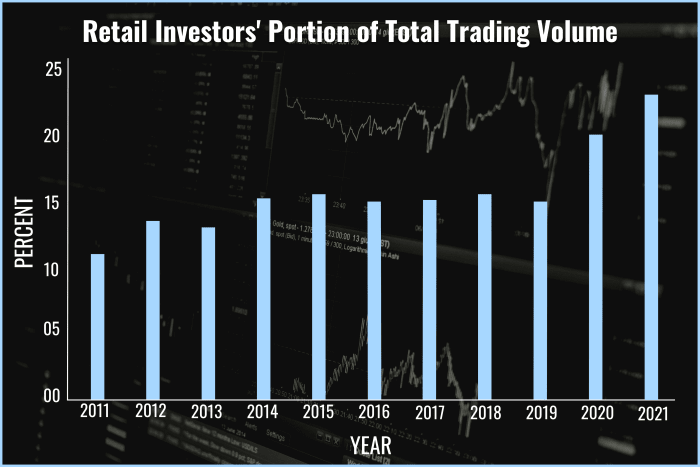

The current market landscape is characterized by a pronounced divergence in investor behavior. According to Bank of America’s client-flow data, hedge funds and institutional clients have unloaded more than $67 billion worth of equities in 2025, marking the heaviest round of institutional selling since the early months of the three-year bull market [1]. This institutional exodus contrasts sharply with retail investors who have emerged as “the market’s backbone” and “most consistent dip-buyers since 2020” [1].

Recent market data corroborates the reported institutional-retail divergence. Major indices show mixed performance with underlying stress signals:

- S&P 500: Slightly positive at +0.23% but trading below 20-day moving average [0]

- NASDAQ Composite: Slightly negative at -0.07%, also below 20-day MA [0]

- Dow Jones: Outperformed with +1.87% gain [0]

- Russell 2000: Significant underperformance at -3.39% [0]

Current trading activity reveals elevated selling pressure, with SPY down 1.66% and QQQ down 2.04% on November 14, both with above-average volumes [0].

The sector performance analysis from November 13 validates the institutional risk reduction narrative:

- Utilities: -3.11%

- Consumer Cyclical: -2.87%

- Real Estate: -2.37%

- Energy: -2.16%

- Technology: -1.57% [0]

The technology sector’s weakness aligns with the report’s finding that hedge funds executed “the biggest net selling of technology shares in two years” during the first week of November [1]. Conversely, defensive sectors (Consumer Defensive +0.87%, Healthcare +0.06%) showed relative strength [0], consistent with institutional risk aversion.

Professional investors are using the market’s record-setting run as profit-taking opportunities, citing fundamental concerns:

- Sky-high valuations, particularly in technology

- Interest rate uncertainty

- Geopolitical conflicts including trade wars and Middle East tensions [1]

The $67 billion in institutional selling represents more than mere profit-taking; it signals deep-seated concerns about market sustainability at current valuation levels.

Retail investors have demonstrated remarkable consistency, but Bank of America notes that “retail enthusiasm is showing early signs of fatigue after the market’s relentless run-up” [1]. This fatigue indicator is particularly concerning because retail buying has been the primary counterbalance to institutional selling throughout 2025.

The current dynamic creates a fragile market structure where liquidity is heavily dependent on continued retail participation. If retail buying diminishes while institutional selling continues, market liquidity could deteriorate rapidly, leading to increased volatility and potential sharp corrections.

-

Retail Investor Fatigue: The reported “early signs of fatigue” among retail investors could remove a key support pillar for the market, potentially accelerating declines if institutional selling continues [1].

-

Valuation Sustainability: Heavy institutional selling, particularly in technology, suggests professional investors see significant downside risk at current valuation levels [1].

-

Liquidity Mismatch: The market’s reliance on retail buying creates structural vulnerability. Any reduction in retail participation could trigger disproportionate market declines given the ongoing institutional exodus.

Key factors that should be closely monitored include:

- Weekly Bank of America client flow reports for changing institutional vs. retail patterns

- Volume patterns during rallies (declining volume could indicate weakening retail participation)

- Continued sector rotation from growth to defensive sectors

- Volatility Index levels as indicators of growing market stress

- Margin debt levels and requirements that could pressure retail investors [0, 1]

The current divergence pattern has historical significance. The “heaviest round of institutional selling since the early months of the bull market three years ago” [1] suggests we may be approaching a similar inflection point. Historical patterns indicate such divergences often precede significant market corrections or sector rotations.

The market is experiencing a structural divergence where institutional investors have sold over $67 billion in equities during 2025 while retail investors have sustained market levels through consistent buying [1]. This dynamic is particularly evident in the technology sector, which saw the largest institutional selling in two years [1]. Recent market performance validates this divergence, with major indices showing mixed performance and defensive sector outperformance [0]. The critical factor to monitor is retail investor fatigue, as continued institutional selling combined with diminishing retail participation could trigger significant market volatility and potential corrections [1]. Current market stress indicators include elevated trading volumes and indices trading below key moving averages [0].

[0] Ginlix Analytical Database - Market indices, sector performance, and real-time stock quotes

[1] CNBC - “Hedge funds are still dumping stocks while retail investors keep the bull market alive” by Yun Li, published November 13, 2025

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.