Market Concentration Risk & Historical Performance Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Reddit users are discussing several key investment themes:

- Historical Performance Claims: The original post claims S&P 500 returned 18% annually from 2000-2008 vs 15% from 2009-2025, though this appears inaccurate based on actual data

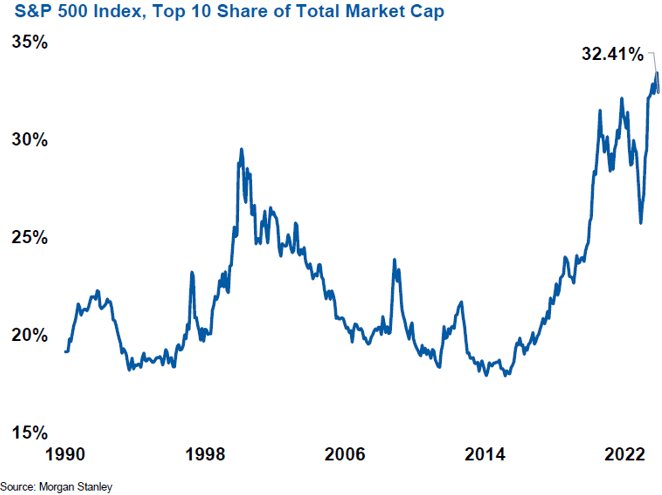

- Concentration Risk Concerns: Users highlight the dominance of Mag7 stocks and suggest equal-weight funds like RSP as a hedge

- Risk Management Strategies: Discussion includes holding 4+ years of cash to avoid forced selling during drawdowns, using puts as insurance, and dollar-cost averaging approaches

- Recovery Time Debates: Mixed views on recovery periods, with some noting inflation-adjusted recoveries can take 15-20 years (NASDAQ, MSFT), while others point to faster recoveries like the 2022 Nasdaq drop recovering in about a year

- 2000-2008 period was actually a “lost decade” with approximately -1.4% annualized returns, driven by dot-com bust and 2008 financial crisis

- 2009-2023 period delivered approximately 12.8% annualized growth, marking one of history’s best bull markets

- The 2000-2008 period had 5 negative years vs only 2 negative years in 2009-2023

- Top 10 S&P 500 stocks now represent 36.8-43% of total market cap, up from 34.8% in June 2024

- Concentration increased by 8.2 percentage points in just over 15 months

- Nvidia alone represents nearly 8% of S&P 500, equivalent to the entire Russell 2000 small-cap index

- Equal-weight S&P 500 ETFs reduce top 10 concentration to 2% but have underperformed cap-weighted versions

- Global ETFs (MSCI ACWI, MSCI World) provide exposure to thousands of stocks across multiple countries

- These international indices show lower concentration risk compared to S&P 500

- Recent US outperformance has been driven by mega-cap tech concentration

The Reddit discussion contains some significant factual errors regarding historical returns but correctly identifies the concentration risk issue. The claimed 18% returns from 2000-2008 are dramatically incorrect - that period actually delivered negative returns. However, the community’s concern about concentration risk is well-founded and supported by research data.

The trade-off is clear: while equal-weight and international diversification reduce concentration risk, they’ve recently underperformed the concentrated US market. This creates a classic risk vs. return dilemma for investors.

- Extreme concentration in S&P 500 creates vulnerability to mega-cap tech corrections

- Historical data shows recovery from major drawdowns can take decades in real terms

- Over-reliance on recent US outperformance may lead to poor diversification decisions

- Equal-weight ETFs (RSP) provide automatic rebalancing and reduced concentration

- Global diversification through MSCI ACWI or World ETFs offers broader exposure

- Strategic cash reserves (4+ years) can prevent forced selling during prolonged downturns

- Put options can serve as insurance against concentration risk

Investors should consider diversifying beyond cap-weighted US indices despite recent underperformance of alternatives. The record concentration levels suggest potential for significant drawdowns if mega-cap stocks falter, making risk management strategies increasingly important.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.