Bond Strategy Analysis: Defensive Positioning Before Potential Recession

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The Reddit discussion reveals a beginner investor’s dilemma about shifting to a 70/30 index/bond allocation before a potential recession, seeking both safety and dry powder for future stock purchases. Key insights from the community include:

- Timing skepticism: Multiple users emphasize that recession timing is impossible, warning that premature bond allocation could cause missed equity gains [Reddit]

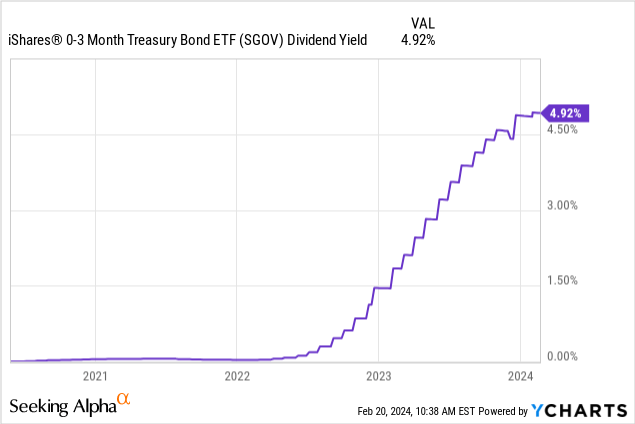

- ETF selection awareness: The poster correctly identifies different use cases for SGOV (rising rates) and BND (falling rates) [Reddit]

- Alternative hedges: Some users suggest defensive equity sectors (energy, consumer staples, utilities) or gold as alternatives to bonds [Reddit]

- Psychological vs. practical debate: Discussion centers on whether bonds provide real protection or merely serve as a “psychological pillow” [Reddit]

Historical analysis strongly supports bonds as defensive assets during economic downturns:

- 2008 crisis performance: Treasury bonds gained approximately 28% while stocks declined 38%, demonstrating effective inverse correlation [Research]

- Monetary policy impact: Central banks typically lower interest rates during recessions, causing existing bond prices to rise and yields to fall [Research]

- ETF-specific characteristics:

- SGOV (0-3 month Treasury): Near-zero duration (0.01), virtually no interest rate risk, optimal for rising rate environments [Research]

- BND (Total Bond Market): Intermediate duration with broad diversification across government, corporate, and mortgage-backed securities [Research]

- TLT (20+ Year Treasury): High duration with inverse correlation to rates, excelling during falling rate periods but experiencing sharp declines when rates rise [Research]

- EDV (Extended Duration Treasury): Highest duration (~24 years), showing extreme sensitivity to interest rate changes with amplified returns in both directions [Research]

The Reddit community’s skepticism about recession timing aligns with practical investment wisdom, while the research validates the poster’s instinct that bonds can provide meaningful protection during downturns. The key reconciliation lies in strategy implementation:

- Timing vs. positioning: While predicting exact recession timing is impossible, maintaining a strategic bond allocation can provide continuous portfolio protection [Reddit + Research]

- ETF selection logic: The poster’s differentiation between SGOV and BND for different rate environments is validated by research showing distinct duration profiles [Reddit + Research]

- Risk management: Bonds serve both practical (capital preservation) and psychological (preventing panic selling) purposes [Reddit + Research]

- Timing risk: Moving to bonds too early could result in missed equity gains during continued market expansion [Reddit]

- Duration risk: Long-term Treasury ETFs (TLT, EDV) can experience significant losses during rising rate environments [Research]

- Opportunity cost: Bonds typically offer lower long-term returns compared to equities [Research]

- Defensive positioning: Historical 28% Treasury gains during 2008 crisis demonstrate effective recession protection [Research]

- Rate flexibility: Different ETFs allow positioning for various interest rate scenarios [Research]

- Portfolio stability: Bonds provide capital preservation and reduce overall portfolio volatility [Research]

- Dry powder strategy: Bond allocation can preserve capital for opportunistic stock purchases during market downturns [Reddit]

Based on the synthesis of Reddit insights and research findings:

- Consider gradual bond allocationrather than attempting to time recession entry

- Utilize SGOVfor immediate rate protection and capital preservation

- Maintain some longer-duration exposure(TLT/EDV) for potential recession benefits

- Avoid 100% bond allocationdue to long-term underperformance risk

- Consult financial advisorfor personalized allocation based on age, risk tolerance, and timeline [Reddit]

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.