Tech vs Defensive Stocks: Strategic Allocation Analysis for Tech-Heavy Portfolios

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The Reddit discussion centers on a 90% tech-heavy portfolio holder (GOOGL, AMZN, AVGO) seeking guidance on defensive rotation. Key community insights include:

-

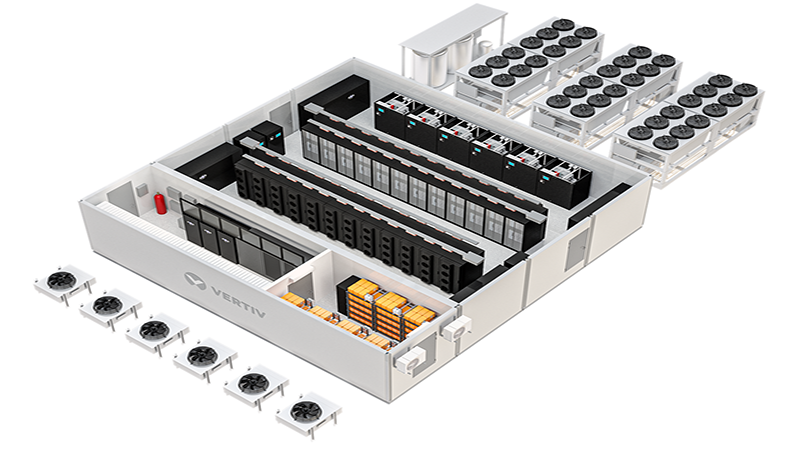

Megatrend Safety Argument: User jerk1 argues that AI infrastructure, data centers, and Mag 7 stocks represent modern safety anchors, citing Goldman Sachs and Blackstone research. The original poster found comfort in this view, particularly with data center picks like Vertiv and Micron[1].

-

Hybrid Defensive Approaches: Community members suggest various defensive strategies:

- CSCO as a low-volatility, dividend-paying tech-adjacent play tied to AI and data centers

- Treasury ETFs like SGOV for cash parking with tax advantages

- Berkshire Hathaway as a defensive stock option

- Hyperscaler and semiconductor ETFs (SMH, XSD, SOXX, WTAI, SMHX) for diversified tech exposure

-

Market Timing Concerns: Some advise selling overvalued positions for ETFs and waiting for pullbacks, while others caution against fear-based investing decisions[1].

Expert analysis provides a nuanced outlook for the tech vs defensive debate:

-

Valuation Extremes: Tech stocks, particularly AI-related companies, trade at extreme valuations of 50-650 times earnings, raising bubble concerns[2][3].

-

Orderly Deflation Expected: Unlike violent crashes, experts anticipate orderly 15-30% corrections in tech stocks, which should be treated as buying opportunities rather than exit signals[4][5].

-

Defensive Sector Strength: Utilities, healthcare, and consumer staples have temporarily outperformed during tech corrections and currently offer attractive entry points, with consumer staples trading at relatively cheap valuations[6][7].

-

Market Breadth Improvement: Cyclical-defensive ratios have recovered 50% from April 2024 lows, indicating improving market conditions beyond tech concentration[8].

- Traditional defensive sectors (utilities, healthcare, consumer staples)

- Tech-adjacent dividend plays (CSCO)

- Cash equivalents (SGOV) for tactical flexibility

- Extended tech valuations could lead to deeper than anticipated corrections

- Fed policy shifts may disproportionately impact high-multiple tech stocks

- Market concentration in Mag 7 stocks creates systemic risk

- Consumer staples at attractive valuations offer defensive upside

- AI infrastructure plays provide growth with defensive characteristics

- Treasury ETFs offer tax-efficient cash management during volatility

- Semiconductor and hyperscaler ETFs provide diversified tech exposure

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.