MSAI Analysis: Reddit Hype vs. Reality - High Risk AI Sensor Play

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

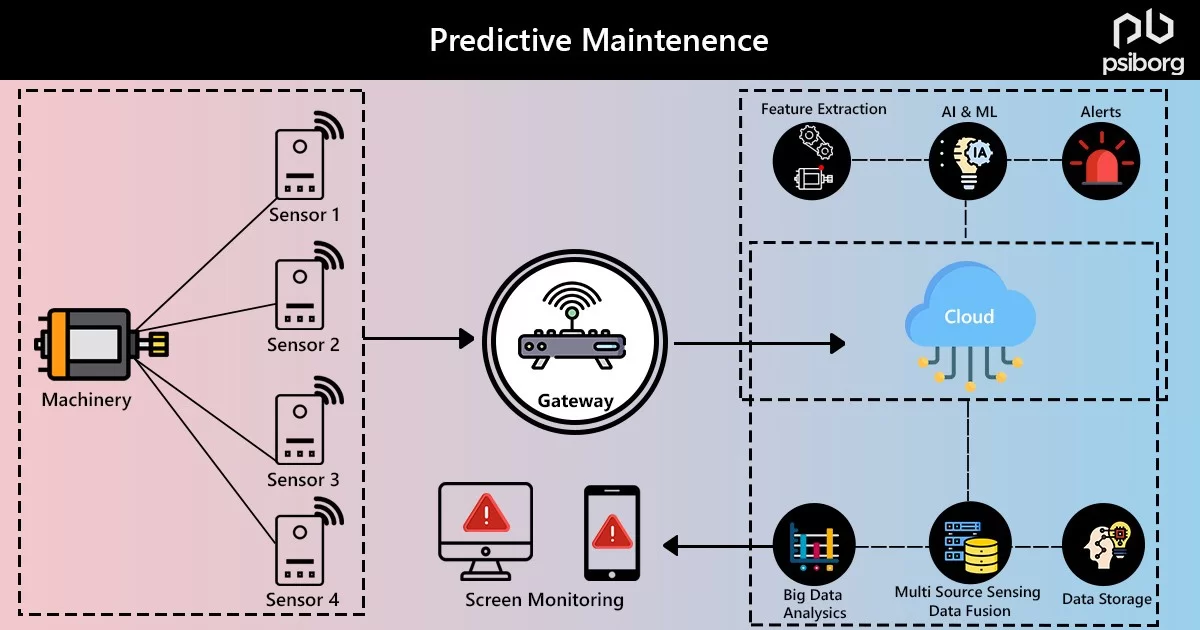

Reddit users highlight MSAI as an AI sensor technology company targeting predictive maintenance for automated warehouses, ghost factories, and ports[1]. Key claims include:

- Strong Fundamentals: 60% gross margins, minimal debt ($60k), $5.5M revenue[1]

- Recent Funding: $15M private placement completed[1]

- Potential Catalysts: Rumored Amazon partnership, upcoming 11/11/2025 earnings, veterinary diagnostic patents[1]

- Market Dynamics: Users discuss consolidation around $1.90 with potential squeeze into earnings, some already up 70% on positions[1]

- Sentiment Split: While some see ghost factories as the biggest opportunity, others express skepticism about the author’s credibility and timing[1]

Comprehensive research reveals significant discrepancies with Reddit claims:

- Company Reality: MSAI (NASDAQ:MSAI) is legitimate, focusing on AI-powered industrial sensor systems for predictive maintenance[2]

- Financial Performance: FY 2024 revenue was $7.4M (not $5.5M claimed), TTM revenue $5.59M with concerning decline - Q1 2025 revenue $1.2M vs $2.3M in Q1 2024 (down 49% YoY)[2][3]

- Losses: Heavy net losses of $18.9M TTM, requiring frequent capital raises due to tiny cash base[2]

- Funding: $15M private placement confirmed in June 2024 as part of $25M total financing round[2]

- Stock Volatility: 52-week range $0.46-$3.33, currently trading around $0.96[2][3]

- Partnerships: Amazon partnership appears unsubstantiated Reddit speculation; legitimate collaboration announced with FOTRIC in April 2025 for advanced camera solutions[4]

- Business Focus: No evidence of veterinary diagnostic patents - company focuses exclusively on industrial condition monitoring and predictive maintenance[4]

- MSAI is a real AI sensor technology company

- $15M private placement funding occurred

- Earnings date confirmed for November 11, 2025

- Focus on industrial predictive maintenance applications

- Financial Health: Reddit’s “strong fundamentals” narrative contrasts sharply with $18.9M TTM losses and declining revenue trends

- Credibility of Catalysts: Amazon partnership rumors appear to be Reddit speculation rather than substantiated business development

- Growth Narrative: Reddit’s optimistic outlook conflicts with 49% YoY revenue decline in Q1 2025

- Market Cap Concerns: At current ~$0.96 share price with high volatility, the company faces significant market perception challenges

- Financial Sustainability: Heavy losses and declining revenue raise questions about burn rate and need for additional financing

- Speculative Nature: Stock appears driven by Reddit hype rather than fundamental performance

- Dilution Risk: History of capital raises suggests potential future shareholder dilution

- Catalyst Dependence: Stock appears positioned for earnings-driven moves, creating high-risk timing scenarios

- Legitimate Technology: Real AI sensor applications in growing industrial automation market

- FOTRIC Partnership: April 2025 collaboration provides genuine growth catalyst

- Earnings Catalyst: November 11, 2025 earnings could provide clarity on business trajectory

- Market Timing: Current depressed levels (~$0.96) versus Reddit-discussed $1.90 suggest potential volatility plays

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.