Corporate Bond Liquidity Risk: Hidden Driver of Spreads in 2-5 Year Sweet Spot

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The Reddit post argues that

Research substantiates several key claims from the Reddit post while providing important nuance:

The Reddit post’s core thesis holds up well under research scrutiny, though with important refinements:

-

Liquidity vs. Credit Risk: Research confirms liquidity risk is indeed a major spread driver in emerging markets, but it’s more accurate to say itcomplements rather than dominatescredit risk. Both factors matter, with their relative importance varying by region.

-

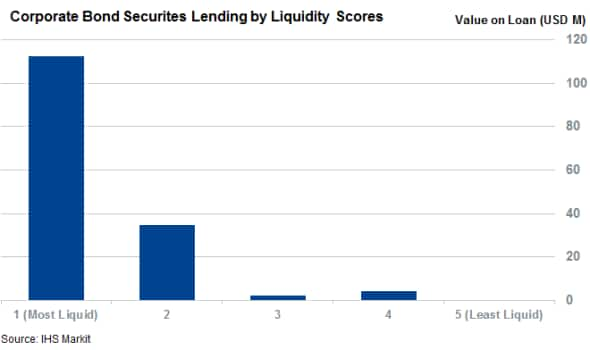

Duration Strategy: The 2-5 year sweet spot is strongly validated by institutional research, suggesting the Reddit community identified a genuine market inefficiency opportunity.

-

Crowding Concerns: Record 2024 issuance levels validate warnings about potential liquidity gaps, though current demand remains robust.

- Targeted exposure to 2-5 year investment-grade corporates to capture liquidity premiums

- Focus on emerging market corporates where liquidity risk premiums may be most mispriced

- Relative value strategies comparing corporate liquidity risk versus Treasury volatility

- Sudden liquidity gaps in crowded corporate bond markets

- Regional variations in liquidity risk effectiveness

- Potential for rapid spread widening if liquidity conditions deteriorate

- Over-reliance on liquidity premiums without adequate credit analysis

The convergence of Reddit insights and institutional research suggests a genuine market opportunity in the 2-5 year corporate bond space, but investors should monitor crowding indicators closely and maintain balanced exposure across regions.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.