Hyperscaler Capex Surge: NVIDIA's Growth Trajectory Under Scrutiny

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Reddit investors present a divided view on hyperscaler capex implications for NVIDIA:

- One user projects capex could reach $3T by 2030, though ROI depends on AI labs capturing global intelligence work

- Infrastructure spending expected to continue due to scarcity and national security imperatives beyond retail quarterly focus

- NVIDIA viewed as accurately priced for expected growth, with dips seen as buying opportunities

- AMD may outpace NVIDIA in percentage growth during H2 2026 and 2027

- Other beneficiaries identified: Micron (DRAM play), TSMC, AMAT, ASML as supply chain plays

- Custom silicon (TPUs, Trainium) could shift demand away from GPUs, pressuring NVIDIA margins

- Succession planning concerns for Jensen Huang, though comparisons to Morris Chang’s longevity noted

- AI spend may not accelerate as training demand drops and inference ROI remains unproven

- China’s decoupling efforts and potential competitive chip offerings

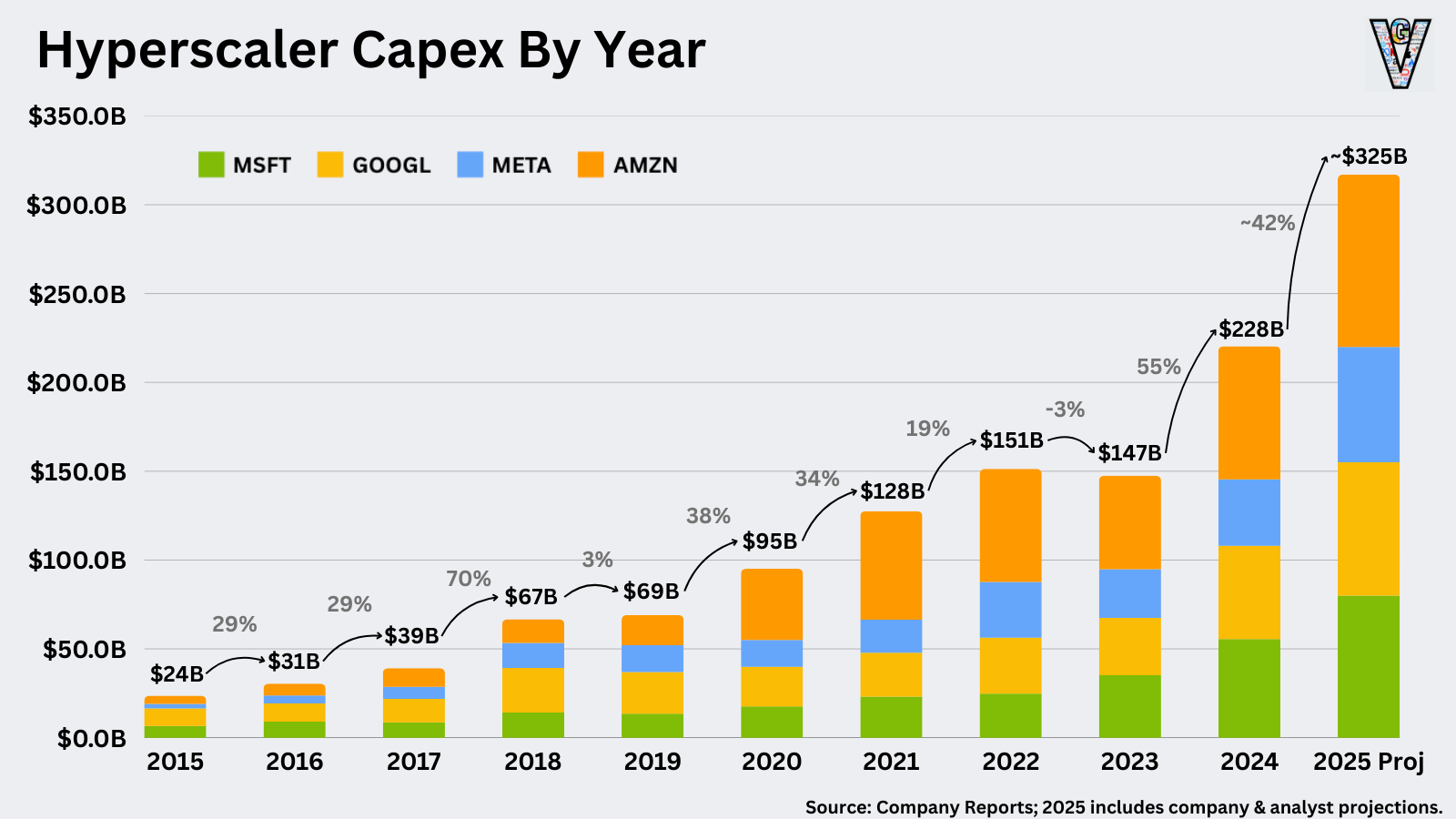

The Reddit claim of $420-450B hyperscaler capex for 2026 appears significantly overstated. Actual company-specific forecasts suggest $300-350B range at most:

- Meta: $70-72B for 2025 with “notably larger” spending expected in 2026, potentially reaching $115B+

- Google/Alphabet: $91-93B for 2025 with “significant increase” hinted for 2026

- Microsoft: Plans to nearly double data center footprint over two years, with $21.4B in recent quarterly capex (50% for data centers)

- Amazon: Leading with $100B projected for 2025, though 2026 forecast unclear

- $500+ billion in revenue visibility through 2026 from Blackwell and Rubin GPU orders (pipeline, not firm commitments)

- Exceptional gross margins (50-75% range) maintained through technological leadership and pricing power

- Analysts project $207.01 billion revenue in 2026 (58.6% growth) and $279.62 billion in 2027 (35.1% growth)

- AI data center electricity demand could increase thirty-fold by 2035

- Custom silicon development by hyperscalers could eventually reduce NVIDIA’s pricing power

- Combined AI infrastructure spending for 2025 estimated at ~$400B across all tech giants

Both Reddit and research confirm hyperscaler capex growth is fundamentally driving NVIDIA’s trajectory, though magnitude differs. The sustainability concerns raised on Reddit align with research findings about energy constraints and custom silicon threats.

- Reddit’s $420-450B capex projection vs. research’s $300-350B reality check

- Reddit’s bullish $3T long-term capex vision vs. research’s more conservative near-term projections

The disconnect between Reddit’s optimistic capex projections and research’s more conservative estimates suggests NVIDIA may be appropriately priced rather than undervalued. The company’s strong pipeline visibility supports near-term growth, but margin compression risks from custom silicon and sustainability constraints warrant caution.

- Continued hyperscaler expansion through 2026 with $500+ billion revenue visibility

- Supply chain beneficiaries (TSMC, AMAT, ASML, Micron) offer diversification

- National security imperatives providing structural demand floor

- Energy constraints potentially limiting AI data center expansion

- Custom silicon development reducing NVIDIA’s pricing power long-term

- Chinese competition and decoupling efforts

- Margin pressure from potential shift to ASICs over GPUs

- Succession planning for key leadership

While NVIDIA’s near-term growth trajectory appears solid, investors should monitor hyperscaler capex execution, energy infrastructure developments, and custom silicon progress as key indicators of sustainability beyond 2026.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.