Corporate America Ends Firing Freeze: Major Layoffs Signal Labor Market Shift

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the Wall Street Journal report [1] published on November 1, 2025, which revealed that Corporate America has ended its firing freeze, with major companies announcing tens of thousands of layoffs in recent weeks.

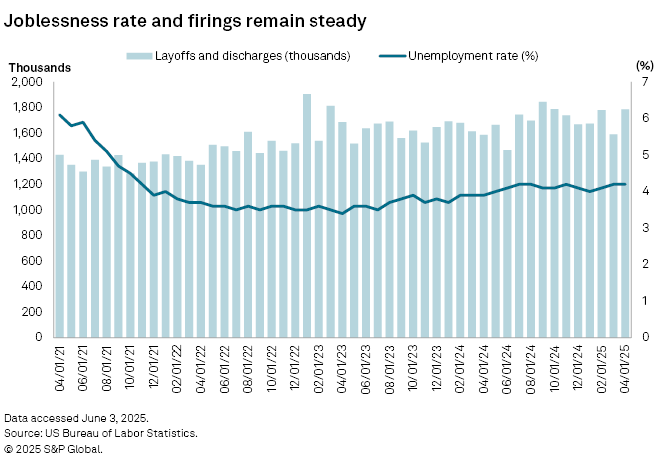

The labor market is experiencing a significant structural shift as companies abandon “labor hoarding” practices that characterized the post-pandemic recovery period. According to the WSJ report [1], the practice of holding onto employees for fear of not being able to rehire them later has reached its end, signaling a fundamental change in corporate employment strategy.

- Consumer Spending Contraction:Widespread corporate layoffs may significantly impact consumer spending, particularly as the holiday season approaches. The combination of job losses and economic uncertainty could reduce discretionary spending [1][3].

- Market Sentiment Shift:While current market reaction has been mixed, sustained layoffs could trigger broader market sentiment shifts, especially if they signal deeper economic concerns.

- Sector Contagion Risk:The technology sector’s current weakness could spread to other sectors if layoffs continue accelerating, potentially affecting market-wide valuations.

- AI and Automation Investments:Companies reallocating resources toward AI and automation may present investment opportunities in technology sectors focused on workforce optimization solutions [2].

- Efficiency-Focused Companies:Firms demonstrating successful workforce restructuring without compromising business performance may be rewarded by investors seeking operational efficiency.

- Sector Rotation:The divergence between declining Technology/Consumer Cyclical sectors and strengthening Energy/Financial Services sectors [0] may present tactical allocation opportunities.

- Track weekly layoff announcements to gauge whether this represents a temporary adjustment or sustained trend

- Monitor consumer confidence and retail sales data for early indications of spending impact

- Watch Federal Reserve commentary or policy adjustments related to labor market changes

- Pay close attention to Q4 earnings guidance from major corporations regarding workforce optimization strategies

The corporate firing freeze has definitively ended, with nearly one million job cuts announced in 2025, representing a 55% increase from 2024 levels [3]. Major technology and retail companies are leading this trend, with Amazon planning up to 30,000 corporate cuts and Target eliminating 1,800 positions [2][3]. The market response has been segmented, with some technology stocks like Amazon showing resilience despite large-scale layoffs, suggesting investors view these moves as efficiency improvements rather than distress signals [0].

The shift away from “labor hoarding” represents a fundamental change in corporate employment strategy, with companies reallocating resources toward AI and automation initiatives [1][2]. While the immediate market impact has been mixed, with major indices showing overall strength over the past 30 days [0], the long-term implications for consumer spending and economic growth remain uncertain. The technology sector’s decline of 1.74% [0] contrasts with strength in Energy (+2.81%) and Financial Services (+1.38%) sectors [0], indicating sector-specific impacts rather than broad market weakness.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.