Disney Q4 2025 Earnings: Mixed Results with Streaming Growth Amid TV Decline

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

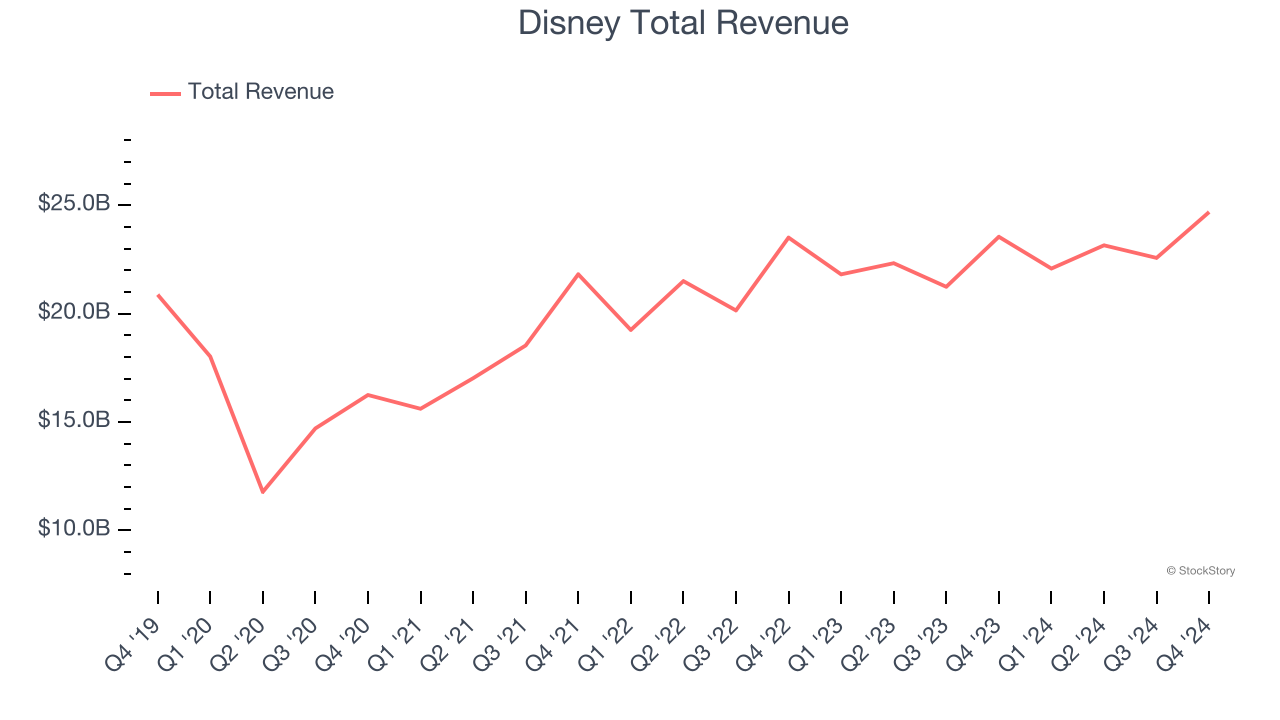

This analysis is based on Disney’s Q4 2025 earnings report released on November 13, 2025, which revealed mixed results across the company’s business segments [1][2]. The stock declined 7.75% to $107.61, underperforming the broader market during a significant sell-off [0][1].

- Linear TV Decline Acceleration:The 21% decline in linear TV operating income represents an accelerating trend that may significantly impact future earnings as cord-cutting continues [1][2].

- YouTube TV Dispute Duration:The ongoing carriage dispute affecting approximately 10 million subscribers could create sustained revenue pressure if not resolved quickly [1][3].

- Content Investment Returns:The $24 billion planned content investment requires careful monitoring to ensure appropriate returns in the competitive streaming landscape [1].

- Leadership Transition:CEO Bob Iger’s contract expires at the end of 2026, with succession planning potentially introducing uncertainty during this critical transformation period [1].

- ESPN Unlimited Expansion:The new ESPN Unlimited streaming service launched in August at $29.99/month represents a strategic evolution in sports content distribution, with Morgan Stanley projecting 3 million subscribers by fiscal 2026 end, contributing $500 million in annual revenue [1].

- Parks Segment Strength:The experiences division’s 6% growth and 13% operating income increase demonstrate continued consumer demand for Disney’s premium experiences [1].

- Streaming Profitability:The 39% increase in streaming profits to $352 million indicates improving unit economics as the business scales [1][2].

Disney’s Q4 2025 results reflect a company in transition, with traditional media operations declining while streaming and parks segments show growth. Management projects double-digit adjusted EPS growth for fiscal 2026 and reiterated similar guidance for fiscal 2027, supported by increased shareholder returns and strategic content investments [1][2]. The YouTube TV dispute and accelerating linear TV declines represent near-term challenges, while the streaming profitability improvements and parks strength provide foundation for long-term growth [1][3]. The company’s ability to manage the traditional media decline while scaling streaming operations will be critical for future performance.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.