Surging Power Costs and Data Center Demand Impact Consumer Economics and Utility Markets

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the Wall Street Journal report [1] published on November 1, 2025, which highlighted the growing financial pressure on American consumers from rising electricity costs driven by data center expansion.

The convergence of multiple inflationary pressures is creating significant economic challenges for American households. According to the WSJ report, surging power costs are overlapping with rising food prices, creating a dual burden that is “frustrating many Americans” and “electrifying local politics” [1]. This situation is particularly acute as data centers continue to drive substantial increases in electricity demand.

Market data reveals a complex picture across the energy and utility sectors. While the overall energy sector is performing positively with a 2.81% gain [0], utility stocks are experiencing significant pressure. Major utility companies show mixed performance: Duke Energy (DUK) declined 0.73% to $124.30, Dominion Energy (D) fell 1.39% to $58.69, and NextEra Energy (NEE) dropped 0.29% to $81.40 [0]. The utilities sector as a whole underperformed with a decline of 1.997% [0], suggesting investor concerns about regulatory challenges and the ability to pass through rising costs to consumers.

The inflation data provides critical context for understanding the consumer impact. Electricity prices have risen 5.1% over the 12 months ending in September 2025, significantly outpacing overall inflation [4]. This comes as food inflation remains elevated at 3.1% annually [4], creating a compounded financial burden for households.

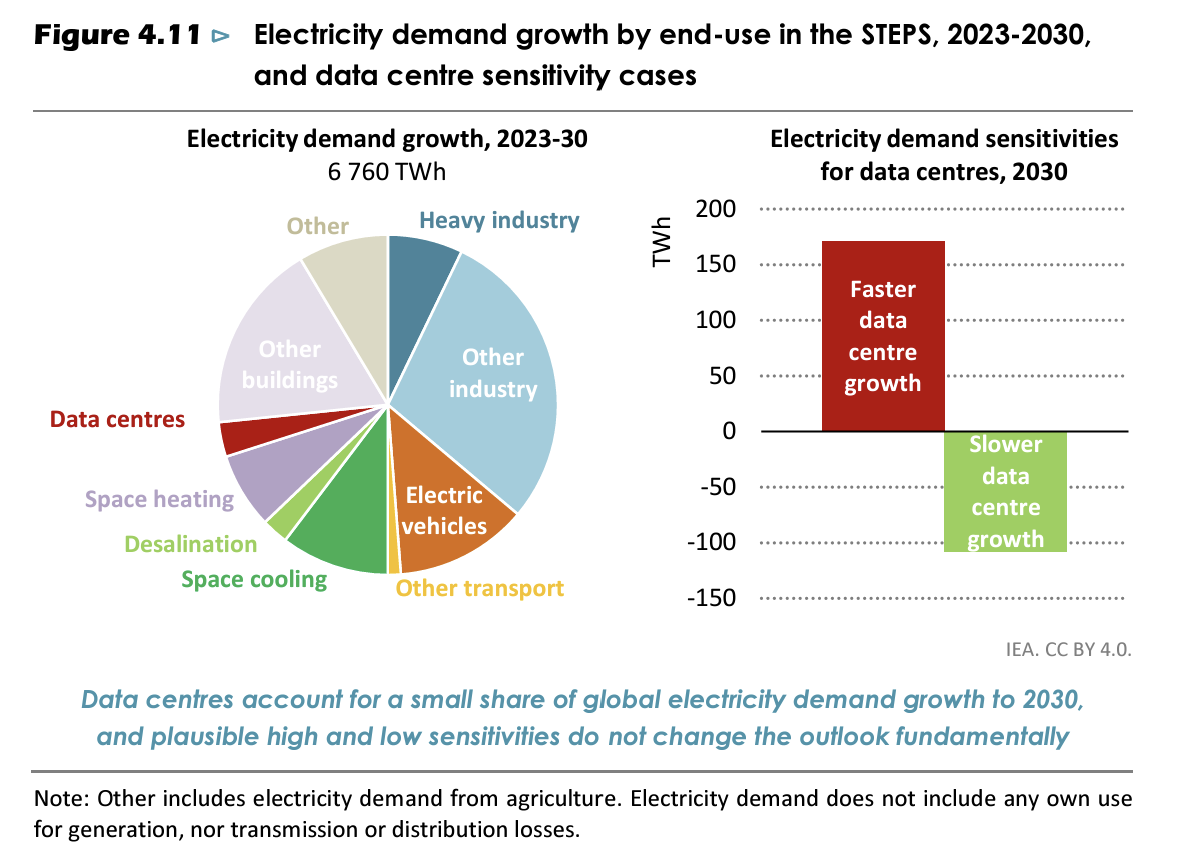

Research indicates that data center-related power consumption is expected to support over 100 basis points (1%) of annual growth in U.S. electricity demand, driven by capital spending averaging $500 billion over each of the next two years [2]. Lawrence Berkeley National Laboratory forecasts that annual energy use by data centers will nearly triple, reaching between 74 and 132 gigawatts by 2028, representing 6.7-12% of total U.S. electricity demand [3].

Northern Virginia, a major data center hub, provides a clear example of the localized impact. Dominion Energy has requested rate increases of approximately $20 per month for average residential customers over the next two years, citing data center demand, inflation, and higher fuel costs [5]. This has already generated substantial customer complaints to regulators [5], indicating growing consumer resistance.

Traditional utilities face emerging competitive threats from technology companies entering the energy sector. Major tech subsidiaries have sold more than $2.7 billion on wholesale electricity markets over the past decade [6], suggesting a potential shift in the energy market structure that could impact traditional utility business models.

State utility commissions face increasing political pressure to limit rate increases or require data centers to pay a larger share of infrastructure costs [1][5]. This regulatory uncertainty could significantly impact utility profitability and create volatility in utility stock valuations.

The convergence of rising electricity costs with food inflation creates substantial political risk as energy costs become prominent issues in local and state elections [1][5]. This political pressure could lead to policy changes affecting utility operations and pricing structures.

The rapid growth in electricity demand may strain existing grid infrastructure, requiring substantial capital investment that could further pressure rates if not efficiently managed. The timing and efficiency of infrastructure upgrades will be critical for maintaining grid reliability while controlling costs.

While current data center demand is robust, questions remain about the sustainability of AI-driven growth rates and potential technological efficiency improvements that could reduce future power demand. This uncertainty creates risk for long-term utility planning and investment decisions.

- Electricity prices have risen 5.1% annually, outpacing overall inflation of 3.1% for food prices [4]

- Data centers are projected to consume 6.7-12% of total U.S. electricity demand by 2028 [3]

- Utility sector underperformed with a 1.997% decline amid regulatory concerns [0]

- Northern Virginia residents face potential $20 monthly rate increases due to data center demand [5]

- Technology companies have sold $2.7 billion in wholesale electricity over the past decade [6]

- Energy sector overall gained 2.81%, suggesting investor confidence in energy producers despite utility challenges [0]

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.